By Poly

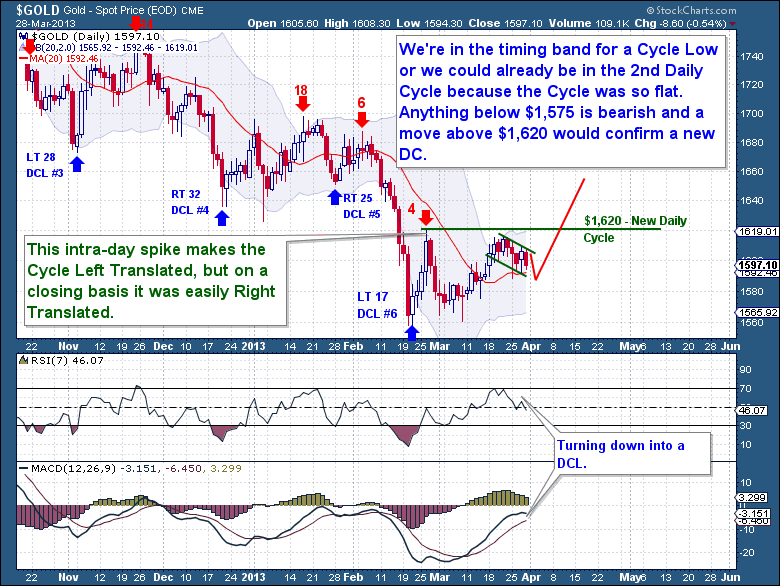

Gold has been declining for the past 6 days as it heads into its 1st DCL. It sits 26 Days into this Cycle and therefore into the timing band for a DCL. Technically the oscillators have clearly turned lower since the Cycle closing high of $1,614 set on March 21st, and this confirms the final DCL decent is in progress. The (closing) high was set on Day 20 and as a DCL is now expected, both pivots should occur comfortably within expected Cycle time-frames.

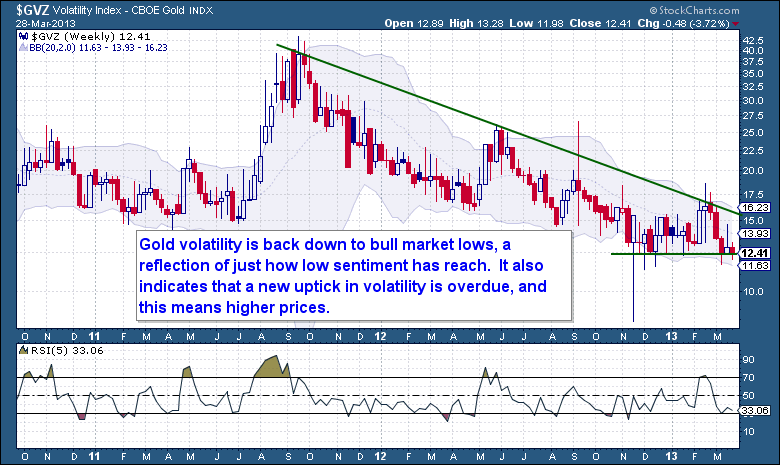

On the Daily chart I see that gold is holding up fairly well here. It has resisted the negative price influence of what has been a hot dollar rally and is now consolidating in a controlled bull flag like decline. Because this Cycle was generally flat and the bid appears to be bullish, I'm working on the assumption that this mini consolidation is going to be mild and resolve itself by moving strongly higher. The Gold volatility index ($GVZ) is also back down to bull market lows and depressed volatility is always associated with Cycle Lows.

So this means that any new rally from this point forward will most likely mark the beginning stages of a 2nd Daily Cycle. I've resigned myself to a lower set of price expectations for the time being, so I'm not going to offer any price predicts here. We will be better served by just sticking to the key Cycle pivots and focusing more on the timing. Obviously if the 1st Daily Cycle is any indication, then we're in for a similar lackluster performance out of the 2nd Cycle. But that's not a guarantee; we often find that a quiet Cycle is backed up by a much more volatile Cycle. If we're to see any upside out of this Investor Cycle, then you would always expect it from the 2nd Daily Cycle, these are historically the best performing.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.