When the world is running down

You make the best of what's still around – Police

This is the chart we'll be watching today:

It's Dave Fry's McClellan Oscillator and -100 is very, very oversold so we can expect some kind of bounce for any silly reason and what we'll be watching closely is how fast a move up works off the oversold condition. If, for example, we come back 13 points on the S&P (weak bounce) to 1,658 and the Ocillator moves all the way back to 0 (neutral) - then the market is likely due for much more pain ahead.

It's not enough to just stare at the charts – you need to understand HOW they are constructed and what factors affect them. On the left is the NYSE Summation Index, sort of a longer-term oscillator and it's showing we're not even oversold yet. This makes it very likely that any bounce we get today will be short-lived and I've already sent out an Alert to our Members (and a tweet) to prepare for stormy weather ahead.

It's not enough to just stare at the charts – you need to understand HOW they are constructed and what factors affect them. On the left is the NYSE Summation Index, sort of a longer-term oscillator and it's showing we're not even oversold yet. This makes it very likely that any bounce we get today will be short-lived and I've already sent out an Alert to our Members (and a tweet) to prepare for stormy weather ahead.

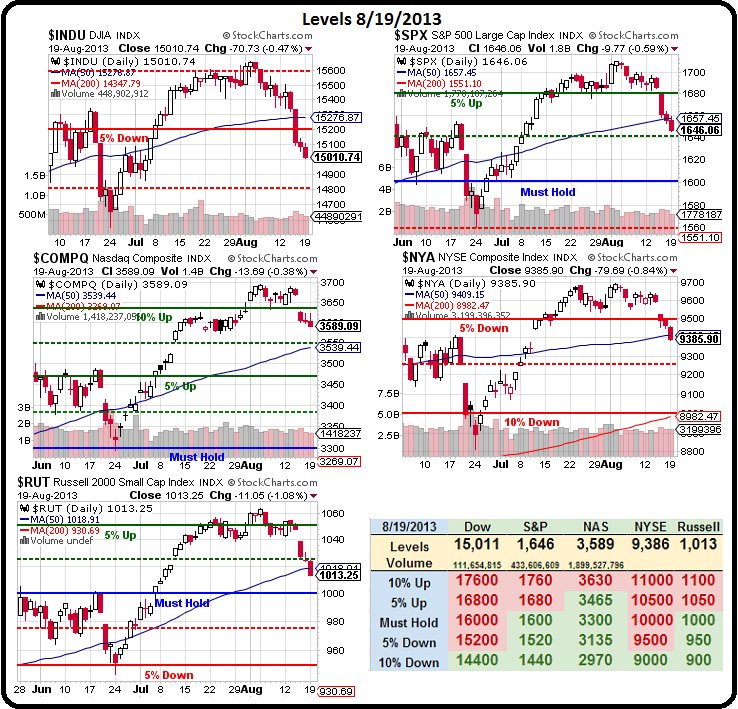

I won't get into the macros again – you can follow the links for that – since I sent out the Alert we had a beat from Best Buy (BBY) and Home Depot beat and raised guidance so that's given us an excuse to bounce higher but also gives us a chance to pick up some inexpensive hedges but, first, our target levels.

Per our 5% Rule™, we look for weak (20%) and strong (40%) bounces off 1.25%, 2.5% or 5% market pullbacks. The S&P, for example, fell from 1,710 to 1,645 and that's 65 points or 3.8% or close enough to 3.75% to make us look at the legs and leg one was 25 points over 8 days, to 1,685, and leg 2 was 40 points over the last 3 days – so we've been accellerating to the downside.

Per our 5% Rule™, we look for weak (20%) and strong (40%) bounces off 1.25%, 2.5% or 5% market pullbacks. The S&P, for example, fell from 1,710 to 1,645 and that's 65 points or 3.8% or close enough to 3.75% to make us look at the legs and leg one was 25 points over 8 days, to 1,685, and leg 2 was 40 points over the last 3 days – so we've been accellerating to the downside.

At the 3.75% line, we expect a 20% retrace as "normal" and not a break of the trend. A 40% retrace (strong bounce) is a sign of possible…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.