- The GBP/USD is extending its losses, trading at the 1.3000 handle.

- Concerns about Brexit, a disappointing GDP, and threats to the government weigh.

- The technical picture looks more bearish than it used to.

The GBP/USD is battling 1.3050, trading lower and extending its drops. Brexit negotiations are going nowhere fast, with the open issues being the Irish border and the customs arrangements. The European Union is stepping up its preparations for a no-deal Brexit. The news of these preparations may be an attempt to put pressure on the British government to abandon its Chequers plan.

Pressure also comes from former Foreign Minister Boris Johnson. The leading contender to replace May laid out his Brexit proposals in a 4,600-word document that seems like a leadership bid. The political move comes days before the Conservative Party convenes in Birmingham for its annual conference. The event, held between September 30th and October 3rd, is a test for the government.

UK data did not help Sterling. While quarterly Q2 GDP was confirmed at 0.4 percent, annual growth was downgraded from 1.3 to 1.2 percent. In addition, the Current Account deficit ballooned to over 20 billion pounds, worse than had been expected.

For GBP/USD, a stronger US Dollar is also key. The greenback enjoys positive momentum in the aftermath of the Fed decision on Wednesday. The central bank raised rates and signaled four more increases through 2019. The removal of the words "accommodative policy" in the statement caused initial weakness for the US Dollar, but it has been on the march ever since Powell clarified it does not imply a change in policy.

US data was pretty good with Q2 GDP confirmed at a robust 4.2 percent annualized in Q2. The Fed's favorite inflation measure, the Core PCE Price Index, is due at 12:30 GMT alongside Personal Income and Personal Spending. The final version of the UoM Consumer Sentiment is also due.

Today is the last day of the week, month, and the quarter. Last minute adjustments by portfolio managers could result in erratic market movements.

GBP/USD Technical Analysis

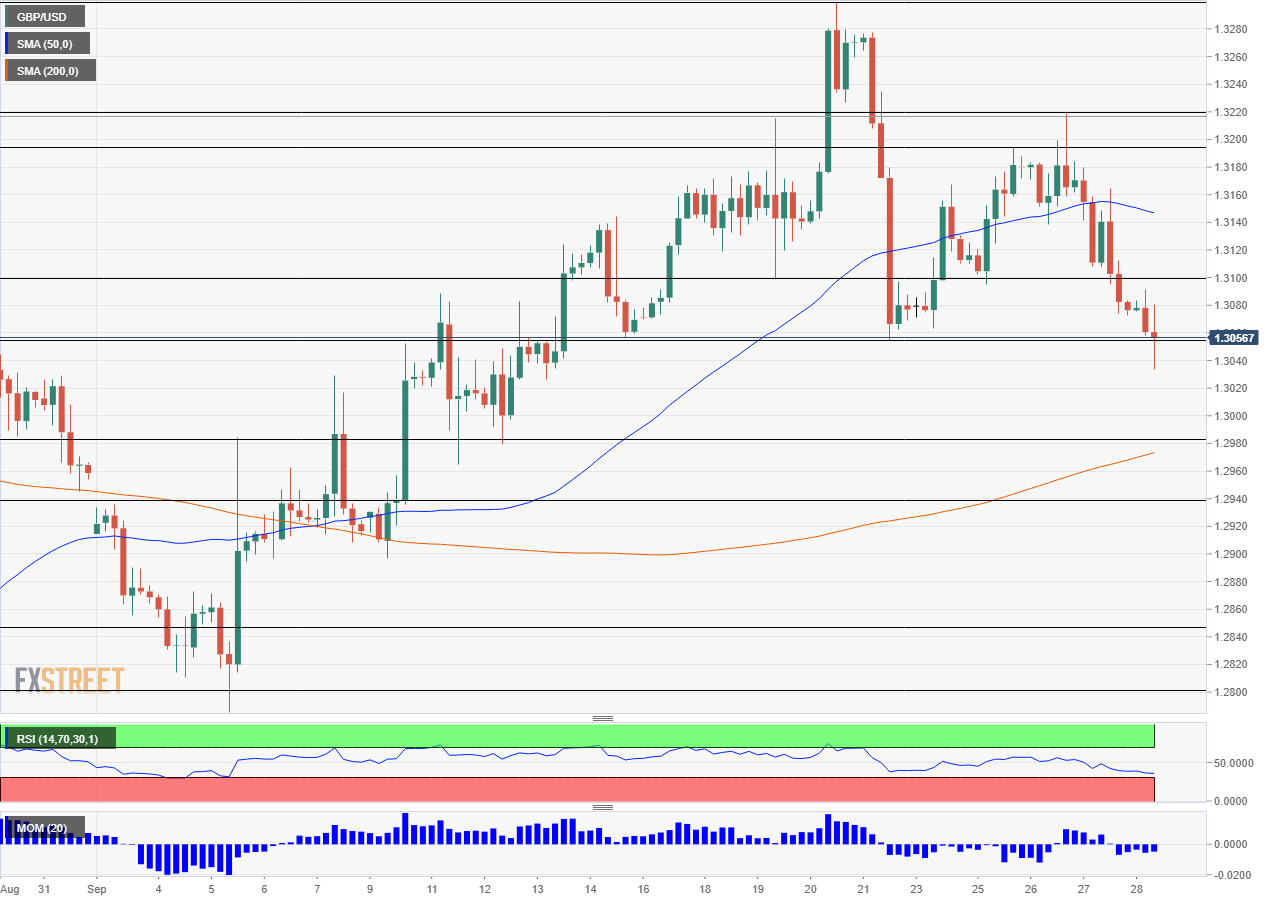

The GBP/USD dropped off support at 3055 which was the low point late last week. It is also trading below the 50 Simple Moving Average on the four-hour chart and the Relative Strength Index points to further falls, avoiding oversold conditions for the time being. Momentum also points to further drops.

1.2980 was a stepping stone on the way up and switches to support. 1.1940 was the gap line around the turn of the month and serves as a support line. 1.2840 is next down the line.

Looking up, 1.3100 was a swing low last week and switches to resistance. 1.3190 capped the pair earlier in the week and it is followed by 1.3220 which was a swing high earlier on.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.