Today’s rock-bottom interest rates and overpriced financial assets have created a low-return investment world that requires proactive yield-enhancement techniques such as covered calls, to generate the additional investment rate of return needed to retire comfortably.

Selling covered calls generates additional income and lowers the break-even cost basis of stock you already own, thus reducing the downside risk of stock ownership at all price points.

Unfortunately, many investors are under the mistaken impression that this strategy underperforms in bull markets. In an article for Personal Finance, an investment advisory service from Investing Daily, I debunked that myth by providing a real-life example involving Chevron Corp CVX. I demonstrated how you could have sold periodic covered calls on Chevron—a stock that appreciated 28.7 percent over a two-year period—and still would have outperformed a simple buy-and-hold strategy.

Many investors think of covered calls as defensive because they provide an income cushion, which is true, but they’re also a bullish strategy that often outperforms just owning the shares.

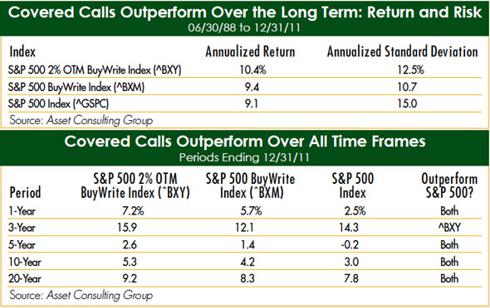

A new study by Asset Consulting Group (ACG), covering the period between June 1988 and December 2011, underscores the superiority of covered calls over a simple buy-and-hold strategy.

ACG’s study compares the S&P 500’s return with the return of two S&P 500 buy/write indexes: the CBOE S&P 500 BuyWrite Index (BXM), which sells S&P 500 covered calls every month at strike prices “at the money” (i.e., the same price as the underlying index); and the CBOE S&P 500 2% OTM BuyWrite Index (BXY), which sells covered calls every month at strikes 2 percent above the price of the underlying index.

For example, if the S&P 500 were trading at 1,000, the BXM would sell call options with the strike price of 1,000 and the BXY would sell call options with the strike price of 1,020. The contrast in performance was dramatic (see “Covered Calls Outperform over the Long Term: Return and Risk”).

Both S&P 500 buy/write indexes beat the S&P 500 index while incurring less volatility—the best of both worlds. Consider that the S&P 500 rose 360 percent during this 23.5-year period, from 273.50 at the end of June 1988 to 1257.60 by the end of December 2011, and yet a covered-call strategy that generated monthly income in exchange for capping monthly gains still outperformed a long-only S&P 500 portfolio.

That’s a powerful testament to the importance of an income-based investment strategy that reduces portfolio volatility by lessening potential losses in exchange for lessening potential gains. Losses are more damaging to a portfolio’s wealth accumulation than gains of an equal percentage are beneficial, so reducing risk through income generation should be a paramount consideration for any serious investor.

Selling covered calls reduces portfolio volatility and, consequently, improves annualized returns. It’s that simple. What’s amazing is that the covered call strategy’s outperformance is so consistent over different time periods.

Consider the table, “Covered Calls Outperform Over All Time Frames.” Whether you look at periods as short as one year or longer periods up to 20 years, the result is the same: At least one of the covered call indexes outperformed the S&P 500. Moreover, in all time periods except the past three years, both covered-call indexes outperformed.

The bull market that has been in effect since the March 2009 low has been one of the most powerful bull runs of the past century, so we can forgive the at-the-money covered-call strategy for not outperforming during this unique period.

To be fair, covered calls typically generate a greater frequency of taxable gains and losses than a long-only strategy, so it is clearly preferable to sell covered calls on stocks held in a tax-deferred retirement account (see On the Money).

Not only does the sale of covered calls create frequent taxable gains, but there’s also always the risk of early exercise, which would require you to sell the underlying stock. Selling stocks that have very low cost bases because they were bought a long time ago and have since appreciated in value can be especially problematic because their sale could trigger substantial capital gains taxes.

Powerful Options

Nonetheless, the potential benefits of covered calls far outweigh the tax implications. First, if you rely on the income from dividend-paying stocksto pay living expenses, getting your stock called away by the exercise of a covered call is only a minor inconvenience—you can always buy the stock back immediately after exercise to continue receiving dividends.

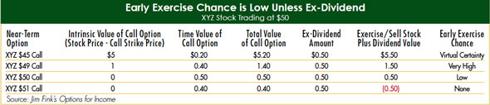

Second, there is a misconception that the moment a stock rises above the strike price of a covered call, the call will be exercised. This is completely untrue. The value of a call option has two components: (1) Intrinsic value, which is the value you could get right now by exercising the option; and (2) Time value, which is a speculative surcharge based on what the option could be worth if the stock moves higher between now and the option’s expiration date.

Although time value decays and reaches zero at the expiration date, it is greater than zero prior to the expiration date, so an option holder is almost always better off selling a call option—thus receiving both intrinsic value and time value—rather than exercising it and receiving only intrinsic value. Early exercise of a call option is only likely in two scenarios. By recognizing these two scenarios and taking action to eliminate them (i.e., buying back the call and selling a different one), you can reduce the risk of option exercise. The two scenarios are:

(1) The covered call option is deep “in the money”—which means that the underlying stock trades far above the call strike—and the bid price of the call option is below the “intrinsic value” one could get from exercising the call. For example, if a stock trades at $77 and a $70 call option is bid $6.75/$7.25, the call owner would make more money exercising and receiving $7 ($77-$70) than he would selling the call for $6.75.

(2) The covered-call option is “at the money” or “in the money” when an ex-dividend date is near.

In the ex-dividend scenario, a call owner will exercise early if the amount of the dividend exceeds the amount of time value he will forfeit by exercising the call.

For example, if XYZ stock trades at $50 and the $45 call sells for $5.20, the call has $5.00 of intrinsic value ($50-$45) and $0.20 of time value. If an ex-dividend date is tomorrow and the dividend is $0.50 per share, the call owner will exercise early because the $0.50 dividend is greater than the $0.20 of time value forfeited.

However, if the dividend were only $0.10 per share, the call owner wouldn’t exercise because the call option’s time value would be worth more than the dividend amount.

Remember, writing covered calls is not a sell-and-forget strategy, but one that requires monitoring. Given the impressive outperformance covered calls have generated over time, however, the small degree of monitoring that is required is well worth it. For a more detailed guide on options trading, check out my free Options Trading Strategies guide

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.