Will bad news be good news again?

Will bad news be good news again?

Or will good news be bad news. It would be very confusing if good news were good news or bad news was bad news as we'd have to go back to reading the news again and, we don't want to do that because the news is sooooooooooo depressing! As Dave Fry noted last night: "There is much to discuss about the Jobless Claims and the Employment Report since much of the data is now skewed by incoherent data. With Jobless Claims data it's been more about people exhausting their benefits and falling off the rolls. Much the same can be said about the Employment Report since the percentage of workers, or the participation rate, is historically low at around 63% of the workforce. The Gallup organization for example has stated less people are working now than one year ago."

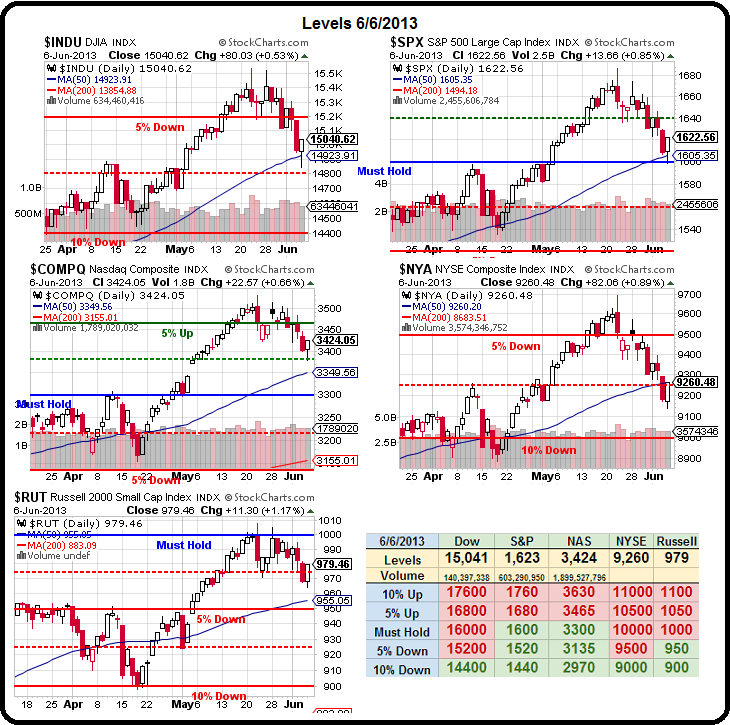

As you can see from Dave's chart, we got to our 1,622 "weak bounce" target, that our 5% Rule™ predicted yesterday morning, the very hard way but hit it right on the nose on that silly-spike close. We also predicted 3,420 on the Nasdaq and it finished at 3,424 and we predicted 9,280 on the NYSE and it finished at 9,260 and we targeted 975 on the Russell and that one got over at 979 right at the close, after spending over an hour at 975.

Well, we can't get them all, can we? The Dow was our biggest disappointment, falling way short of our 15,108 target at 15,040. Not that we care – those were just the lines we expected to bounce to and maybe they'll catch it this morning before failing into the weekend. That's right, we're still bearish BECAUSE the weak bounce lines failed on day one and ONLY catching the strong bounce lines into the weekend (15,216, 1,634, 3,440, 9,360 and 981.40) would change our minds.

Well, we can't get them all, can we? The Dow was our biggest disappointment, falling way short of our 15,108 target at 15,040. Not that we care – those were just the lines we expected to bounce to and maybe they'll catch it this morning before failing into the weekend. That's right, we're still bearish BECAUSE the weak bounce lines failed on day one and ONLY catching the strong bounce lines into the weekend (15,216, 1,634, 3,440, 9,360 and 981.40) would change our minds.

Keep in mind that the Dollar (which these indexes are priced in) has fallen 2% this week and 4% this month so, if we apply a 4% discount to those index spike bottoms from yesterday, we get (in steady dollar terms) 14,250 on the Dow, 1,534 on the S&P, 3,242 on the Nasdaq, 8,784 on the NYSE and 926 on the Russell.

THAT's how far the markets have fallen off the top if not for…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.