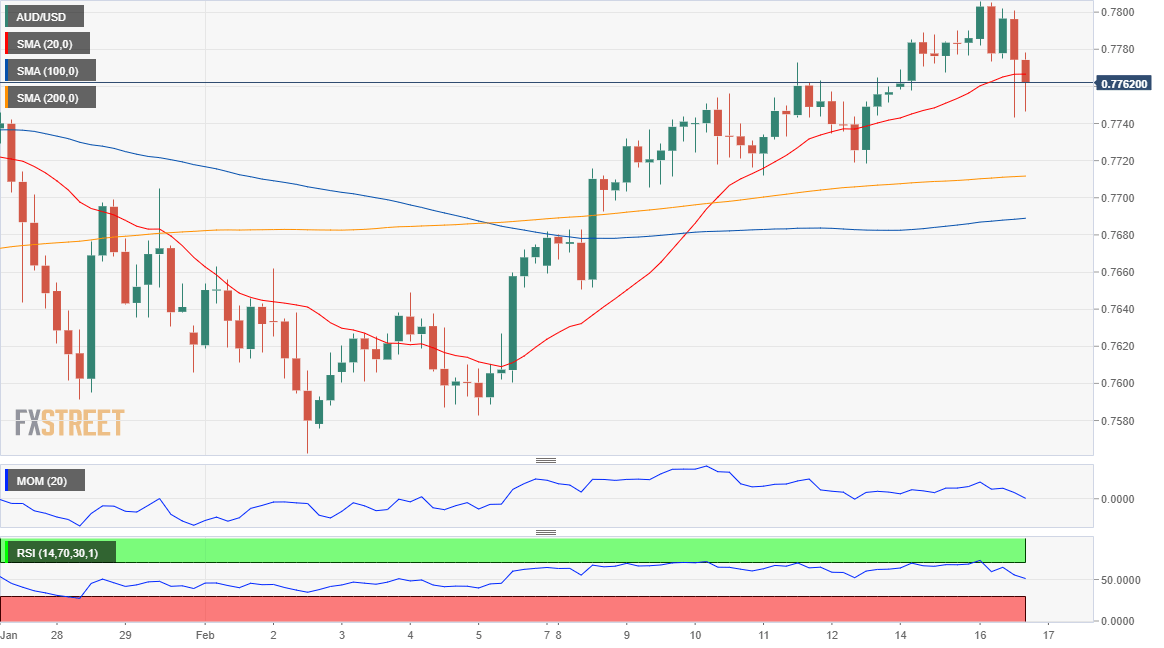

AUD/USD Current Price: 0.7762

- RBA believes the economy will need “very significant” monetary support for some time.

- Australia will publish the January Westpac Leading Index, previously at 0.12%.

- AUD/USD retreated after testing 0.78, but the risk remains skew to the upside.

The AUD/USD pair peaked at 0.7804, retreating from the level on the back of a stronger greenback and the sour tone of equities. European stocks traded in the green for most of the session, but closed with modest losses, while US indexes trimmed early gains to close mixed around their opening levels.

The Reserve Bank of Australia released the Minutes of its February meeting, which showed that policymakers believe that the economy will need “very significant” monetary support for some time. Members note that it will take a significant and sustained tightening in the labour market to lift inflation to more comfortable levels, a tough task that could take years to achieve. Early on Wednesday, Australia will publish the January Westpac Leading Index, previously at 0.12%.

AUD/USD Short-Term Technical Outlook

The AUD/USD pair trades around 0.7760, down for the day but with the bearish potential limited. In the 4-hour chart, it’s battling with a flat 20 SMA, which anyway stands well above the larger ones. The Momentum indicator bounced from its midline while the RSI indicator is directionless around 52, leaving the pair neutral-to-bullish in the near-term.

Support levels: 0.7745 0.7710 0.7675

Resistance levels: 0.7770 0.7815 0.7850

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.