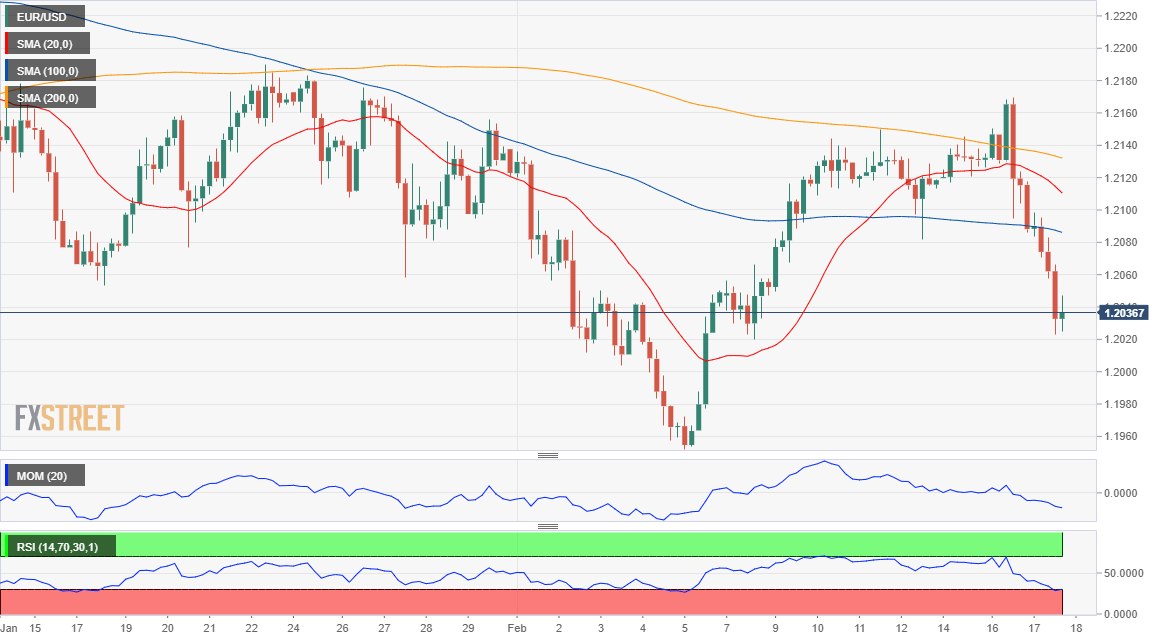

EUR/USD Current Price: 1.2036

- Upbeat US Retail Sales and soaring Treasury yields boosted the greenback.

- FOMC Meeting Minutes noted economic recovery moderated in the last months.

- EUR/USD has turned bearish in the near-term and could retest the 1.1951 level.

The EUR/USD pair traded as low as 1.2022 as demand for the greenback prevailed most of the day. US Treasury yields were the main driver, as that on the 10-year Treasury note peaked at 1.33%, its highest in a year. The American currency retained most of its intraday gains despite yields retreated ahead of Wall Street’s close, finding support in upbeat local data. On the other hand, stocks traded dully, with uneven losses in European and American indexes.

US Retail Sales rose in January 5.3%, much better than anticipated, while the core reading jumped from -2.4% to 6%, also beating expectations, a result of the latest government stimulus checks. The country also published the January Producer Price Index, which was up 1.7% yearly basis, and Industrial Production for the same month, which surged 0.9%.

The FOMC published the Minutes of their latest meeting, which showed that policymakers believe it’s premature to talk about tapering QE, as assets purchases would remain at current levels until Q1 2022. Policymakers also noted that the pace of the economic recovery has moderated in recent months. On Thursday, the ECB will publish its Monetary Policy Meeting Accounts, while the US will release weekly unemployment claims for the week ended February 12.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair broke below the 38.2% retracement of its November/January rally in the 1.2060 price zone, now the immediate resistance. In the near-term picture, the risk is skewed to the downside. The 4-hour chart shows that the pair is well below all of its moving averages, while technical indicators have barely bounced from oversold readings, lacking directional strength. The upside seems well limited by the mentioned Fibonacci resistance level, while another leg lower towards the recent lows in the 1.1950 price zone are likely.

Support levels: 1.2020 1.1970 1.1915

Resistance levels: 1.2065 1.2110 1.2160

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.