Are You An Investor?

Then Get Lido Isle Advisors "Favorite 3"

Alternative Money Managers Emailed to You

by Clicking Here. Don't Miss It!

The S&P 500 rose to its fourth straight record yesterday and the Dow closed above 15,000 for the first time. In key earnings action, Symantec Corp. lost 3.8 percent while Whole Foods Market Inc. gained 8.8 percent. This is a quiet week for economic data releases, and investors will continue to monitor earnings report to gauge the strength and corporate confidence in the economy.

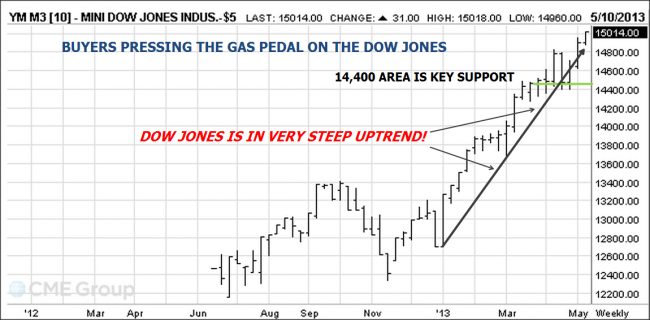

Equities: The JUN13 mini dow jones futures are trading up again today, after breaking through 15000 for the first time yesterday. Today this market is up 28 points, and as of this writing continuing to make new highs. We see the 14,400 level as a key support area for this market. If the Dow can stay above this level, we look for the bulls to continue to bring this market higher. In the absence of bad news, we believe this market will have a strong tendency to continue to go up.

Bonds: The US bond futures, while they have sold off a good measure since the jobs report, are rebounding today in the wake of key auctions. We believe this could be a short term rebound, and especially if the stock indices continue to march higher, we could see bond sellers re-enter the market to take it lower.

Get Lido Isle Advisors "Favorite 3" Alternative Money

Managers Emailed to You by Clicking Here.

Commodities: Gold continues its heightened daily ranges since the big drop last month. Today, gold is back up to $1465, or +1.17%. An interesting story in the commodities world is copper. Copper is trading up $.0665 todasy to $3.367. Copper is commonly known to help give investors a quick reading on the health of the global economy. If copper prices are lower, it can be construed as meaning global economic growth is slowing, if prices start to move higher, it could mean the growth activity is picking up. Today we see copper rally, very likely due to positive data coming out of China and Japan.

Currencies: The British Pound and the Euro are both having strong rallies today. The Euro is up 100 ticks while the Pound is up 97 ticks. Strong German data surprised the market, and caused Euro buyers to come out in droves. The Aussie Dollar is unchanged on the day, and we expect this market to head lower, possibly to the parity level with the US dollar.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.