How will we finish November?

How will we finish November?

With just 4 trading days left to the month and then just 19 more to close out the year – it's already been a wild ride but, as you can see from Doug Short's S&P chart, we're up a very solid 200 points for the year (16.66%) and not likely to give much of that back and, of course, 1,400 on the S&P represents a 100% recovery off those 2009 lows.

That's 25% a year folks! What are you complaining about? No, we didn't go up in a straight line but sticking with pretty much any stock over the past 4 years has been a winning strategy and that's been replenishing 401Ks and IRAs and Pension Funds and has allowed the investing class to recoup most of their losses from the crash and NOW the question is – what happens next?

Surely we can't grow the market 25% every year. This year we will struggle to get back to 20% (1,450) – if it happens at all and, realistically, we have to assume that closing high of 1,565 was not deserved at the time and, if we figure it was a 10% overshoot of the proper top – then 1,400 IS the right level for the S&P to be hanging out at.

Surely we can't grow the market 25% every year. This year we will struggle to get back to 20% (1,450) – if it happens at all and, realistically, we have to assume that closing high of 1,565 was not deserved at the time and, if we figure it was a 10% overshoot of the proper top – then 1,400 IS the right level for the S&P to be hanging out at.

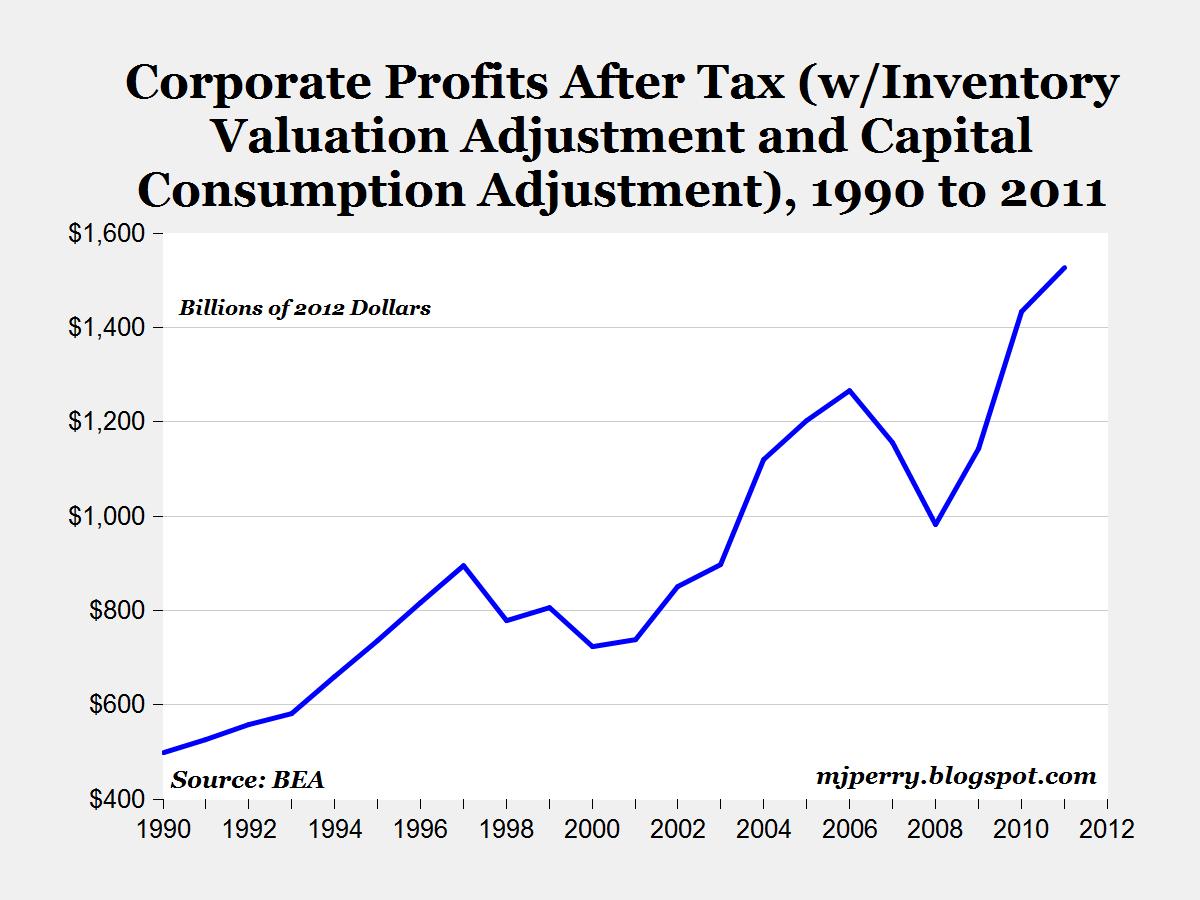

Clearly we still have plenty of economic challenges to deal with and the World is not growing as fast as we thought it was in 2007 but it did grow and Corporate Profits are higher now than they were in 2007 and, if anything, tracking at the top of their 20-year trend so it makes sense that the S&P should be reflecting this – risk on or risk off.

Notice, by the way, that's $1.6 TRILLION Dollars in annual Corporate Profits and that's AFTER deducting the net of losses from some Corporations to offset the profits of others. How much tax do these Corporations pay on $1.6Tn in profits? Last year – it was just $192Bn – 12%. If Corporations paid 35% like their fellow citizens, that would drop another $368Bn into the US Treasury – THOSE are the rich people we need to chase down and force to pay their fair share! Why is this not discussed more?

Mitt Romney's #1 backer, Shelly Adelson's LVS only paid $211M on $2,094M in income last year (10%) and now, rather…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.