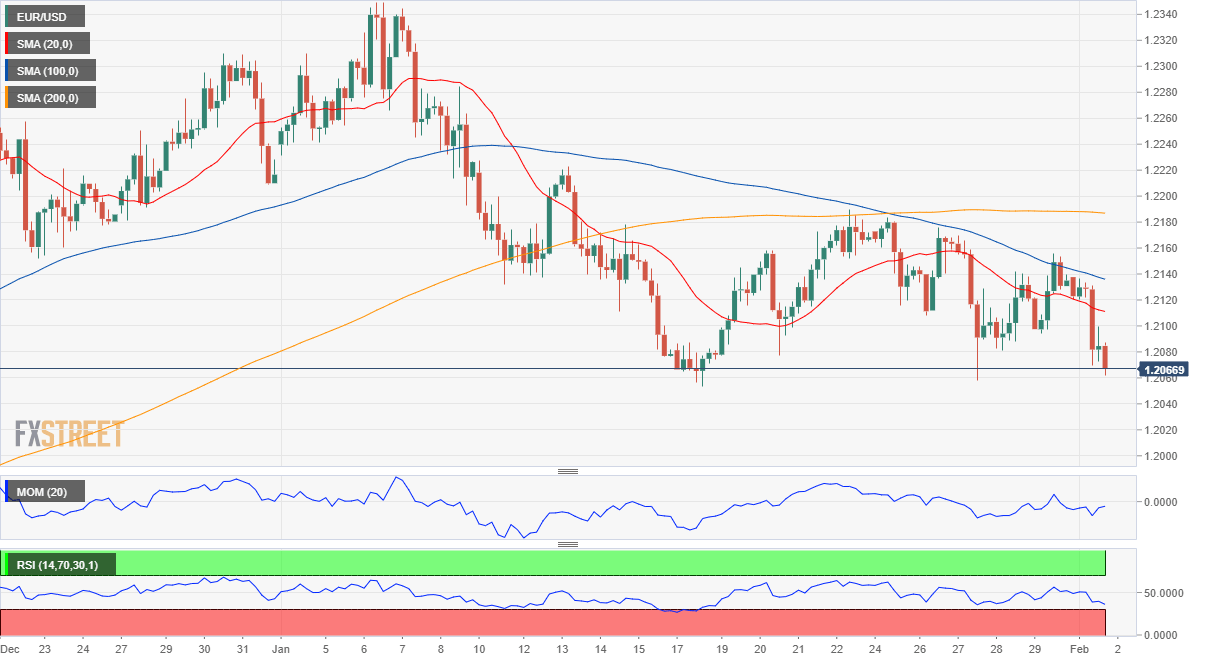

EUR/USD Current Price: 1.2066

- The US ISM Manufacturing PMI contracted to 58.7 in January from 60.5 previously.

- Upwardly revised Markit Manufacturing PMIs in the EU failed to support the shared currency.

- EUR/USD is pressuring a critical Fibonacci support level, could extend its decline to 1.1970.

The American dollar has rallied on Monday, pushing EUR/USD to a daily low of 1.2062. The pair trades nearby ahead of the Asian opening, as US stocks retreated from intraday highs, anyway holding in the green. Asian and European indexes finished the day with gains, which somehow prevented the greenback from appreciating further. The shared currency eased despite Markit upward revisions to January Manufacturing PMIs. The EU index was confirmed at 54.8 from a preliminary estimate of 54.7. The US PMI for the same month was also revised higher from 59.1 to 59.2. However, the official ISM Manufacturing index resulted at 58.7, missing the expected 60.

Meanwhile, speculative interest tried to digest news indicating that a group of US Republican senators have called for President Joe Biden to scale down his $1.9 billion stimulus plan, and reportedly floated a $600 billion alternative to garner bipartisan support. On the stocks´ side, things cooled down a bit, although silver soared over 11% after falling under retail investors’ radar las week.

This Tuesday, the EU will publish the preliminary estimate of Q4 Gross Domestic Product, foreseen at -2.1% from 15.9% in the previous quarter. The US will release the January ISM-NY Business Conditions Index and February IBD/TIPP Economic Optimism.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair is resting on the 38.2% retracement of its November/January advance and is poised to break below it. Technical readings in the 4-hour chart favor another leg lower, as the 20 and 100 SMAs head firmly lower above the current level. Technical indicators main their bearish slopes near oversold readings, without signs of bearish exhaustion. The pair has room to extend its slump towards 1.1970 on a clear break below 1.2060.

Support levels: 1.2060 1.2025 1.1970

Resistance levels: 1.2095 1.2140 1.2180

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.