The USD/JPY pair closed last month at 106.66, confirming a long-term bullish-to-bearish trend change.

The monthly chart shows the could drop to 100-month moving average (MA) of 99.38 in the next 6 months.

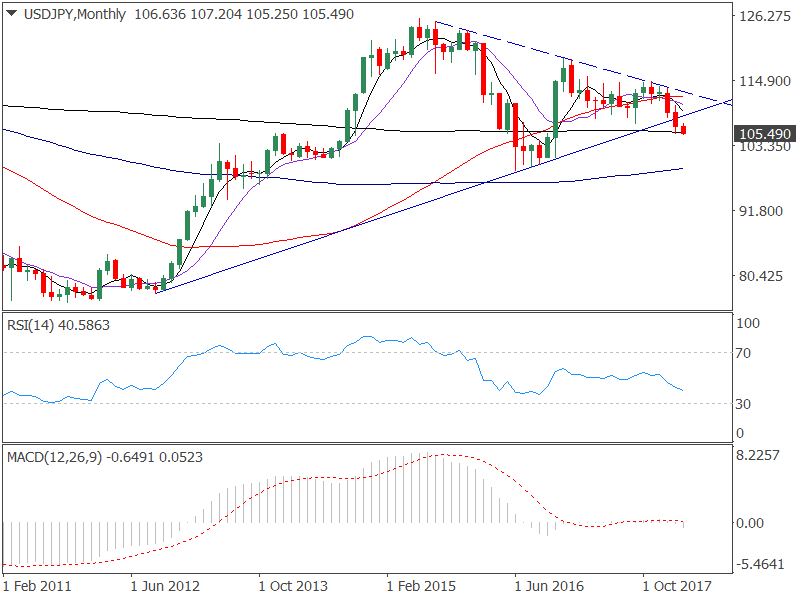

Monthly chart

- The bearish symmetrical triangle breakdown adds credence to the argument that the rally from the 2011 low of 75.56 topped out at 125.86 in June 2015 and could revisit 2016 lows below 100.00.

- Also, the pair has breached 106.38 - 38.2 percent Fib retracement of the June 2016 low - December 2016 high.

- The MACD shows the bearish momentum is gathering pace.

- Further, the relative strength index (RSI) is biased bearish.

Technicals are perfectly aligned with bearish macro factors

- Trade wars are likely to escalate and could yield deeper pullback in the equities.

- Faster Fed tightening is Yen positive as rising bond yields are equity negative.

- The BOJ is stuck between the rock and a hard place - More stimulus will likely be counterproductive.

- Yen usually appreciates in March, courtesy of repatriatio of overseas profits ahead of the fiscal year end.

Long-term View - bearish

- The spot looks set to test 100.71 (50 percent Fib retracement of 2011 low - 2015 high) in the next six months or so. A violation there would expose 98.79 (Brexit low).

- On the higher side, only a close above the ascending trendline (back inside the symmetrical triangle) would signal bearish invalidation.

Short-term view - risk of a minor corrective rally

The daily chart shows the RSI is holding well above the lows seen in the Feb. 14. So, a positive move today would establish a bullish price-RSI divergence and could yield a re-test of the descending trendline resistance.

- A close above the trendline would allow a stronger corrective rally to descending 50-day MA (now seen at 108.90).

- However, the 5-day MA and 10-day MA are trending south, indicating a bearish setup. Thus, sustainability of gains is under question.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in