EUR/USD Current Price: 1.2128

- US weekly unemployment claims held at high levels around 800K in the week ended Feb 5.

- Financial markets are still in search of a new catalyst to trigger directional movements.

- EUR/USD keeps grinding higher as the dollar is out of investors’ radar.

The EUR/USD pair extended its advance to 1.2149 but finished the day unchanged in the 1.2120 price zone. Financial markets traded in a dull fashion amid a scarce macroeconomic calendar exacerbated by holidays in Asia. The dollar was incapable of attracting buyers following dovish words from Federal Reserve chair, Jerome Powell on Wednesday, advancing just modestly ahead of the daily close amid falling equities.

Germany published the January Wholesale Price Index, which was up 2.1% in the month, but remained flat when compared to a year earlier. The US just published Initial Jobless Claims for the week ended February 5, which resulted at 793K, worse than expected. On Friday, the most relevant macroeconomic figure will be the preliminary estimate of the US February Michigan Consumer Sentiment Index, foreseen at 80.8 from 79 in January.

EUR/USD Short-Term Technical Outlook

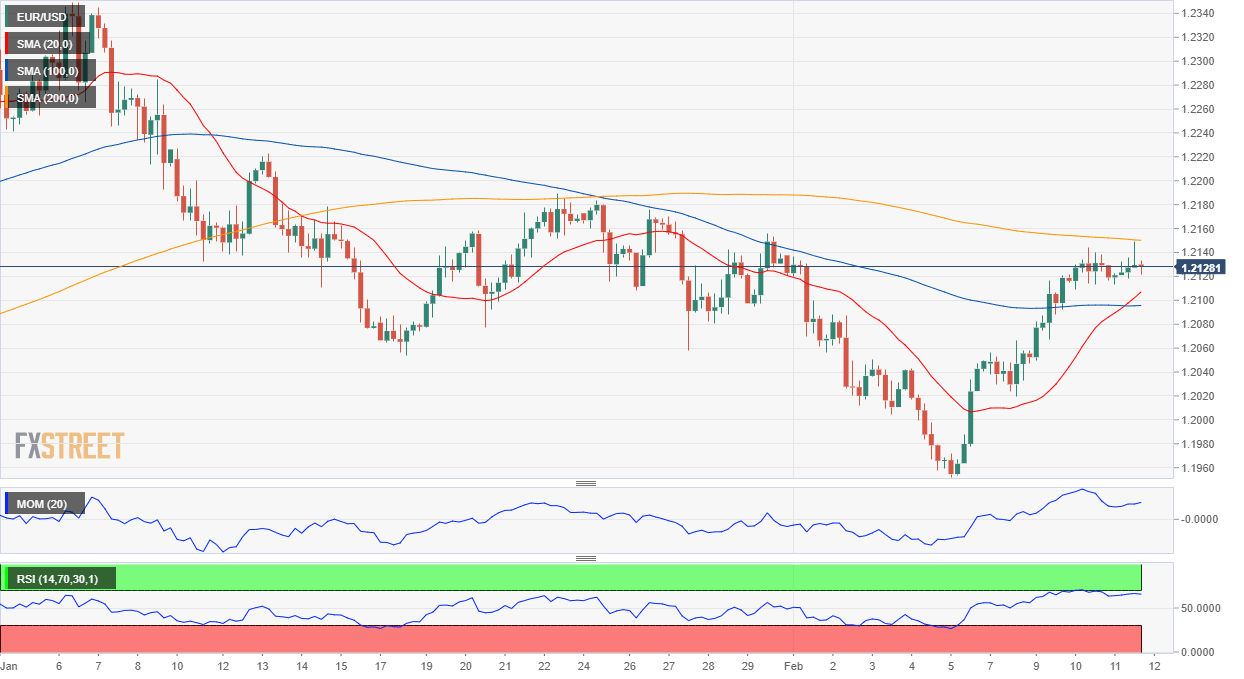

The EUR/USD pair is neutral-to-bullish in the near-term. The 4-hour chart shows that technical indicators retreated from near overbought readings, but stabilized within positive levels. The 20 SMA crossed above the 100 SMA, both below the current level, but a flat 200 SMA capped the upside. The pair needs to advance beyond a Fibonacci resistance in the 1.2170 price zone to gain bullish potential ahead of the weekly close.

Support levels: 1.2100 1.2065 1.2020

Resistance levels: 1.2175 1.2215 1.2260

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.