Since 2011, the currencies of Australia (AUD) and New Zealand (NZD) have fallen versus USD. Of the two, NZD has done a little better. While AUD has fallen 31% versus USD since the beginning of 2011, NZD is down about 15% over the same period (Figure 1). In fact, AUD peaked versus NZD nine years ago, with an AUD worth 1.37 NZD at its height. Earlier this year, the AUDNZD rate nearly reached parity for the first time, before rebounding to around 1.05 (Figure 2).

Figure 1: AUD and NZD versus USD

Figure 2: AUDNZD fell to an intraday record low close to parity earlier this year

NZD’s outperformance of AUD over the past decade appears to come down to three factors:

- Prices for commodity exports from New Zealand held up better than Australia’s

- New Zealand’s economic growth was more robust over the past decade

- New Zealand has much less private sector debt than Australia

Distinct Exports

Sometimes grouped together because of their geographical location, it is easy to overlook how distinct Australia and New Zealand’s economies are. Australia relies to a great extent on mining, whereas New Zealand’s exports are dominated by dairy products and lumber.

In 2019, exports of coal briquette alone accounted for 4.1% of Australia’s GDP, with exports of iron ore adding about 3.4% of GDP. Australia’s gold exports were about 1% of GDP, while other mineral exports including aluminium and copper contributed about 1.7%. Natural gas exports were about 1.3% of GDP in 2018, the most recent year with full transparency to data.

For New Zealand, concentrated milk exports accounted for 2.7% of GDP. Exports of cheese, butter, whey and other dairy products contributed an additional 2.2%. New Zealand’s other major export is lumber, which is 1.2% of GDP.

New Zealand does export a small amount of metals, including aluminium, but these exports add up to less than 1% of GDP. Likewise, Australia exports some livestock and agricultural products such as beef and wheat but these total only a small percentage of GDP. New Zealand is primarily an exporter of agricultural goods, whereas Australia relies mainly on a variety of minerals. Both AUD and NZD track commodity indices of exchange-traded products weighted to reflect their economic importance (Figures 3 and 4).

Figure 3: Falling prices for iron ore, coal and natural gas weighed on AUD this past decade

Figure 4: New Zealand commodity export prices have also fallen but less so than Australia’s

Over the past decade, dairy products have been volatile, but with little overall trend (Figures 5 and 6). By contrast, key Australian export prices of goods such as coal and iron ore have generally fallen (Figures 7 and 8).

Figure 5: Milk prices have been choppy without an overall trend

Figure 6: Milk product prices have traded in wide ranges with no consistent trend

Figure 7: Falling coal prices have weighed on AUD

Figure 8: Although iron ore prices are far off their lows, they are still well off their 2011 highs

New Zealand is the world’s third biggest producer of dairy behind the US and the European Union. The difference is that with 330 million people in the US and over 400 million in Europe, much of their production is used domestically. By contrast, with only 5 million people, New Zealand is able to export most of its production.

Still, New Zealand’s dairy producers compete with the US and EU for a share of the global export market. If the euro (EUR) falls in value, that makes European producers more competitive. Perhaps its not too surprising then that NZD has been tracking EUR more closely than it does AUD, given Australia’s very different mix of exports (Figure 9).

Figure 9: NZD tracks EUR, another dairy exporting currency, more closely than it does AUD

Economic growth differentials

Australia is famous for great wines and kangaroos, among others, and in the last few decades it has added one more item to the list: the longest continuous economic expansion recorded by any developed country in memory. The expansion lasted 28 years from late 1991 through early 2020, and it might have continued had it not been for the pandemic.

