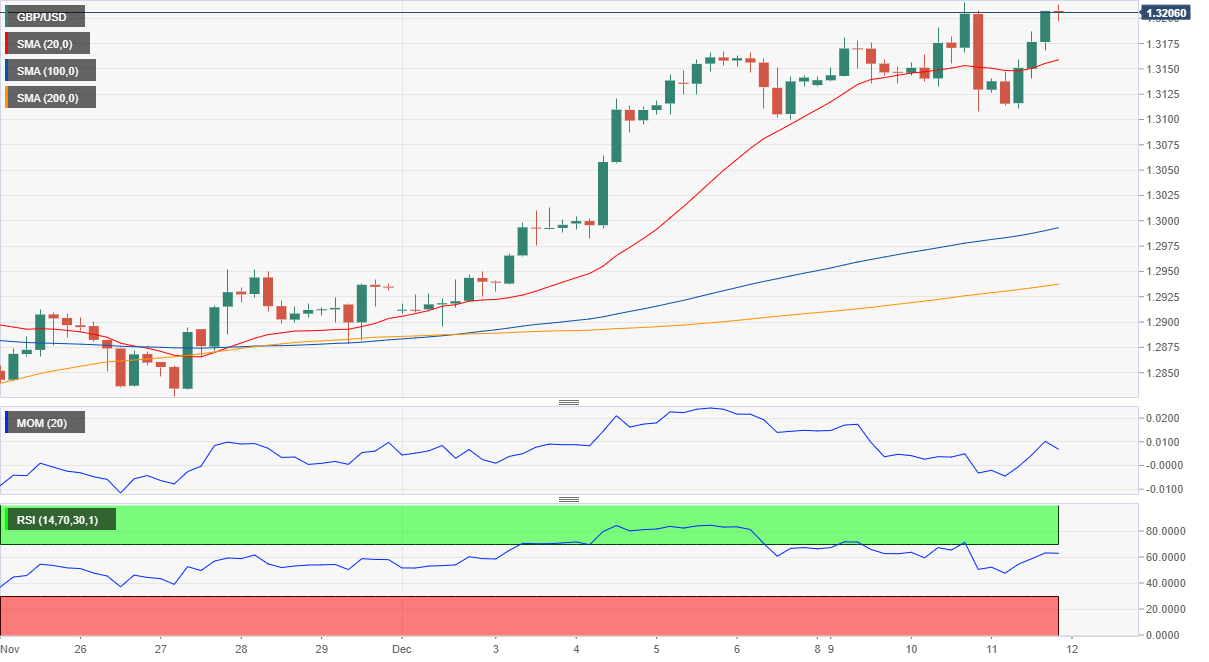

GBP/USD Current Price: 1.3206

- Market players chose to ignore the latest polls showing a limited Conservatives’ advantage.

- UK PM Johnson at risk of not getting enough support to pass its Brexit deal.

- GBP/USD holding near 1.3200, market players will likely remain cautious ahead of elections’ outcome.

The GBP/USD pair has fallen to 1.3107 early Wednesday, following the latest YouGov poll, which showed that Conservatives’ lead on Labors kept shrinking, now at just 9 points, which means that PM Johnson won’t be able to get enough seats to pass its Brexit deal through Parliament.

At this point, it seems Conservative will have a majority of just 28 seats, way below the 68 seats shown in previous surveys. The pair later trimmed early losses amid persistent dollar’s weakness, now trading near the 7-month high reached this week at 1.3214.

The UK will vote this Thursday, although the results won’t be out until late in the day. Ahead of it, little should be expected around Pound crosses, particularly considering the kingdom won’t release relevant macroeconomic data.

GBP/USD Short-Term Technical Outlook

The GBP/USD pair retains its intraday gains, trading around the 1.3200 figure. The short-term picture is bullish as the pair pierced, but recovered above, its 20 SMA in the 4-hour chart, which now heads north. Technical indicators, in the meantime, advance within positive levels, although below their weekly lows. The Pound is all about the general election now, and it seems unlikely there will be relevant moves ahead of the result of it.

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.