Forget the trade war, let's talk briefly about the yield war.

Stocks have been a proxy for yield for quite some time now. Income-seeking investors crowded into dividend payers with large investment institutions hammering this mentality into retail clients. This may have something to do with the weakness within Consumer Staples which was down 14 percent at one point this year, and still down over 7 percent.

I don't think it is a coincidence that Staples peak valuation was July of 2016 at 24x earnings, at the same time rates were really starting to accelerate higher. Additionally paying 24x earnings for the sector with the lowest profit margins and static growth did not seem too rational in my view.

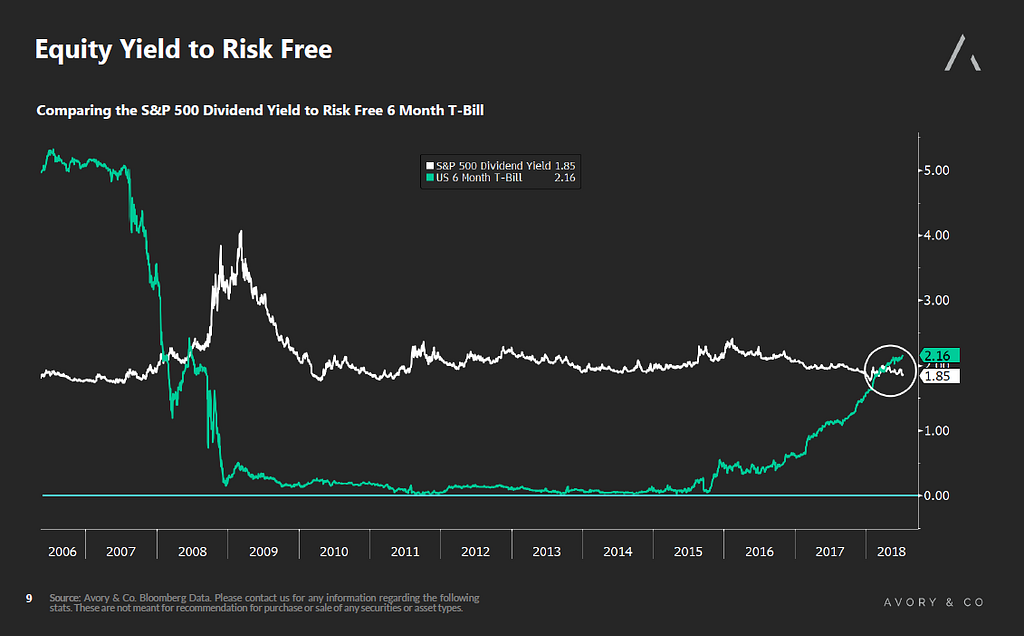

Looking below at the chart you can clearly see how the 6-month U.S. Treasury Bill has been well below that of the S&P 500 dividend yield since 2008. As the Fed began raising rates, the yield for T-bills rose and has officially surpassed that of the S&P 500 yield.

This is a critical change in the investment landscape and one that should be on the top of everyone's mind. The yield war has begun, and I believe this is a net negative for equities.

Disclaimer: This is not a recommendation for purchase or sale of any securities.

Avory & Co. is a registered investment adviser. Information presented is for educational purposes only. Please see full disclaimer here.

Related Links:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.