Nice and bouncy!

Nice and bouncy!

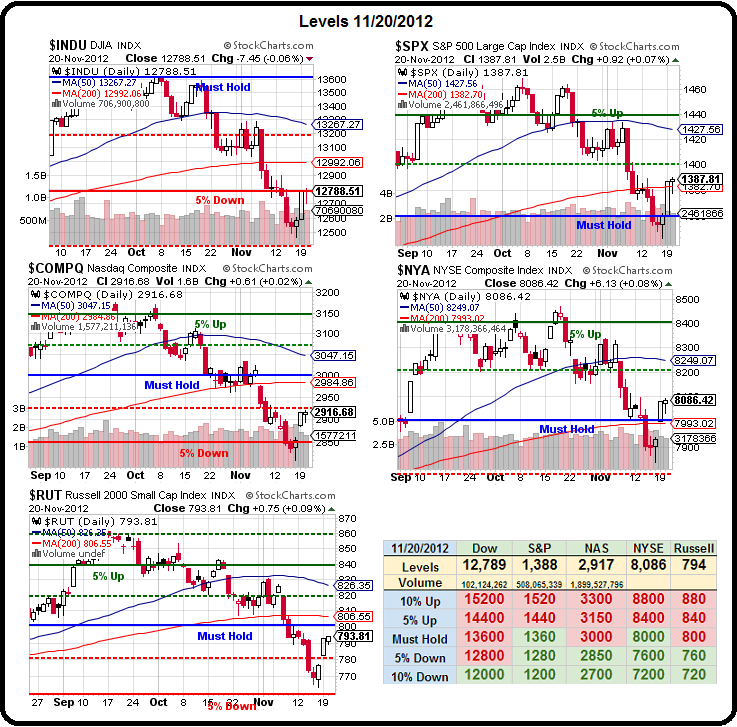

Check out our Big Chart. Check our our bounce levels, which I posted on Monday and still are:

- Dow 12,720 weak, 12,950 strong.

- S&P 1,375 weak, 1,400 strong.

- Nasdaq 2,900 weak, 3,000 strong.

- NYSE 8,000 weak, 8,100 strong.

- Russell 790 weak, 805 strong.

Just two days later we're right in the zone and – most importantly, our weak bounce lines held on yesterday's dip – that's a very good sign.

The best thing about re-establishing trading ranges is that it lets us take advantage of channel bets like yesterday's USO trade from the morning post, where we caught a nice 50% gain for the day and we took that money and ran as oil tested the $86 line – just $1 off our target without all that tedious waiting… Of course the Futures bet on /CL was well-timed and a $3 move in the Futures pays $3,000 per contract so thanks to the oil crooks for being so predictable. We got our cease-fire rumor in the Gaza and that was all it took to knock oil back 3% but it was a rumor only – which is why we quickly got out and now, maybe, we'll be able to do it all again on a new set-up (oil currently back at $87.50).

Unfortunately, the HPQ Jan $12 puts we also talked about in the morning post only made it to $1.17 at the open but, as expected, they have already fallen back to .90 for a 23% gain on the day. Trades like that simply follow PSW's Rule #1 (and there are only 2): "ALWAYS sell into the initial excitement." Our job is to sell premium – so…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.