AUD/USD Current Price: 0.6937

- Australian data keeps beating the market’s expectations and backing the Aussie.

- The poor performance of global indexes put a cap to the AUD/USD pair’s advance.

- AUD/USD with a limited bearish scope despite some signs of bullish exhaustion.

The AUD/USD pair has surpassed its previous monthly high for a couple of pips closing in the green yet spending most of this Thursday within familiar levels. The intraday peak at 0.6987 was achieved within the ECB monetary policy announcement, which exacerbated the dollar’s sell-off. The pair eased from the mentioned high amid the poor performance of equities on the back of dismal US data.

At the beginning of the day, Australia released the April Trade Balance, which posted a surplus of 8800 million, better than anticipated. Retail Sales fell in the same month by 17.7%, also above forecast. This Friday, the country will release the AIG Performance of Services Index for May, previously at 27.1, and April HIA New Home Sales, previously at -21.1%.

AUD/USD short-term technical outlook

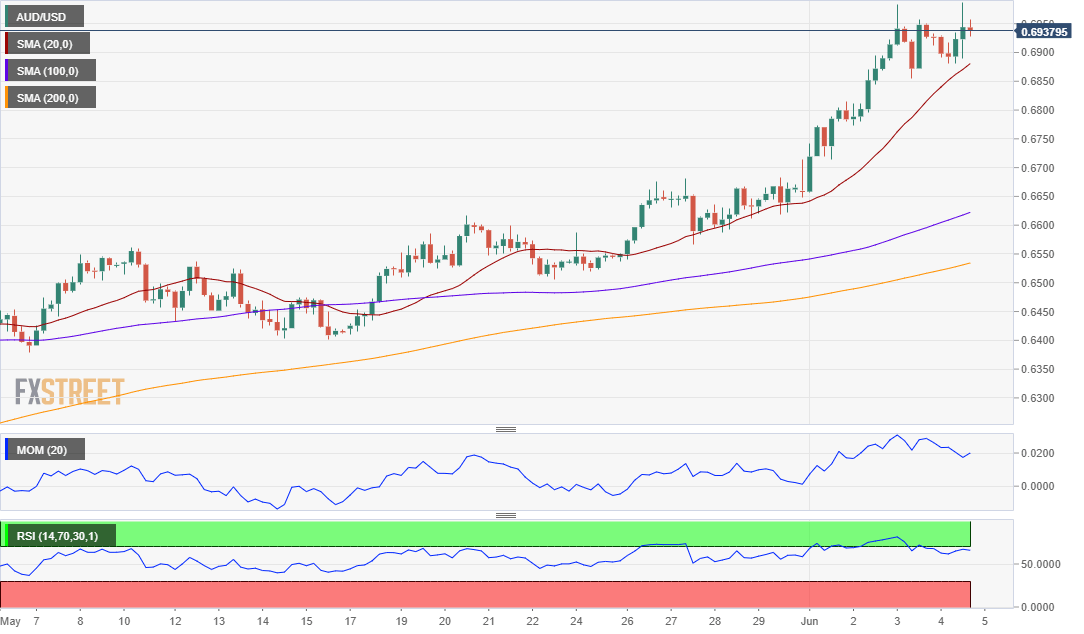

The AUD/USD pair may continue advancing during the upcoming Asian session, as technical readings suggest so. In the 4-hour a sharply bullish 20 SMA limits intraday declines, currently at around 0.6880, where the pair bottomed daily basis. The Momentum indicator diverges from price, heading south within positive levels, while the RSI consolidates around 68. The pair could enter in a corrective decline once below 0.6880, but buyers are expected to resurge around the next support level at 0.6840.

Support levels: 0.6880 0.6840 0.6800

Resistance levels: 0.6990 0.7025 0.7060

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.