What Happened: Former Ark Invest analyst James Wang believes that Ethereum, the second-largest cryptocurrency by market cap, has a much higher valuation than the current market suggests.

“Ethereum isn't just a crypto currency. It's a software platform with users, revenue, and applications. If you cover software like AWS, MSFT, SNOW, or TWLO you should cover Ethereum ($ETH),” (sic) he explained, sharing a break-up of the network’s “First Quarter 2021 Results.”

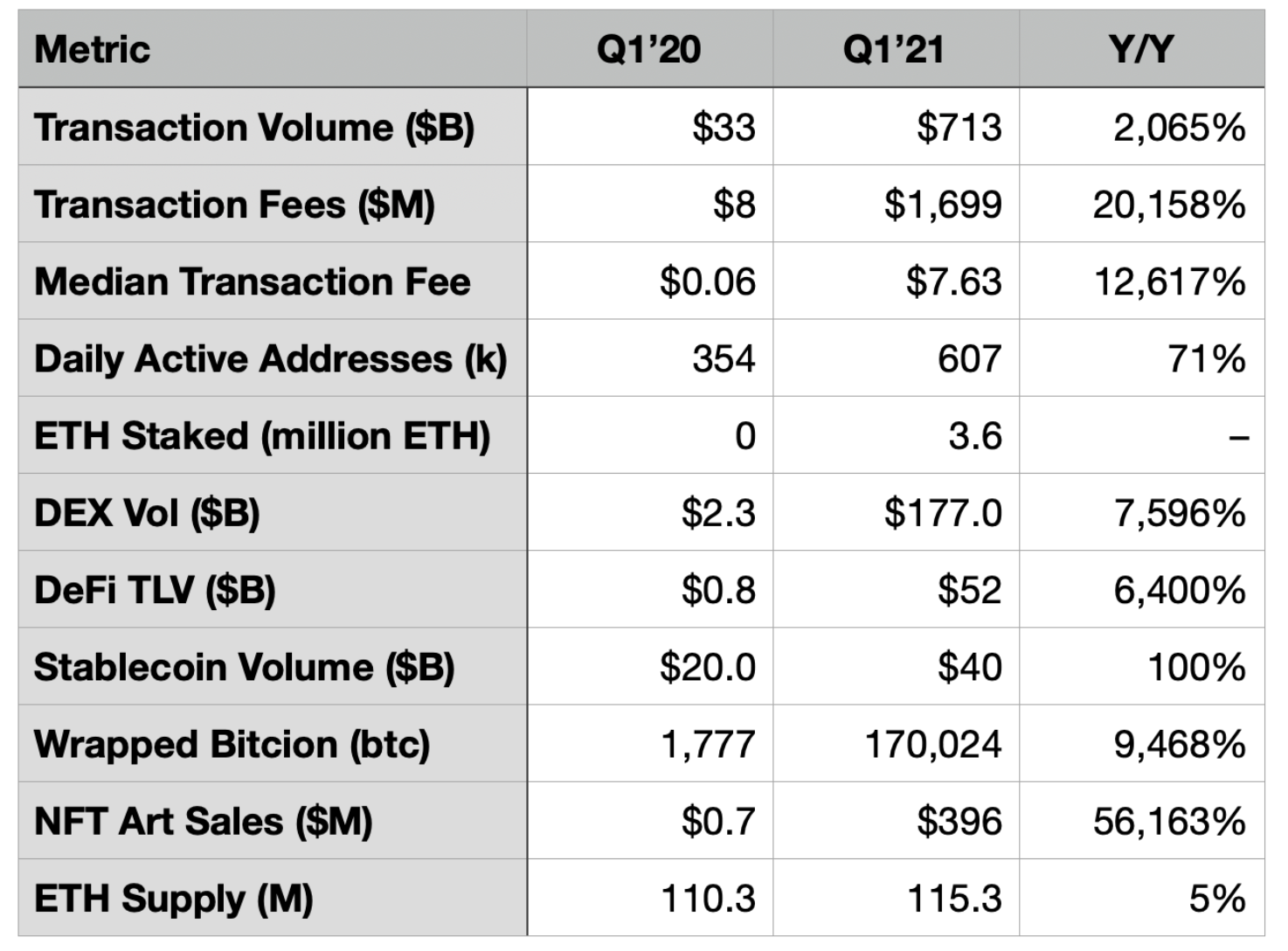

According to his findings, total transaction volume on the network increased 20x to $713 billion in Q1 of this year, compared to just $33 billion recorded in Q1 2020.

The number of daily active addresses, which can be considered a proxy for the network’s daily active users, increased 71% over one year to 607,000 for Q1.

One of the highlights of the network's “financial results” was the total transaction fees, which Wang refers to as “network revenue,” which increased 200x to $1.7 billion in Q1 2021, compared with $8 million in Q1 2020.

Why It Matters: It is worth noting that the network revenue, or transaction fees, mentioned here are often a cause for grievance for many in the crypto community.

However, as one DeFi developer on Twitter pointed out, “massive transaction costs on ETH are indeed a flaw, but they are a result of extremely high network usage. This is more bullish than not because it shows us that way more transactions are occurring, even with all the fud about the high gas fees. People are willing to pay them!”

See also: Is Ethereum About To Move Lower?

The entire Ethereum ecosystem also recorded phenomenal growth over a one-year period. Decentralized exchange (DEX) volume increased 76 times to $177 billion in Q1 2021, compared with $2.3 billion last year, and NFT sales increased 560 times to $396 million in Q1 2021, compared with $0.7 million in Q1 2020.

Price Action: The cryptocurrency recorded a high of $4,362 last week but has since traded lower. At press time, Ethereum was trading at $3,267, down 8.43% in the past 24-hours, according to CoinMarketCap.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.