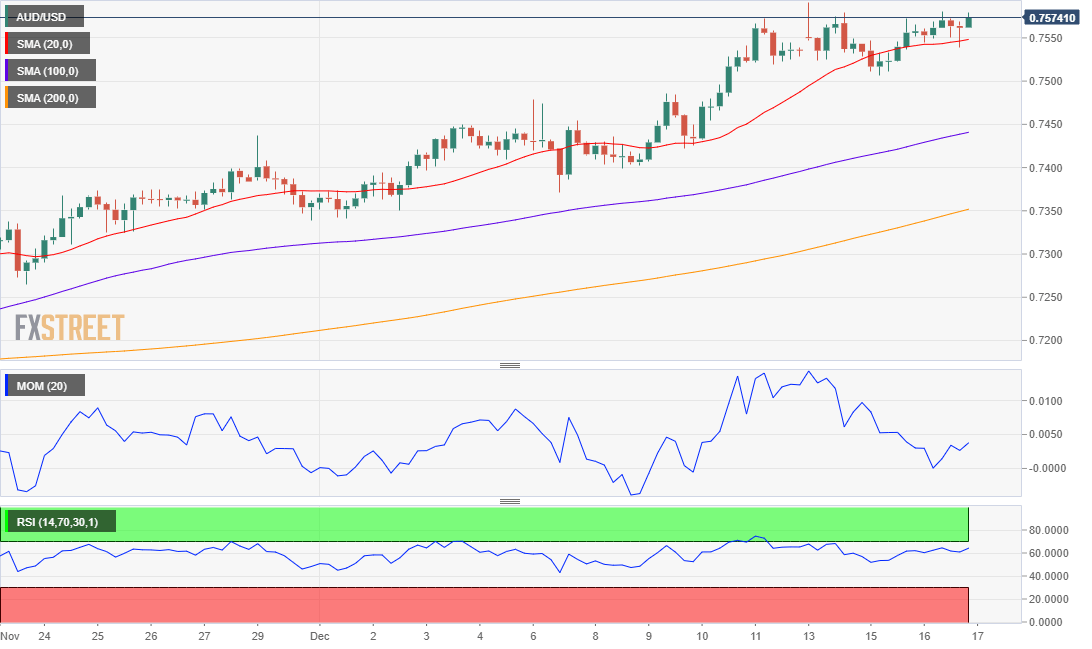

AUD/USD Current Price: 0.7574

- Australian growth-related figures came in better than anticipated.

- Australia November employment data could underpin the aussie.

- AUD/USD continues to consolidate near this year´s high at 0.7577.

The AUD/USD pair has spent a fourth consecutive day confined to a tight intraday range near its year’s high. The pair is heading into the Asian opening, trading a handful of pips below such a high at 0.7577, little affected by the dollar’s back and forth. Early on Wednesday, Australia published the November Westpac Leading Index, which came in at 0.46%, improving from 0.3% in the previous month. The Commonwealth Bank Manufacturing PMI improved to 56 in December from 55.8, while the services index came in at 57.4.

Australia will release this Thursday November employment figures, and once again, the market’s forecasts seem a bit pessimistic. The country is expected to have added 50K new jobs after gaining 178.8K in the previous month. The unemployment rate is foreseen unchanged at 7%, and the same goes for the participation rate, which is expected at 65.8%.

AUD/USD Short-Term Technical Outlook

The short-term picture for the AUD/USD pair indicates that further gains are still on the table. In the 4-hour chart, the pair keeps holding above its 20 SMA, while the larger ones head firmly higher below it. The Momentum indicator keeps easing, currently pressuring its midline, reflecting the lack of bullish strength instead of suggesting an upcoming decline. The RSI holds within positive ground and starts picking up, in line with a bullish continuation.

Support levels: 0.7510 0.7470 0.7425

Resistance levels: 0.7580 0.7620 0.7660

View Live Chart for the AUD/USD

Image sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.