For most of this year and last, you’d have been lucky to earn a stingy 1.5% interest yield on the average money-market fund.

Then, pandemic panic erupted and the Federal Reserve slashed interest rates to near zero. Yields on U.S. Treasuries plunged and, in late March, actually fell below zero.

Now, former IMF Chief Economist Kenneth Rogoff is calling on global central banks to push for -3% interest rates.

So, if you need to earn income from your investments, where on earth do you turn?

Well, what few investors are aware of ... is that cryptocurrencies now offer yields up to 8%. And in some cases, more.

In other words, up to five times the yield you'd earn on your money market fund.

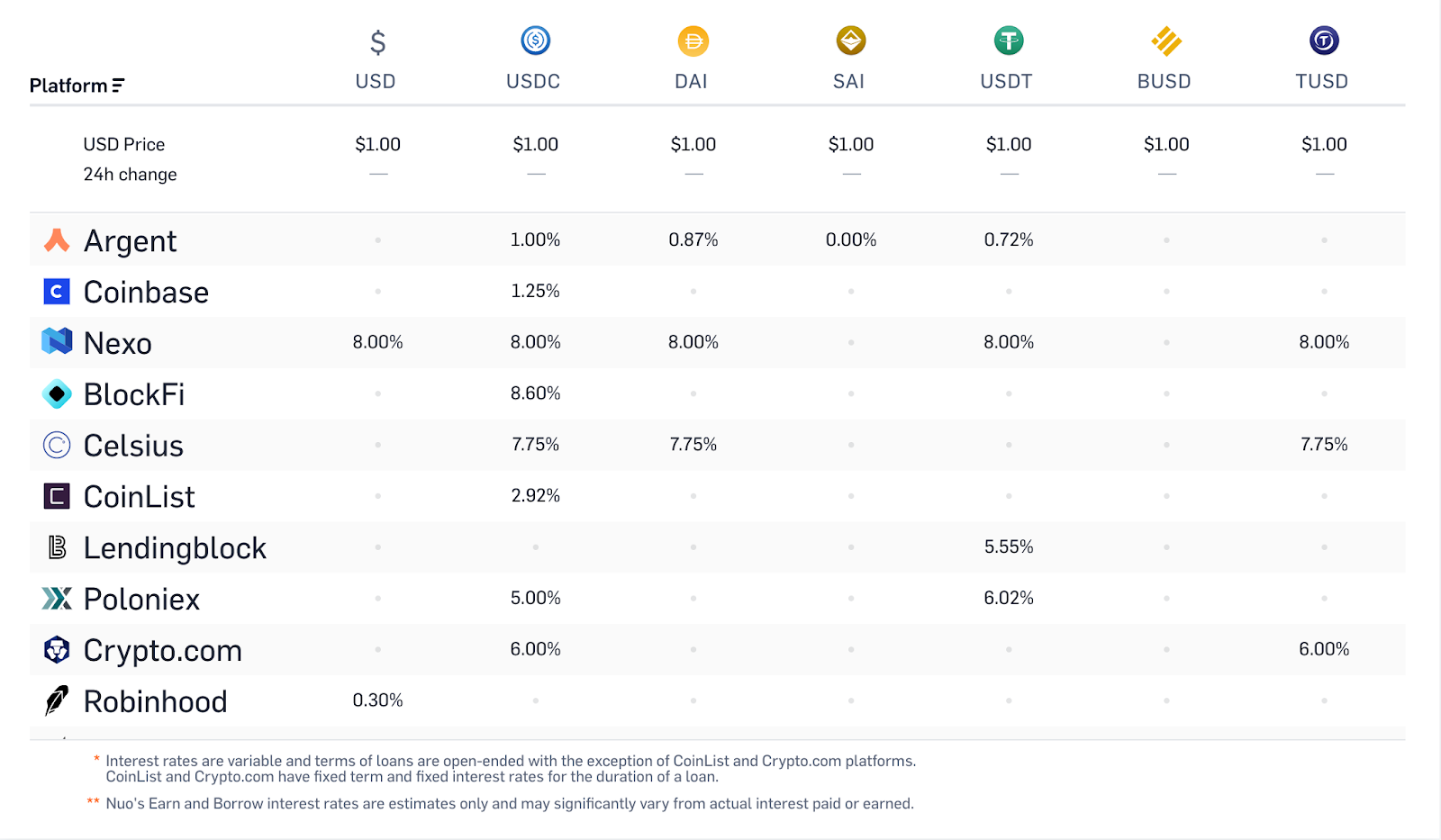

Hard to believe? Just go to loanscan.io — where you can find a number of crypto yields summarized in one place:

Figure 1: Some crypto interest rates on loanscan.io.

The most suitable cryptos for earning interest are stablecoins — that is, cryptos pegged 1:1 to the U.S. dollar. That's because — unlike Bitcoin (BTC, Tech/Adoption Grade “A”) and Ethereum (ETH, Tech/Adoption Grade “A”) — they are stable enough for you to accrue interest without worrying about wild price swings during your holding period.

Examples of such stable coins include USDC, DAI and USDT. For the purpose of this article, we will use USDC as an example to earn passive income.

Enter BlockFi

Crypto lending platforms like BlockFi, Nexo and Aave work much like traditional banks. Only instead of offering deposit accounts denominated in dollars, they're denominated in USDC. Like banks, they pay interest on the crypto you deposit, and then lend these funds out to borrowers.

In this article, we will only focus on how to use BlockFi because it's the most secure lending platform available now. And it's reasonably simple to use.

Please keep in mind, though, that we do not recommend or make referrals to brokerage firms, crypto exchanges or lending platforms. And aside from trading accounts that we ourselves may have, we have no business relationships with any that we cover.

We think BlockFi is secure and simple to use, but only you can determine if it’s the right lending platform for you. For more information on the other lending platforms mentioned above, click here for Nexo and here for Aave.

Now, back to BlockFi.

