EUR/USD Current Price: 1.2269

- Wall Street kept rallying and posted new all-time highs.

- The US is expected to have created just 71,000 new job’s positions in December.

- EUR/USD is stable below 1.2300, bearish potential limited.

The American dollar extended its Wednesday’s gains against most major rivals, with EUR/USD falling to 1.2244, but pared gains during the US session. Wall Street kept running and reaching record highs, while US Treasury yields reached fresh multi-month highs. The market moved past US political turmoil and remained focused on hopes that immunization will revive economies in the second half of the year, also encouraged by monetary stimulus.

Tepid EU data added pressure on the shared currency. EU Retail Sales fell 6.1% MoM in November and contracted 2.9% from a year earlier, missing the market’s expectations. The preliminary estimate of the EU December inflation came in at -0.3% YoY, below expected. A positive headline came from the Economic Sentiment Indicator, which improved from 87.7 to 90.4. The US published its November Trade Balance, which posted a deficit of $68.1 billion, worse than expected. Initial Jobless Claims for the week ended January 1 came in at 787K better than anticipated. Finally, the December ISM Services PMI, previously at 55.9, improved to 57.2.

This Friday, attention will be on the US Nonfarm Payroll report. The country is expected to have added just 71K new positions in the month, while the unemployment rate is foreseen at 6.8%. Average hourly earnings are expected to have grown by a modest 0.2% MoM, while the annual figure is foreseen unchanged at 4.4%.

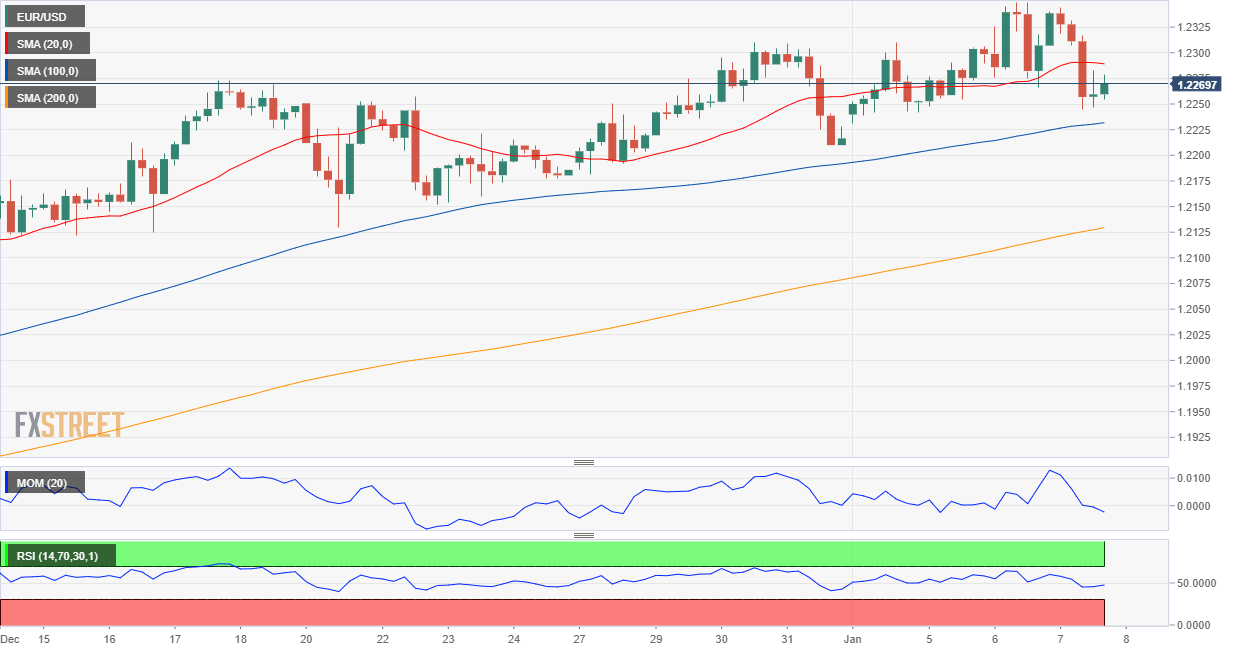

EUR/USD Short-Term Technical Outlook

The EUR/USD pair stabilized around 1.2270, where it stands ahead of the Asian opening. The 4-hour chart shows that the pair settled below a flat 20 SMA, but it keeps developing above a bullish 100 SMA. Technical indicators have turned flat after pulling down from daily highs, the Momentum around its midline and the RSI at 46. The corrective decline will likely continue on a break below the mentioned 100 SMA, currently at 1.2230

Support levels: 1.2230 1.2190 1.2140

Resistance levels: 1.2285 1.2345 1.2390

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.