( click to enlarge )

NVIDIA Corporation NVDA rebounded strongly today on pretty heavy volume and might be on the way up again. As you could see above, the stock has several favorable technical factors suggesting that it could breakout its 200-day EMA which often attracts additional traders on the buyside, putting upward pressure on shares. Positive MACD indicates that the stock is a buy. Any move over $12.91 will probably lead to a strong rally. Let's keep an eye on it.

I recomend : Benzinga Pro : Real-time news and data feed delivered at blazing fast speeds and designed specifically for traders. Sign up Now

( click to enlarge )

I continue to watch Gevo, Inc. GEVO. The volume is still large so it could potentially break out again at any moment. Further rally could be seen to retest $2.68 short-term resistance. As long as the stock stay above $2.12 area, the bullish scenario is still intact. Technical chart shows bullish sign with MACD above the signal line and RSI above its 50% level. Next targets for the stock are $3.10 and $3.22. Only a close below $2.31 reverses the current short-term uptrend. The Accumulation/Distribution line is moving upwards (accumulation).

( click to enlarge )

OmniVision Technologies, Inc. OVTI broke out and closed above resistance on a nice volume increase. If the technical chart does what is supposed to do, it will be going higher in the days to come. Technically, the stock is in a Bull Market with share price above 20, 50 and 200 daily moving averages. Let's see if tomorrow the stock will confirm the breakout. Keep an eye on her as i think momentum will pick up.

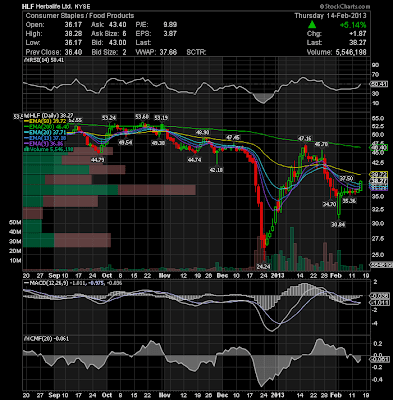

( click to enlarge )

Shares of Herbalife HLF shot up in after-hours trading after Hedge fund manager Carl Icahn revealed a huge stake in the company. Icahn now owns nearly 18% almost 14 million shares. Per the filing, Icahn will seek talks with Herbalife, including possibly going private. Levels of resistance to watch in HLF after this pop : $46.40 ( 200EMA ) and the recent highs at $47.16

( click to enlarge )

Zynga Inc ZNGA traded down over the last trading sessions but not enough to make me stop watching. The volume was relatively weak compared with recent sessions when prices rose, which means traders are not betting on the downside. The stock finally has found support at the $3.12 level, which looks to be a launching point to propel the stock back to the $3.60 level

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Posted In: MarketsTrading Ideas

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in