One of these things is not like the other:

One of these things is not like the other:

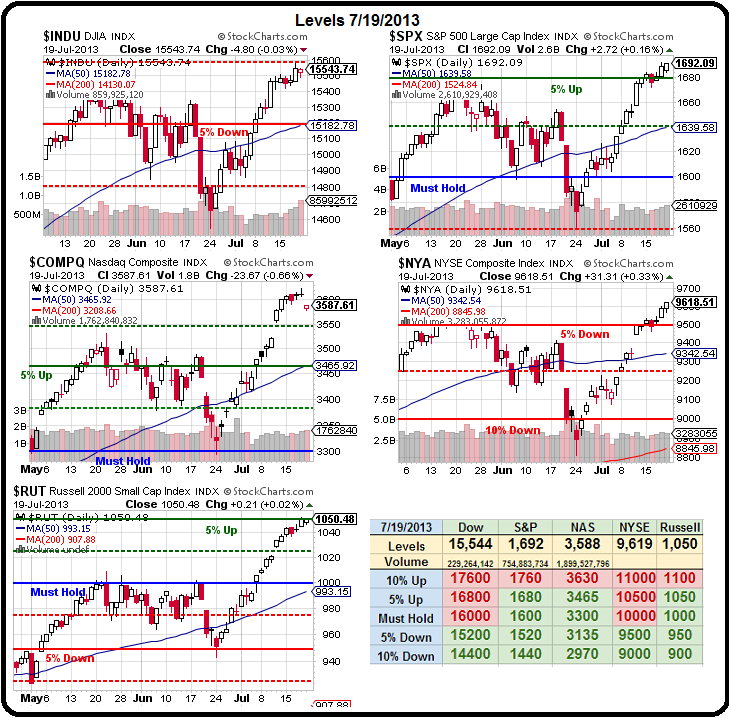

That's right, it's the Nasdaq, which fell hard and fast on Friday and, as I said to our Members over the weekend: "Will the Nasdaq correct or IS the Nasdaq correct?" Based on the possibility the rally would continue and the Nasdaq would right itself (nothing matters until AAPL earnings tomorrow, anyway), we picked up the weekly QQQ $74.50/75 spread for .30 on Friday afternoon – a spread that gains 66% in 7 days if the Qs hold $74.50 (any positive move for the week).

This is a very simple trade idea – if the Nasdaq goes up – we're good. If the other indexes go down – we stop out – not at all complicated.

Also not complicated is our short position on oil. If they (the crooks at the NYMEX) want to keep pretending they want to buy 1,000 barrels of oil for $108.50 each then we are very happy to promise to sell it to them for that price. This is a very easy promise to keep as we can roll our obligation (just like they do) and we can buy December barrels for just $102.68, an almost $6,000 per contract spread in our favor.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | ||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.