EUR/USD Current Price: 1.2306

- Market players ignored a terrible US ADP survey, rallied on Georgia elections.

- Business activity in the EU contracted for a second consecutive month in December.

- EUR/USD eased from intraday highs but holds around 1.2300.

The EUR/USD pair soared amid an upbeat market mood, with equities rallying and Treasury yields trading at levels not seen since March 2020. The pair hit 1.2349, turning south during US trading hours as the dollar finally got to run with local indexes. The pair retreated but later recovered the 1.2300 threshold as Wall Street hit fresh all-time highs. The mood got boosted by Georgia elections, which granted Democrats control of the chambers.

Data wise, Markit published the final figures of the September PMIs. Services output further contracted into negative territory for a second consecutive month in December, although the latest decline was far softer than that recorded in November, according to Markit. The final EU Services PMI resulted in 46.4, while the Composite index shrank to 49.1. Germany published the preliminary estimate of December inflation, which remained at -0.3% YoY. The US published a terrible ADP survey showing that the private sector lost 123K positions in December. Finally, the Fed published the Minutes of its latest meeting. The document had a limited impact on currencies, as it showed that some members are in favor of expanding stimulus.

This Thursday, Germany will publish November Factory Orders, while the EU will unveil December Retail Sales, inflation data, and Consumer Confidence. The focus during the American session will be on employment data, ahead of the Nonfarm Payroll report to be out on Friday, and the December ISM Services PMI, foreseen at 54.5 from 55.9 in the previous month.

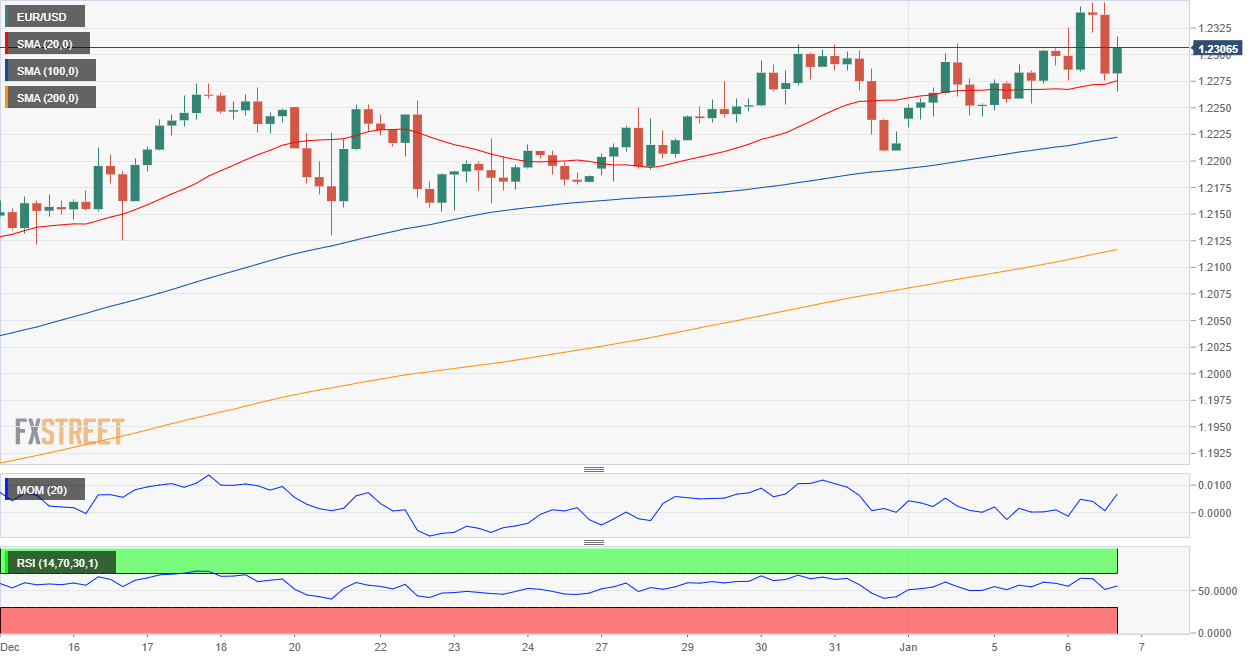

EUR/USD Short-Term Technical Outlook

The EUR/USD pair holds on to its bullish stance, despite having lost momentum. The 4-hour chart shows that buyers surged around a flat 20 SMA, while the longer moving averages maintain their bullish slopes below it. Technical indicators eased from near overbought readings, but lost their bearish strength after nearing their midlines, indicating limited selling interest. The pair has room to extend its advance, mainly on a break above 1.2345, the immediate resistance level.

Support levels: 1.2265 1.2220 1.2170

Resistance levels: 1.2345 1.2390 1.2420

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.