Big two days to start the week!

Big two days to start the week!

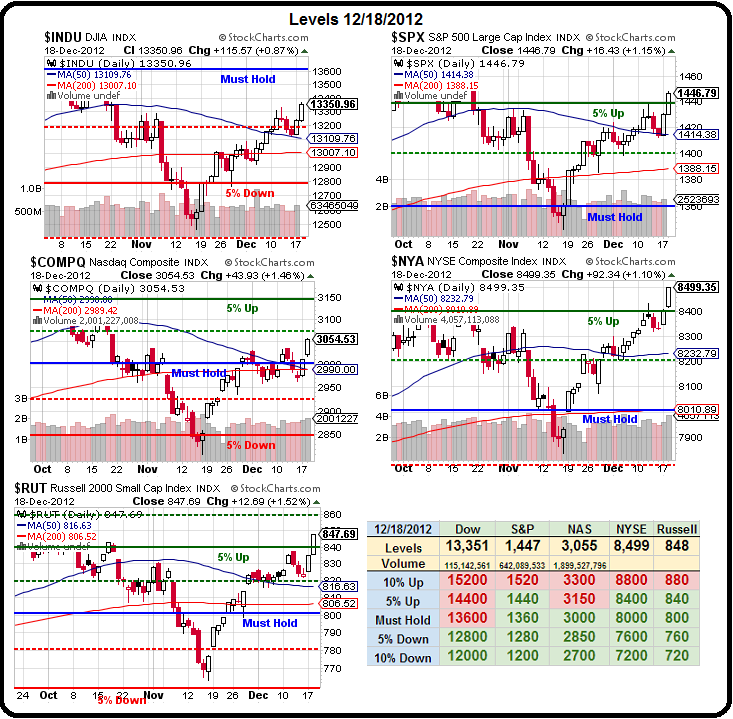

Look how exciting the chart looks now – if only we can hold those 5% breakout lines on the S&P (1,440), NYSE (8,400) and Russell (840), then we can expect a little catch-up action from the Dow and the Nasdaq but, in order for the Nasdaq to catch up, AAPL must move up and that's still a bit questionable with all the negative chatter and year-end tax selling. As I said to Members this morning:

Big Chart – Now we kind of do have that V-shaped recovery – especially on the RUT and NYSE. That's the funny thing about technicals – they can "so obviously" predict disaster right before they are proven completely wrong. Of course the same goes for predicting bull runs – so stay on your toes! Very encouraging to be over 5% on S&P, NYSE and RUT – all our broad indexes. Nas is held down by AAPL (for now) and Dow just lagging, as usual so a long play on the Dow could be fun as we look for them to re-test 13,600, at least. Very easy bear indicators if any of our 3 indexes blow their 5% lines now.

Of course we have a falling Dollar to thank for helping to goose the markets – as well as keeping commodities up despite a fundamentally bearish story. As you can see from Chris Kimble's chart, the Dollar is off almost 2.5% from it's high in mid-November, corresponding to a roughly 6% move up in the S&P during the same period.

Of course we have a falling Dollar to thank for helping to goose the markets – as well as keeping commodities up despite a fundamentally bearish story. As you can see from Chris Kimble's chart, the Dollar is off almost 2.5% from it's high in mid-November, corresponding to a roughly 6% move up in the S&P during the same period.

Now the Dollar is testing a possible floor at 79 this morning and, if it can't break any lower than that, we may once again face rejection back at our 2012 highs. We REALLY don't want to form a double top going into the new year – that can make for a very ugly January – especially if earnings are even a little bit light – so we're certainly not out of the woods yet and we're going to play it cashy and cautious into the holidays unless the Dollar drops below 78.50 on whatever nonsense they come up with to "fix" the Fiscal Cliff.

We've already discussed our primary TZA hedge and now may be a good time to add a Mattress Play (see "The Stock Market Parachute") and we'll…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.