What is going on with these indexes?

What is going on with these indexes?

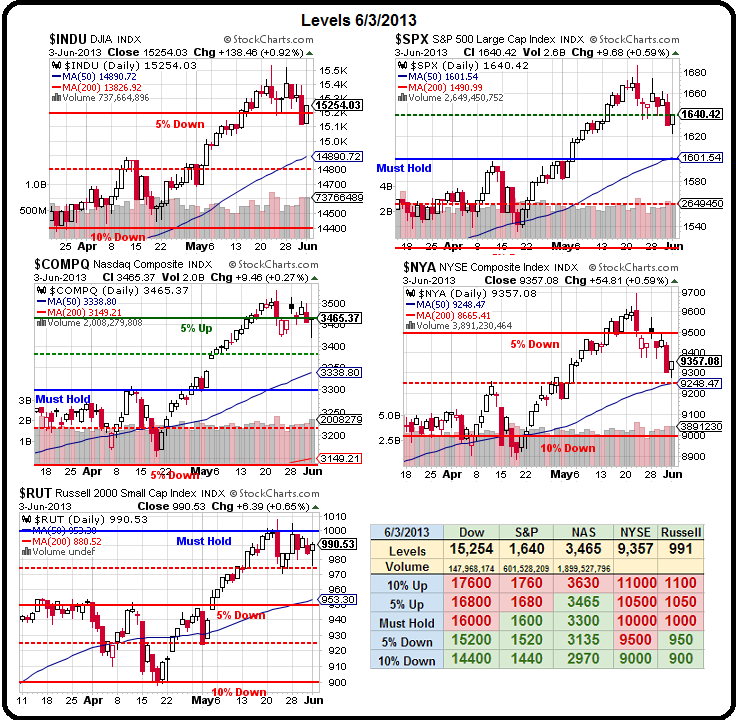

Last week, I said "975 is bust" on the Russell and, yesterday, we hit 975 on the nose before turning back up. Is this bullish, or shadows of breakdowns to come? Clearly the Fed is still very much in the game so buying the f'ing dip is still the logical way to play the market but any hint that the Fed may stop, or even slow, the FREE MONEY train is going to have a dramatic impact on investor confidence since, without the Fed, what do we have?

- We have a Euro-Zone in it's longest recession ever (6th consecutive quarter of contraction) with their GDP out tomorrow.

- Euro-Zone Unemployment is at an all-time high 12.2% with youth unemployment in Greece at 62.5% and Spain 56.4% (buy TASR ahead of riot season!).

- Australia is falling apart.

- India has its slowest growth in the 21st Century.

- Japan (say no more).

- China is not much better.

- Global Cash Flow is falling off a cliff, despite the stimulus.

- US Real Wages continue to decline for bottom 90%.

We also have the dreaded "Hindenberg Omen" that has predicted 20 of the last 3 market crashes but I'm more concerned with the fundamental issue of Margin Debt hitting a new all-time high at $384.3Bn – $3Bn higher than July of 2007 and THAT indicator has correctly predicted pretty much every correction pretty much ever.

We also have the dreaded "Hindenberg Omen" that has predicted 20 of the last 3 market crashes but I'm more concerned with the fundamental issue of Margin Debt hitting a new all-time high at $384.3Bn – $3Bn higher than July of 2007 and THAT indicator has correctly predicted pretty much every correction pretty much ever.

What's really scary is this chart of the so-called "smart money" flying for the exits last month. We are included in that group, of course, as we also took the opportunity to "sell in May" and now, in June, we're simply waiting to see if we were right or if we pulled up our tent-poles before the show was over.

It's not like we're missing things though. Just last week, in Stock World Weekly, we have a bullish play on FDX as well as a short play on TSLA and a bullish play on TZA (which is market bearish, of course).

The FDX trade idea is still good but the TSLA idea was buying the 2015 $110/90 bear put spread for $14 and selling the 2015 $130 calls for $21 for a net $7 credit and now that spread is still $14…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.