Wiring fiat dollars to BlockFi is no different than any other conventional wire transfers that you are used to. When the dollars arrive, BlockFi automatically converts them 1-for-1 to USDC and puts them in your deposit account.

When the deposit is successful, you will receive an email saying something to the following effect:

The 48.920000 USDC you sent BlockFi has been confirmed. These funds are now stored in your BlockFi Interest Account.

This means your funds have already started to earn interest. It’s as simple as that.

In our trial case, we accrued $0.04 in interest after only four days. That’s equivalent to an interest rate of 8.6%.

However, these earnings are not withdrawable until interest is actually paid — which is the beginning of every month.

Interested also compounds on a monthly basis. So, if you were to withdraw your funds in the middle of the month, you won’t earn any interest on the withdrawn amount.

Miscellaneous, But Important, Additional Information

Lots of key questions are answered in the BlockFi FAQ. But let’s discuss some important points here:

Income taxes: U.S. customers will receive an IRS Form 1099 at year-end, detailing the total dollar value of interest paid. Non-U.S. customers are responsible for determining their own tax obligations. BlockFi will provide international clients a summary of account activity upon request.

Security: BlockFi stores its funds with the Gemini Cryptocurrency Exchange (run by the famous Winklevoss twins) and is licensed by the New York State Department of Financial Services. BlockFi funds go into Gemini’s cold storage system, which is not normally connected to the Internet. For more details on custody, please see this. In short, your funds are insured and secure.

Withdrawal fees: BlockFi allows one free withdrawal per month. After that, there is a withdrawal fee of either the U.S. dollar equivalent of 0.0025 BTC or 0.0015 ETH.

Earning up to 8% passive income or more — with USDC deposits on BlockFi — is a great way to fight back against today's near-zero interest rate climate.

If you love income as much as we do ... why not give it a try?

Best,

Bruce Ng and Juan Villaverde

Check out Weiss Crypto Ratings and Indexes:

https://www.benzinga.com/cryptocurrency/weiss-crypto-ratings/

https://www.benzinga.com/cryptocurrency/weiss-crypto-indexes/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.