Whales with a lot of money to spend have taken a noticeably bullish stance on Lyft.

Looking at options history for Lyft LYFT we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $206,089 and 9, calls, for a total amount of $484,135.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $16.0 and $22.0 for Lyft, spanning the last three months.

Analyzing Volume & Open Interest

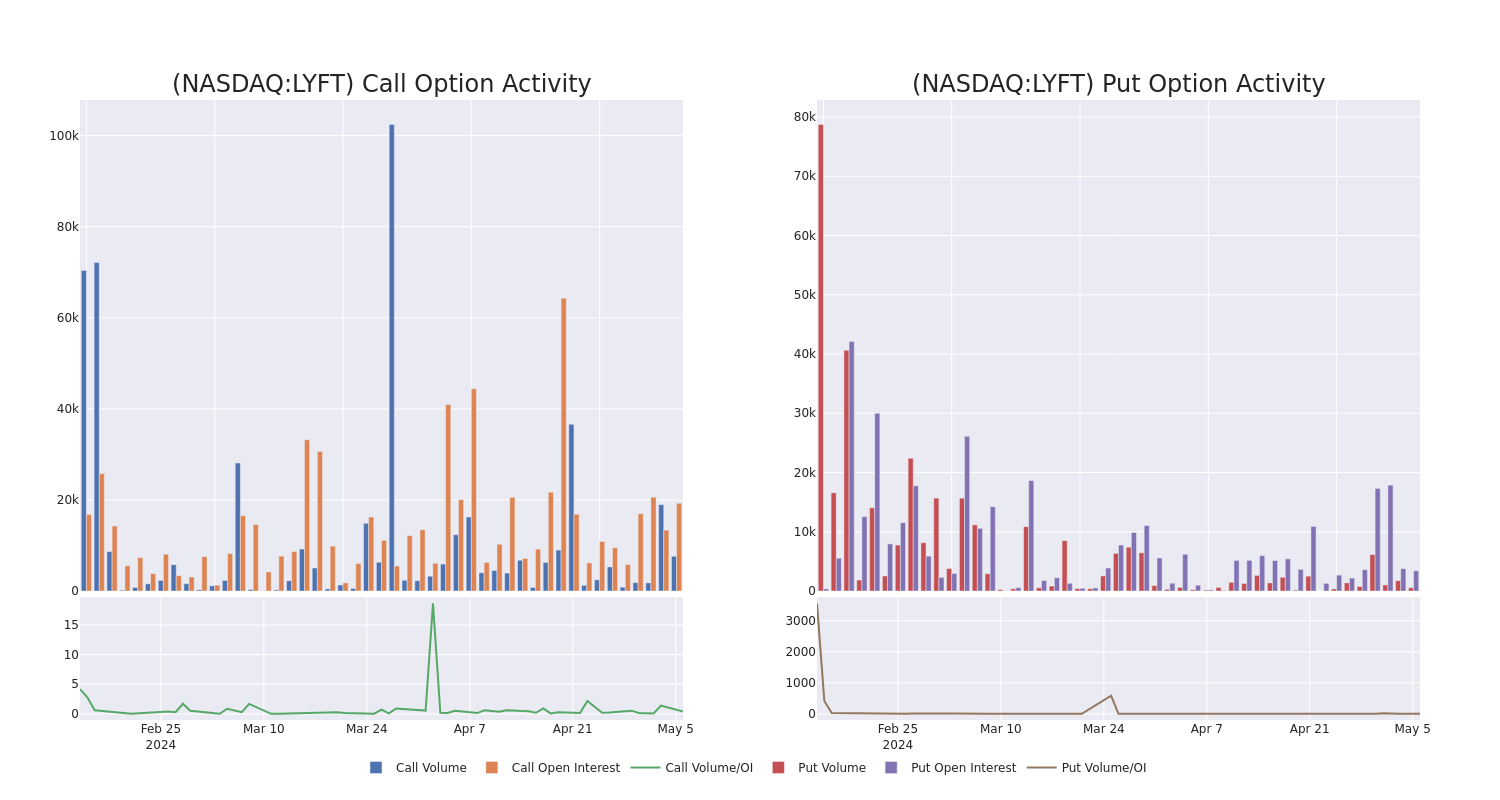

In today's trading context, the average open interest for options of Lyft stands at 1621.43, with a total volume reaching 8,186.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lyft, situated within the strike price corridor from $16.0 to $22.0, throughout the last 30 days.

Lyft Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LYFT | CALL | TRADE | BEARISH | 05/10/24 | $0.81 | $0.78 | $0.78 | $19.50 | $172.1K | 2.8K | 2.5K |

| LYFT | CALL | SWEEP | BEARISH | 05/10/24 | $0.35 | $0.3 | $0.3 | $22.00 | $58.4K | 288 | 2.3K |

| LYFT | CALL | SWEEP | BEARISH | 05/17/24 | $0.64 | $0.63 | $0.63 | $20.50 | $54.5K | 47 | 864 |

| LYFT | PUT | TRADE | BULLISH | 08/16/24 | $3.15 | $3.1 | $3.1 | $18.00 | $53.9K | 17 | 1 |

| LYFT | CALL | SWEEP | BULLISH | 05/10/24 | $1.76 | $1.75 | $1.75 | $17.00 | $50.5K | 1.4K | 954 |

About Lyft

Lyft is the second-largest ride-sharing service provider in the us and Canada, connecting riders and drivers over the Lyft app. Incorporated in 2013, Lyft offers a variety of rides via private vehicles, including traditional private rides, shared rides, and luxury ones. Besides ride-share, Lyft also has entered the bike- and scooter-share market to bring multimodal transportation options to users.

Lyft's Current Market Status

- With a volume of 6,998,331, the price of LYFT is up 1.42% at $17.45.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 1 days.

Professional Analyst Ratings for Lyft

In the last month, 3 experts released ratings on this stock with an average target price of $18.333333333333332.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Lyft, targeting a price of $18.

- An analyst from Morgan Stanley persists with their Equal-Weight rating on Lyft, maintaining a target price of $13.

- An analyst from Tigress Financial has decided to maintain their Buy rating on Lyft, which currently sits at a price target of $24.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lyft options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Date of Trade | ticker | Put/Call | Strike Price | DTE | Sentiment |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.