Stock averages will try for a fourth straight day of gains if early action holds. The S&P 500 (SPX) and other leading indices jumped Wednesday after Federal Reserve meeting minutes left Wall Street believing the central bank has its interest rate campaign on ice amid global market uncertainty.

Gains for crude oil prices amid expectations for production relief contributed to the stock market’s climb.

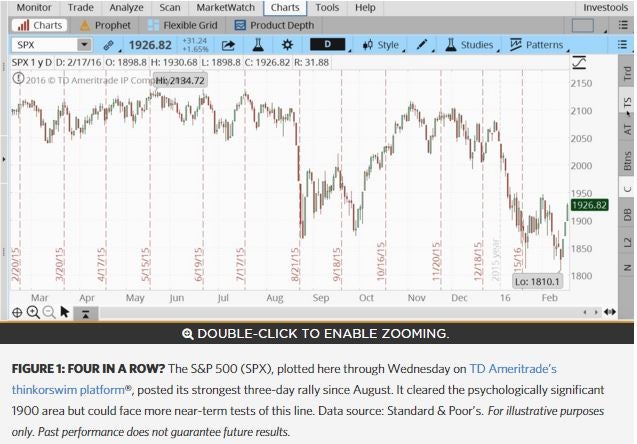

SPX just topped the closely watched 1900 line in Wednesday’s session (figure 1) and may need to build some chart congestion here to confirm a potential upside breakout, say chart watchers.

Oil Back Above $31. A sharp rebound in oil prices follows an agreement this week between Saudi Arabia, Russia, and others who will freeze oil output at January levels contingent on agreement by Iran and Iraq. Iran, which has recently been allowed to return to selling on global markets following lifted sanctions, offered its support for the deal on Wednesday. Iran did not commit to a production cap, however. Still, the move sent crude up more than 7% on Wednesday. The U.S.-traded futures contract continued to trade higher overnight and early Thursday, moving above $31 a barrel.

Bruised Apple? Apple Inc. AAPL edged higher in early action, perhaps caught up in general market enthusiasm and despite some cautionary industry data. Gartner research showed iPhone sales dropped for the first time in Q4, down 4.4% from the same quarter last year. Apple also lost market share during the period but increased market share for 2015 as a whole. Overall, global smartphone sales for all manufacturers grew 9.7% quarter-on-quarter, the slowest rate of growth since 2008, Gartner found.

Wal-Mart Cuts Sales View. Wal-Mart Stores, Inc. WMT on Thursday cut its sales outlook for the year, citing the strong-dollar impact and its store-closure plans. The big-box chain also said core sales growth in its U.S. business was softer than expected in the holiday quarter. The company is forecasting earnings of $4 to $4.30 a share for 2016, which would represent a decline from the $4.57 a share posted in the prior year. Street analysts are expecting $4.17 a share in adjusted earnings. WMT did boost its annual dividend by 2% to $2 a share.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.