EUR/USD Current Price: 1.2141

- US employment-related figures were encouraging ahead of the NFP release.

- EU October Retail Sales beat expectations, rising 4.3% from a year earlier.

- EUR/USD at risk of correcting, but bulls retain control.

The EUR/USD pair reached 1.2174, a level that was last seen in April 2018, as the dollar’s sell-off continued after the breakout of critical levels. US data was mixed, although employment-related figures were quite encouraging, boosting Wall Street. The Initial Jobless Claims for the week ended November 27 improved to 712K, beating expectations. Challenger Job Cuts printed at 64.797K in November, better than the previous 80.666K. The ISM Services PMI, however, contracted to 55.9 in November from 56.6 in the previous month.

The EU published October Retail Sales, which were upbeat, surging 1.5% MoM and 4.3% YoY. Markit published the final November Services PMIs, with the EU index revised to the upside and the US one confirmed at 58.4. Market players kept looking beyond data, focusing on vaccine hopes and US stimulus chatter.

Germany will release October Factory Orders this Friday, while the US will publish the November Nonfarm Payrolls. The country is expected to have added 481K new positions in the month, below the previous 638K. The unemployment rate, however, is seen improving from 6.9% to 6.8%.

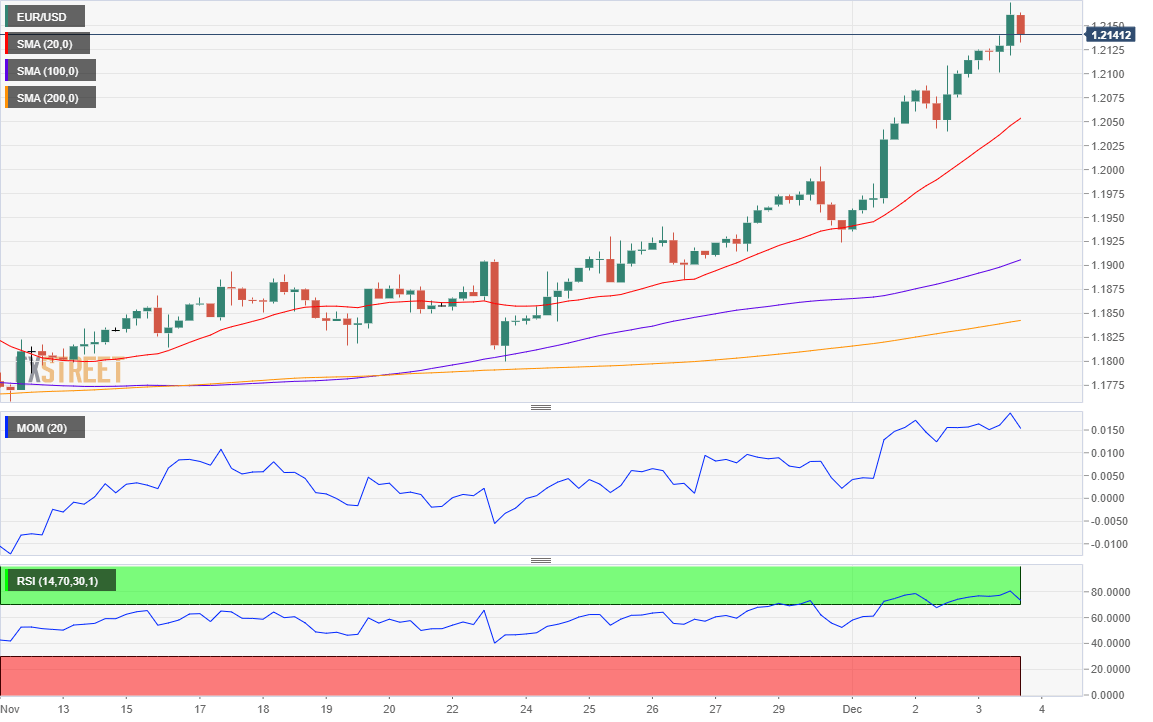

EUR/USD Short-Term Technical Outlook

The EUR/USD pair retreated from the mentioned high but remains well above the 1.2100 threshold. The pair is extremely overbought, but a corrective decline could not be taken for granted. The 4-hour chart shows that it keeps developing far above all of its moving averages, while technical indicators are barely retreating from extreme overbought levels. The pair could correct lower, but the upside will remain favored as long as it holds above 1.2000.

Support levels: 1.2110 1.2070 1.2020

Resistance levels: 1.2175 1.2230 1.2280

View Live Chart for the EUR/USD

Image sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.