EUR/USD Current Price: 1.2101

- ECB could cut deposit rate further, counter EUR’s appreciation if needed.

- Fed gloomy about economic recovery, left monetary policy unchanged.

- EUR/USD is at risk of extending its decline, mainly once below 1.2060.

The EUR/USD plummeted to 1.2057 in the first hours of the American session, recovering some ground afterwards. The shared currency initially fell with comments from ECB’s member Klass Knot, who said that policymakers could decide to cut its deposit rate further below zero if that proved necessary to keep its inflation target in sight, adding that the ECB has tools to counter the EUR’s appreciation if needed, in an interview with Bloomberg TV. Such comments triggered risk-aversion, later fueled by a dismal US Durable Goods Orders report which resulted at 0.2% in December, much worse than the 0.9% expected.

The pair recovered some ground as Wall Street bounced off daily lows, ahead of the US Federal Reserve monetary policy decision. As widely anticipated, the central bank left its monetary policy unchanged. The central bank reiterated that the “path of the economy would depend significantly on the course of the virus, including progress on vaccinations,” while adding that the pace of the recovery in economic activity and employment has moderated in recent months. A generally dovish statement maintained markets in risk-off mode.

This Thursday, the EU will publish the January Economic Sentiment Indicator, foreseen at 89.5 from 90.4. Germany will release the preliminary estimate of January inflation, although the star of the day will be the preliminary estimate of the US Q4 GDP, expected to show an annualized growth of 3.9% after an impressive 33.4% in Q3. The country will also release Initial Jobless Claims for the week ended January 22, foreseen at 875K from 900K in the previous week.

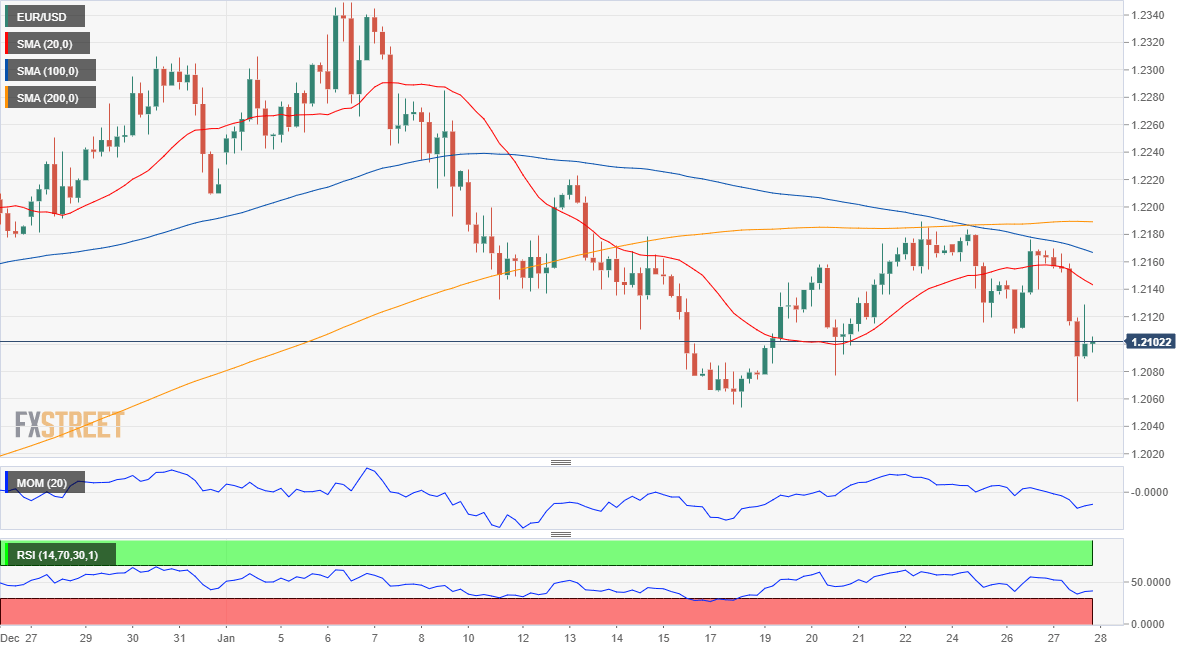

EUR/USD Short-Term Technical Outlook

The EUR/USD pair is trading around 1.2100 post-Fed, maintaining the sour tone. In the 4-hour chart, it is developing below all of its moving averages, with the 20 SMA gaining bearish strength and the 100 SMA accelerating south after crossing below the 200 SMA. Technical indicators head south within negative levels, all of which skews the risk to the downside. A clear break below 1.2060 should open the doors for a steeper decline throughout the upcoming sessions.

Support levels: 1.2060 1.2025 1.1970

Resistance levels: 1.2135 1.2180 1.2225

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.