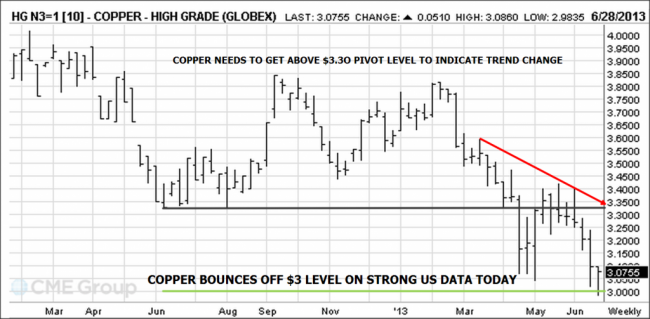

STRONG US DATA MAKES COPPER RALLY TODAY |

|

Are You An Investor? Then Get Lido Isle Advisors "Favorite 3" Alternative Money Managers Emailed to You by Clicking Here. Don't Miss It!

Orders for U.S. durable goods rose more than forecast in May, & purchases of new houses in May rose 2.1 percent to an annualized pace of 476,000. The People’s Bank of China said it will keep money-market rates at reasonable levels. Equities: The SEP13 emini SP is trading up 8.25 points to 1574.50, which is very close to our magnet/high-volume area of 1574. We have a resistance level at 1584, and a potential short term bullish pattern which indicates that this market may find its way up to 1590. The key pivot point for the short term is 1574. If the market can’t stay above this level, we could see a test of yesterday’s lows in the low 1550′s. We don’t think the market is ready quite yet to make a drastic bullish turn-around, but with strong US data continuing to be released, bullish forces at these levels could start to build. Bonds: On strong economic data, the bonds are down again today, with the SEP13 30yr trading down 20 ticks to 134’06. 134’02 is the support level from yesterday’s trade, and then below there 133’26 is another support level. The bonds have been in a very strong downtrend, and they could have a lot of room to fall especially if the data keep coming out strong. We believe 133’26 is the key line in the sand. If the market can stay above here, it could rally back up to 135. Currencies: The Euro is down 45 ticks on US dollar strength, and the Aussie is down 37 ticks to 91.79. The Aussie could indeed make a push to the psychological key barrier of 90.00 at some point. 91.50 is one of our key support levels. If the market can stay above here, it could rally to the mid 92′s again. If the market keeps dropping below 91.50, we look for a test of 90.00. Commodities: Gold continues to trickle lower, today trading down $4 to $1272. We reiterate our next downside target of $1242. AUG13 natural gas is down $.06 to $3.70. We think there could be selling exhaustion below the $3.68 level. Copper has been in a bearish trend recently, but today it bounced up from the $3 level on positive economic data. We believe copper could head back up to $3.12, which is a key target and resistance level. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. TRADING COMMODITY FUTURES AND OPTIONS IS SPECULATIVE, INVOLVES RISK OF LOSS, AND IS NOT SUITABLE FOR ALL INVESTORS.

Are You An Investor? Instantly Receive Full Summaries of Our "Favorite 3" Managed Futures & Options Programs by Clicking Here. Don't Miss It!

Lido Isle Advisors is an elite provider of futures and options brokerage. The leadership of Lido Isle Advisors has been featured on CNBC, Bloomberg TV, and referenced in leading publications such as Financial Times, Wall Street Journal, Reuters, Benzinga, Futuresmag, & Marketwatch for expertise on the futures and commodities markets. |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.