EUR/USD Current Price: 1.2137

- European Central Bank acts as expected, “recalibrates” monetary policy instruments.

- Soft US data supports EUR/USD on Thursday.

- DYX drops despite decline in global equities.

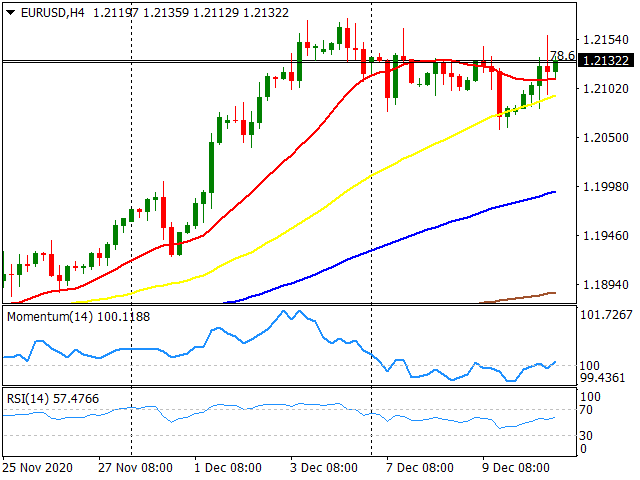

The EUR/USD pair moved within Wednesday’s range during Thursday despite the European Union summit, the European Central Bank meeting, US data and the new chapter in the Brexit drama. The pair reached a four-day high at 1.2160 during the American session and after all the events at the ECB. The move higher was mostly supported by a weaker US dollar rather than by a stronger euro. The pair then pulled back, holding above 1.2100. Ahead of the Asian session, it is looking at the 1.2160 area with a positive bias but not looking very strong.

The ECB increased its emergency purchase program by EUR500bn and extended it at least to March 2022. The TLTRO-III will also be extended, and more longer-term refinance operations were announced for 2021, to provide liquidity. Regarding the euro, the central bank reiterated it has no exchange rate target and will continue to monitor developments in FX. The euro rose after the ECB meeting and Lagarde’s press conference, only modestly.

In the US, initial jobless claims unexpectedly jumped to the highest in ten weeks to 853K. Also, continuing claim rose. In November the CPI rose 0.2%. US yields held relatively steady while equity prices in Wall Street were mixed. House Speaker Pelosi and Treasury Secretary Steven Mnuchin mentioned progress regarding a new stimulus package. Claims data could help increase negotiations, probably supporting Wall Street.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair ended Thursday with a bullish bias but still in the recent range and limited by 1.2160. The longer it takes to break above 1.2160/70, the more likely a bearish correction will gain speed. Technical indicators in the 4-hour chart are biased to the upside, showing no much strength and pointing to more consolidation ahead. A slide below 1.2100 would likely expose 1.2080 and then the weekly low at 1.2057.

Support levels: 1.2090 1.2065 1.2035

Resistance levels: 1.2160 1.2200 1.2230

Image sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.