Are You An Investor?

Then Get Lido Isle Advisors "Favorite 3"

Alternative Money Managers Emailed to You

by Clicking Here. Don't Miss It!

Applications for unemployment insurance payments decreased by 4,000 to 323,000 in the week ended May 4, the least since January 2008. The Bank of Korea cut its interest rates today, lowering the benchmark seven-day repurchase rate to 2.5 percent from 2.75 percent. It seems as though central banks are taking a much larger role in the valuation of publicly traded assets than ever before.

Equities: The JUN13 emini SP 500 futures are down slightly at -.14%, after hitting another record high in overnight trading at 1631. The market has hit record highs for 5 straight days, and today is relaxing a little bit from its new high making activity. We believe that this market is still very susceptible for another bullish run higher, but it may take a few days to occur. We think the market is due for one more buying burst and then perhaps will begin to trade in a range. The market should be waiting for more data points to confirm or reject these relatively lofty levels.

Bonds: The US bond futures are up slightly on the day. This goes along with the overall quiet tone of the US financial markets today, as we wait for more important data to give guidance to investors as to the appropriate actions to take in the market. Overall, we believe the bonds are indeed susceptible to a downturn, most especially if the unemployment percentage keeps ticking lower. The next key data for the bond market is the US inflation data.

Currencies: After a strong Aussie jobs report, the Aussie dollar had a very strong rally, which was very short-lived. The Aussie reached 102.50, but then immediately was sold right back down below 1.02, and is now trading at 1.66. The Aussie has been getting its share of negative press recently, with rumors of George Soros going short and now Stanley Druckenmiller saying he believes the Aussie will come down hard. We would not be surprised to see the Aussie approach the 1.00 parity level.

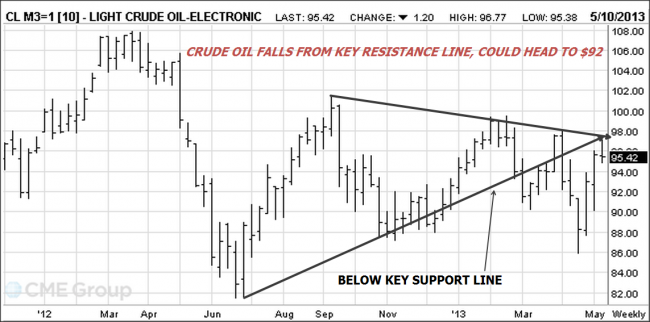

Commodities: Gold continues to stay below our key $1475 level, trading down $6 to $1468 this morning. Natural gas is rebound from a small dip below $3.90, and has actually hit the $4 again today, after selling off $.50 in just the past week. We focus more on crude oil today. Crude supply data continues to show large supplies, yet this market has still held up and even rallied over the past week or two. Today, crude is down almost $1 to $95.75. We believe this is mainly fear premium regarding the Syria situation. Technically, it looks as though oil is at the top of its downward channel, and could head lower to at least $92 from here.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.