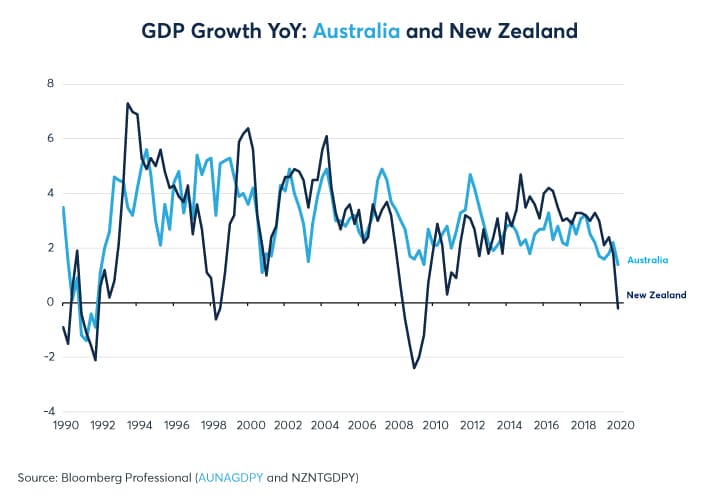

New Zealand’s economy has done well over this period, but has been somewhat more variable during during the Asian Crisis of 1997-98 and the Global Financial Crisis in 2008-09. However, while Australia holds the record for the longest expansion, New Zealand’s economy has been outperforming Australia’s on a year-on-year basis for nearly every quarter from 2014 to the end of 2019 (Figure 10). This may also explain why NZD made headway against AUD over the same period.

Figure 10: Australia had a 28-year expansion, but New Zealand outperformed from 2014

Debt Levels

New Zealand also has somewhat lower levels of debt than Australia. Public sector debt in both countries is low, and particularly so in New Zealand. At the end of Q4 2019, Australia’s government debt totaled 37.1% of GDP; in New Zealand it was 28.5%.

Private sector debt is high in both countries, but especially so in Australia. Households in Australia are among the world’s most indebted, with liabilities totaling 119.5% of GDP, compared to 94.4% of GDP in New Zealand. New Zealand’s corporate debt is more substantial than Australia’s at 80.7% of GDP versus 71.7%, but overall, New Zealand’s total public and private sector debt amounts to 203.6% of GDP, about 25% less than Australia’s (Figures 11 and 12). Both countries have relatively low levels of debt compared to Canada, China, Europe and the US (in the 250-280% of GDP range at the end of Q4 2019) and certainly much lower than in Japan, where debt total 400% of GDP. As such, both countries are well positioned to run fiscal deficits to offset the impact of the pandemic.

Figure 11: Total loans to Australia’s non-financial sector were 229% of GDP in Q4 2019

Figure 12: Total credit to New Zealand’s non-financial sector was 204% of GDP in Q4 2019

In most other respects, there is little difference between the two economies. Both countries have had consistently low inflation for decades and their central banks recently set interest rates at nearly zero for the first time (Figures 13 and 14). Likewise, both nations appear to have contained, for the moment, the coronavirus outbreak and are reopening their economies.

Figure 13: Low inflation helped eased the path to RBNZ’s first experiment with ZIRP

Figure 14: Australia finally joined the US, Japan and Europe at near-zero rates

Their export markets remain challenged. But weak export markets might have less impact on New Zealand, which could see consistent demand for food products and is currently witnessing soaring demand for lumber. Australia’s exports of coal, iron ore, natural gas, copper and aluminum might be more vulnerable to continued weak global growth. That said, Australia is benefiting, at least temporarily, from higher prices for certain products like iron ore and copper as its mines remain open while many competing mining operations in South America and Africa have curtailed production because of the pandemic.

Bottom Line

- New Zealand relies heavily on exports of dairy and lumber

- Australia’s primary exports are coal, iron ore, gold and natural gas

- New Zealand’s export prices performed better in the last decade than Australia’s

- New Zealand had faster economic growth from 2014-19 than Australia

- Government and household debt levels are lower in New Zealand than in Australia

- Both nations’ central banks have gotten to near zero rates for the first time

To learn more about futures and options, go to Benzinga’s futures and options education resource.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.