Deep-pocketed investors have adopted a bearish approach towards Cleanspark CLSK, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CLSK usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 20 extraordinary options activities for Cleanspark. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 60% bearish. Among these notable options, 3 are puts, totaling $82,500, and 17 are calls, amounting to $724,153.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $37.0 for Cleanspark over the recent three months.

Analyzing Volume & Open Interest

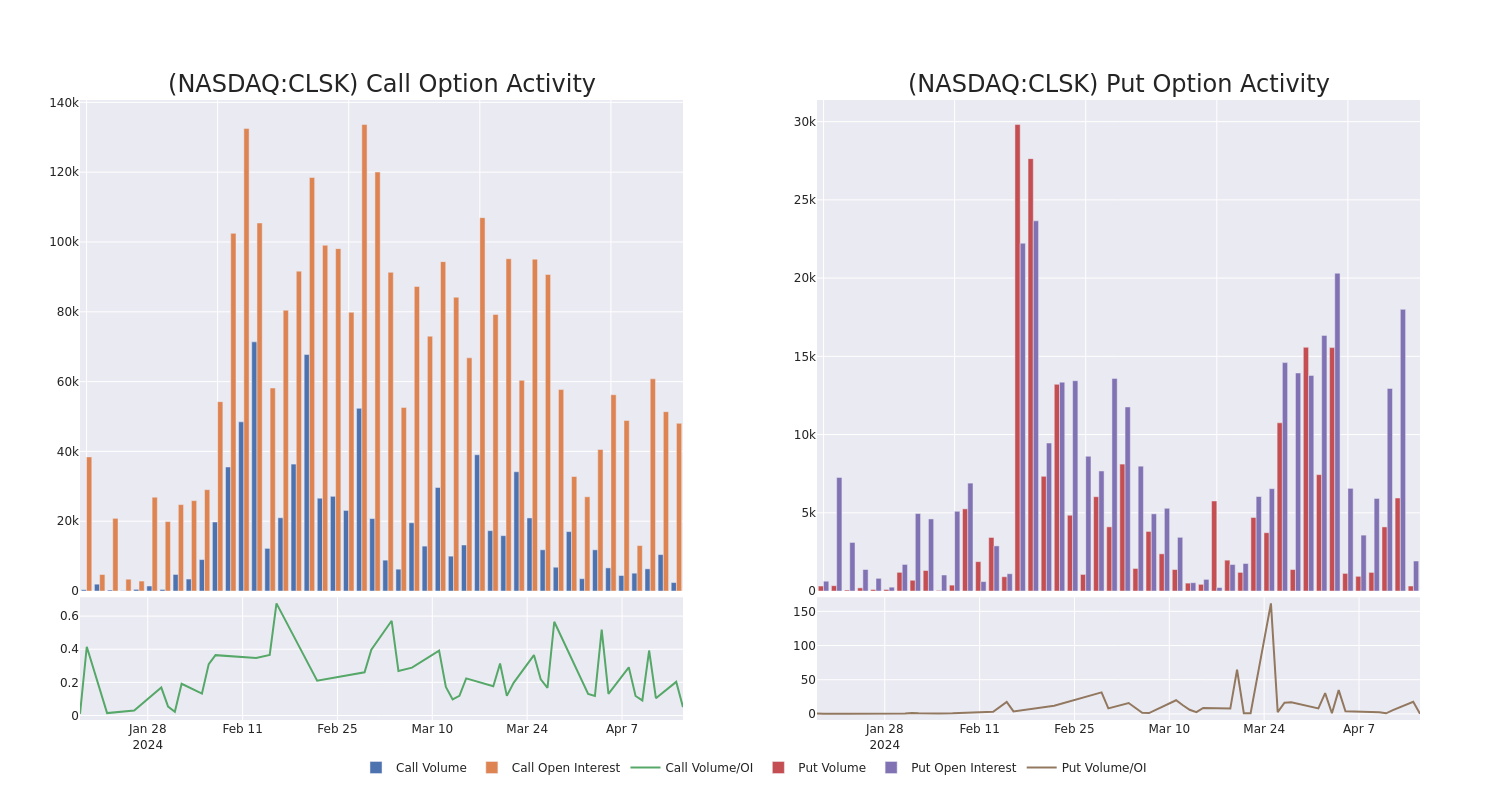

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Cleanspark's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Cleanspark's substantial trades, within a strike price spectrum from $10.0 to $37.0 over the preceding 30 days.

Cleanspark Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CLSK | CALL | SWEEP | BULLISH | 07/18/25 | $7.1 | $6.9 | $7.1 | $20.00 | $71.0K | 3.2K | 108 |

| CLSK | CALL | SWEEP | BULLISH | 09/20/24 | $6.5 | $6.4 | $6.5 | $10.00 | $64.9K | 390 | 13 |

| CLSK | CALL | TRADE | NEUTRAL | 01/17/25 | $5.7 | $5.5 | $5.6 | $17.50 | $56.0K | 3.5K | 27 |

| CLSK | CALL | SWEEP | BEARISH | 06/21/24 | $2.25 | $2.15 | $2.15 | $17.50 | $53.7K | 4.9K | 146 |

| CLSK | CALL | TRADE | BEARISH | 07/18/25 | $5.5 | $5.3 | $5.36 | $30.00 | $53.6K | 1.6K | 124 |

About Cleanspark

Cleanspark Inc is a bitcoin mining company. Through CleanSpark, Inc., and the Company's wholly owned subsidiaries, the company mines bitcoin. The company entered the bitcoin mining industry through its acquisition of ATL. Bitcoin mining is the sole reportable segment of the company.

Having examined the options trading patterns of Cleanspark, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Cleanspark Standing Right Now?

- Currently trading with a volume of 11,837,464, the CLSK's price is down by -2.62%, now at $14.3.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 22 days.

What Analysts Are Saying About Cleanspark

In the last month, 5 experts released ratings on this stock with an average target price of $23.2.

- An analyst from HC Wainwright & Co. has decided to maintain their Buy rating on Cleanspark, which currently sits at a price target of $27.

- In a cautious move, an analyst from HC Wainwright & Co. downgraded its rating to Buy, setting a price target of $27.

- Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on Cleanspark with a target price of $22.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $20.

- Maintaining their stance, an analyst from Cantor Fitzgerald continues to hold a Overweight rating for Cleanspark, targeting a price of $20.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cleanspark with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Date of Trade | ticker | Put/Call | Strike Price | DTE | Sentiment |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.