By Poly

The week closed out with some truly amazing action, and to a large extent expected too. Within the mid-week report I noted

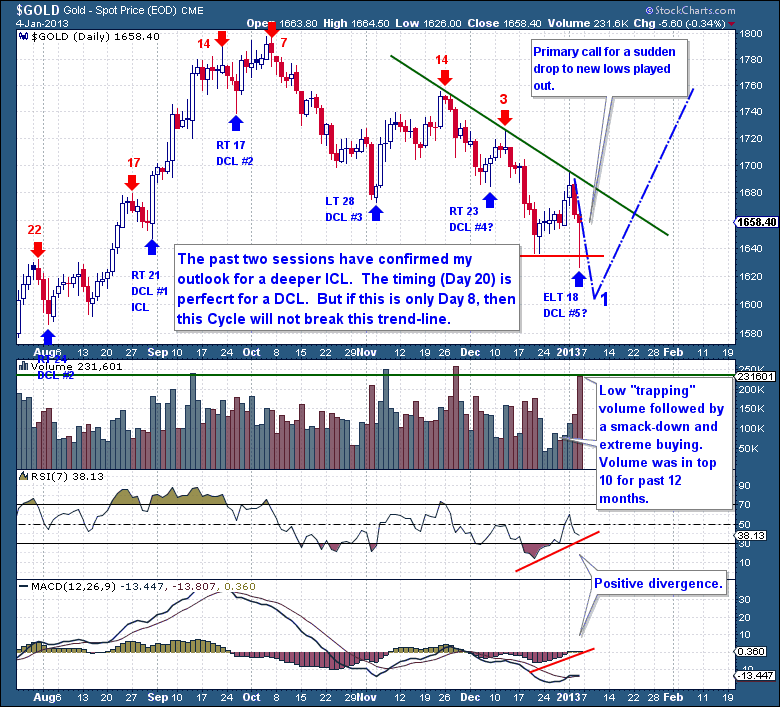

“The currently marked Cycle remains as this being a very late stage Daily Cycle that is trapping investors before its final collapse. If this scenario holds true, then gold should fall tomorrow or Friday and spend the next 5 days falling into a DCL and ICL.”

The amazing action was the $80 “tip to tip” decline in gold futures in just 24 hours; exactly the type of response I outlined would be expected if the primary Cycle count was still valid.

So what I expected (at least the primary expectation) centered on the idea that the 7 day rally (Dec 20th+) was simply luring speculative traders into weak long positions. The rally just didn't have the type of characteristics (buying strength or volume) that ever made me feel comfortable. Certainly not the comfort level I would normally associate with a new Daily and Investor Cycle. The Cycle count was telling me it was too early (Dec 20th) to mark the DCL and the weakness of the rally convinced me another drop was coming.

What was “not” expected (at least so suddenly) was the bullish nature of the buying witnessed on Friday morning and then throughout Friday's trading session. The entire precious metal complex (including the miners and Silver) exhibited high volumes and bullish reversals across the board. This action was significant because it is classic Cycle Low behavior. There is more work ahead for gold and we all know gold has thrown more than one “curve-ball” and “sucker-punch” recently. But I'm quietly optimistic that Friday marked a significant turn for gold and in due time price action will support this “opinion”.

(The below chart does not show any new “projected” price lines, only the primary line from the mid-week report. The point is that the sharp collapse into a new low was fulfilled. Further downside is possible, we just need to wait and see. If or when we form a new Cycle it will be clear on this chart, we will see a Daily and Weekly Swing Low, followed by a clean trend-line break)

If we did print a DCL on Friday, that would mark a 19 day Cycle which was extremely Left Translated. The Cycle fell 6.1% from the top and 3.7% overall. According to my Cycle Analyzer this would place that Cycle well within the bulk of similar (late failing Daily) Cycles.

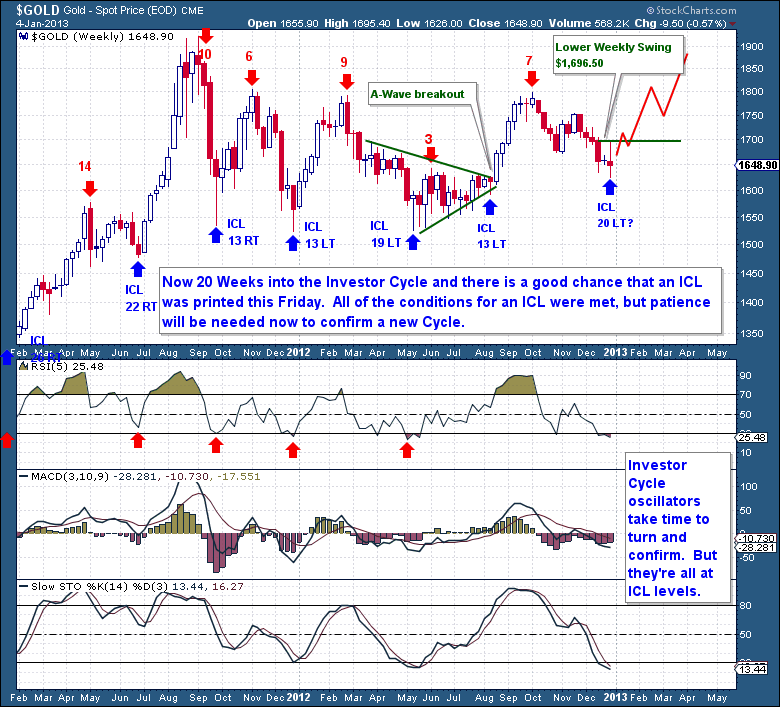

When we glance at the Investor Cycle chart we now see more evidence that an ICL could have formed this past Friday. On the Daily chart we are seeing plenty of bullish technical divergences. The Investor Cycle is now 20 weeks old and has reached the timing band for a Cycle Low. The RSI(5) has reached the level (<30) consistent with past ICL's, while the oscillators have also reached lows and appear to be turning higher.

Based on the Daily Cycle action and the reversal on Friday, along with my general feel and read of the tape, I believe we are now in new Daily and Investor Cycles. But gold remains in a 17 month consolidation and arguably still in a downtrend since the Aug 2011 peak. The Investor Cycle indicators and oscillators are slow turners and for ultimate confirmation, one must remain patient. It's only prudent that we exercise some caution here and force gold to prove itself as opposed to front-running what appear to be favorable Cycle developments. In a C-Wave, calling an ICL early can be quickly recovered or corrected by the bull. But as this is technically not a C-Wave, the surprises will likely come to the downside if we're wrong, as witnessed in 2012.

This as is an excerpt from this weekend's premium update published on Saturday (1.05) focusing on Gold from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly, as well as real time trade alerts to profit from market inefficiencies.

They offer a FREE 15-day trial where you'll receive complete access to the entire site. Coupon code (ZEN) saves you 15%.

Related Posts:

Sharp Declines For US Dollar Coming

Slowing World Economy Will Make 2013 Rough

Desperately Seeking A Gold DSL-Daily Cycle Low

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.