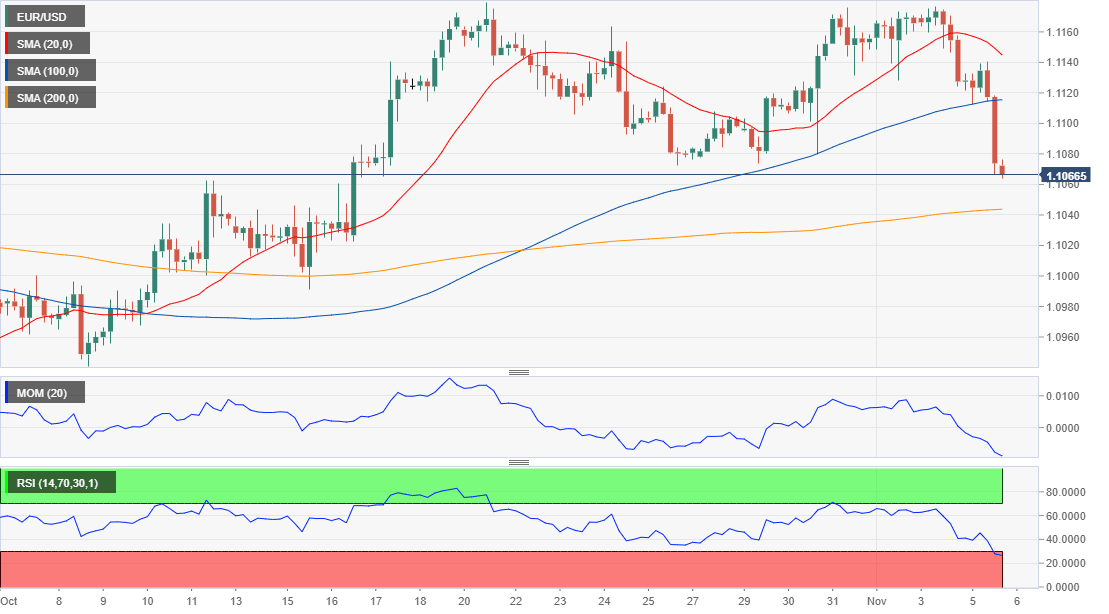

EUR/USD Current Price: 1.1066

- Hopes that the US and China will sign a trade deal maintained sentiment upbeat.

- US ISM Non-Manufacturing Index jumped to 54.7 in October.

- EUR/USD to extend its slump on a break below the daily low.

The EUR/USD pair fell to a fresh three-week low of 1.1063, amid renewed dollar’s demand on the back of risk-appetite and persistent hopes that the US and China are heading into a trade arrangement. The greenback got an additional boost from the US ISM Non-Manufacturing Index, which beat expectations by printing 54.7 in October, much better than the 53.5 expected and the 52.6 previous. The news spooked the ghost of a US recession, therefore suggesting the US Federal Reserve would refrain from cutting rates further.

This Wednesday, Markit will release the final versions of the October Services PMI for the Union and its members. The EU figure is foreseen at 51.8, unchanged from its previous estimate, while the German index is foreseen at 52.5 from 51.2. The EU will release September Retail Sales, seen up by 0.1% MoM and by 2.5% YoY. The US calendar will be quite light, as it will only include weekly MBA Mortgage Applications and a speech from Fed’s Evans.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair has bounced just modestly from the mentioned daily low, also a critical Fibonacci support, as it stands for the 38.2% retracement of the October rally. Technical readings in the 4-hour chart suggest that further slides are likely, as the pair has extended its slump well below the 20 and 100 SMA, with the shortest gaining bearish traction. The 200 SMA is now flat below the current level, a few pips above the 50% retracement of the mentioned rally, this last at 1.1030. Technical indicators have pared their declines and bounced modestly after reaching oversold levels, suggesting selling interest remains strong despite the pair being at a major support.

Support levels: 1.1030 1.1000 1.0970

Resistance levels: 1.1100 1.1145 1.1180

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.