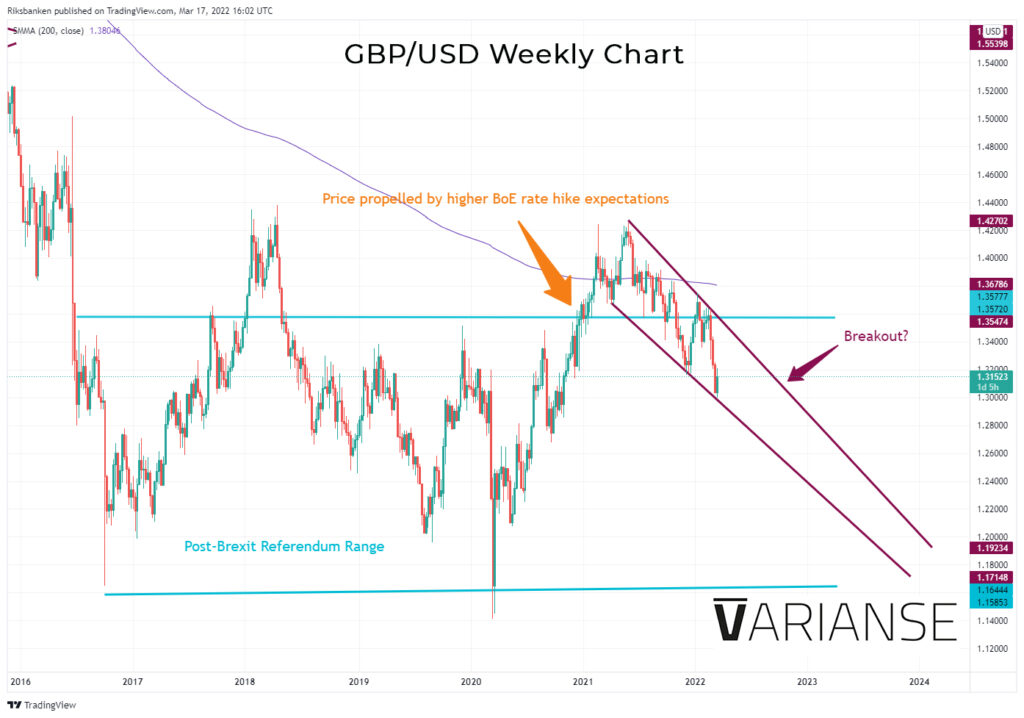

GBP/USD found little support after the BoE raised its bank rate by 25 bps to 0.75% on Thursday. Within the forty-five minutes after the announcement, the pair shed c. 0.90% of its value to touch an intra-day low of 1.30876 before retracing only some if its losses later in the day.

Maybe part of the knee-jerk reaction lower in GBP/USD could be attributed to typical “buy the rumour sell the fact” behaviour. Bond market investors and economist had placed near certainly on Thursday’s 25 bps hike.

Less expected, however, was the dissenting vote against a hike from BoE Deputy Governor over the hit to demand from higher commodity prices. Economist were expected a unanimous 9 - 0 vote in favour of raising interest rates.

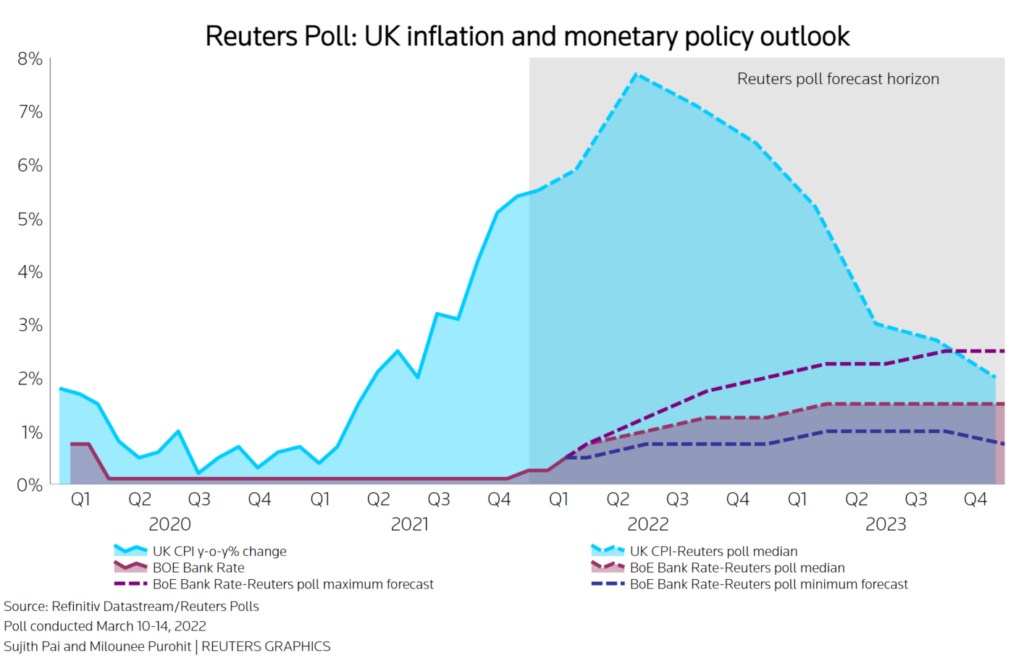

Economists have pared back their growth and raised their inflation forecasts for the UK economy. In a recent Reuters economist poll, UK GDP was projected to grow by 3.9% in 2022 versus expectations of 4.3% in February. UK inflation, on the other hand, is now expected to peak at 7.7% in Q2 versus 6.6% in February.

Investors are questioning whether the BoE has the wherewithal to raise interest rates beyond its next meeting in May. In contrast, the message from Wednesday’s Fed meeting is the FOMC looks willing to do whatever it takes to curb inflation and normalise interest rates.

This situation could certainly dampen any GBP/USD upside, should the pair break out above of its almost wedge like weekly chart pattern, or force a bigger breakout to the downside. At the very least, a return above the post-Brexit referendum range looks more difficult to fathom without further BoE interest rate hike support.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.