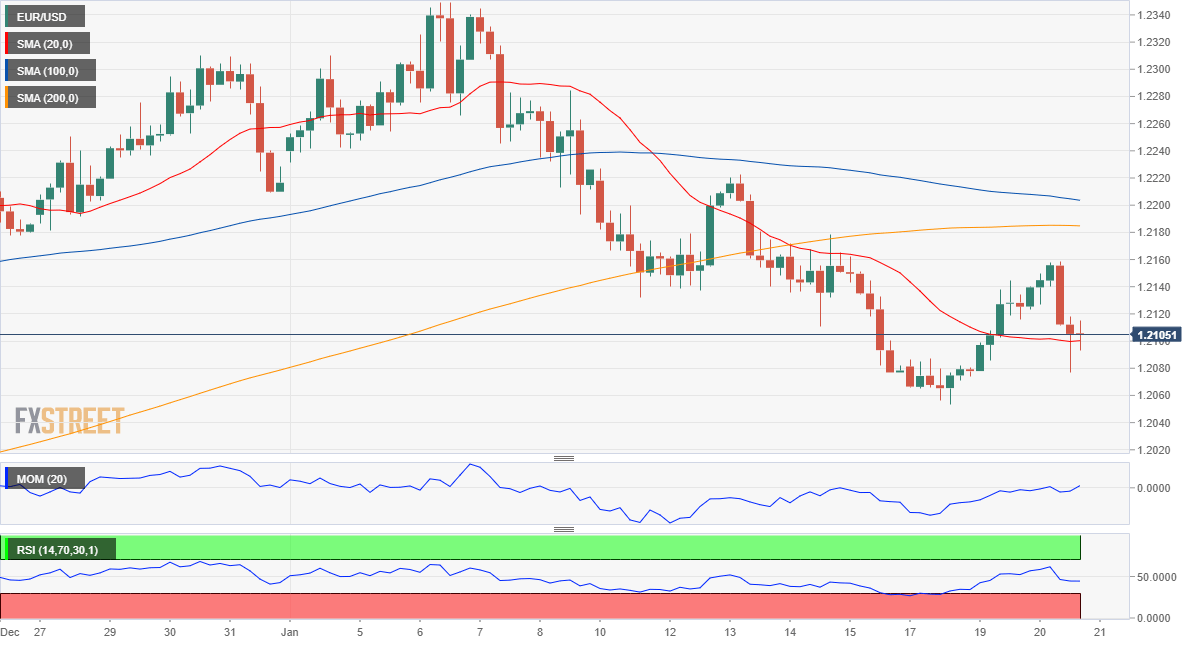

EUR/USD Current Price: 1.2105

- Joe Biden has become the 46th US President, Wall Street hits record highs.

- The focus shifts to the European Central Bank monetary policy decision.

- EUR/USD is neutral-to-bearish, could accelerate its slump on a break below 1.2060.

The EUR/USD pair closed the day in the red around the 1.2110 level, with the market sentiment still in positive mode but the greenback trading unevenly across the FX board. The absence of first-tier macroeconomic data seems to be leaving investors clueless on where to go next. Meanwhile, stocks surged in Europe and the US, but Treasury yields were unable to catch directional strength.

The EU published the final versions of its December inflation, which was confirmed at -0.3% YoY. In the US, Joe Biden has been sworn as the 46th President in a quiet ceremony. This Thursday, the European Central Bank is announcing its latest decision on monetary policy. The central bank is expected to leave its policy unchanged this time, although policymakers will likely paint a gloomy picture due to the persistent setback attributed to the ongoing pandemic.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair continues to trade between Fibonacci levels, offering a neutral-to-bearish stance in the near-term. The 4-hour chart shows that the pair is barely above a still bearish 20 SMA, while below the longer ones, which have lost their bullish strength. Technical indicators are directionless, the Momentum around its 100 level and the RSI around 44. failing to provide directional clues. Chances of a steeper decline will increase on a break below 1.2060, the 38.2% retracement of the November/January rally.

Support levels: 1.2060 1.2020 1.1970

Resistance levels: 1.2170 1.2225 1.2260

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.