Financial giants have made a conspicuous bearish move on Palo Alto Networks. Our analysis of options history for Palo Alto Networks PANW revealed 8 unusual trades.

Delving into the details, we found 25% of traders were bullish, while 75% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $851,245, and 4 were calls, valued at $205,548.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $200.0 and $310.0 for Palo Alto Networks, spanning the last three months.

Insights into Volume & Open Interest

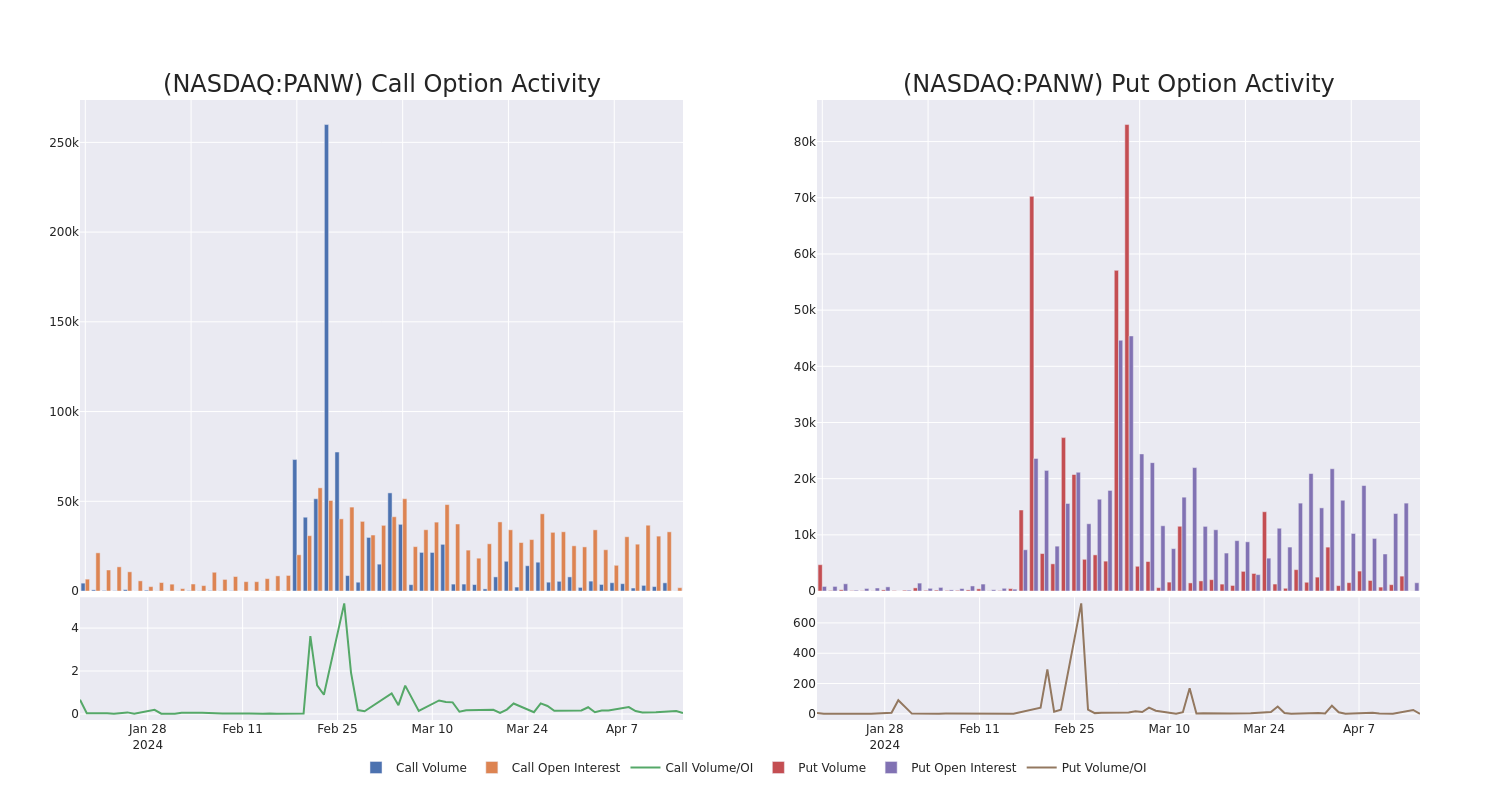

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Palo Alto Networks's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Palo Alto Networks's significant trades, within a strike price range of $200.0 to $310.0, over the past month.

Palo Alto Networks Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | PUT | TRADE | BULLISH | 01/16/26 | $28.85 | $28.6 | $28.6 | $230.00 | $572.0K | 743 | 20 |

| PANW | PUT | SWEEP | BEARISH | 12/20/24 | $9.4 | $9.3 | $9.35 | $210.00 | $174.8K | 441 | 1 |

| PANW | PUT | SWEEP | BULLISH | 03/21/25 | $13.0 | $12.85 | $12.85 | $210.00 | $68.1K | 97 | 0 |

| PANW | CALL | TRADE | NEUTRAL | 04/26/24 | $3.85 | $3.25 | $3.5 | $280.00 | $67.9K | 537 | 20 |

| PANW | CALL | TRADE | NEUTRAL | 07/19/24 | $11.05 | $10.8 | $10.92 | $310.00 | $58.9K | 435 | 55 |

About Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 85,000 customers across the world, including more than three fourths of the Global 2000.

After a thorough review of the options trading surrounding Palo Alto Networks, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Palo Alto Networks

- With a volume of 767,369, the price of PANW is up 0.13% at $272.5.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 35 days.

What Analysts Are Saying About Palo Alto Networks

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $350.0.

- An analyst from Redburn Atlantic has decided to maintain their Buy rating on Palo Alto Networks, which currently sits at a price target of $350.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Palo Alto Networks, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.