Whales with a lot of money to spend have taken a noticeably bearish stance on Uber Technologies.

Looking at options history for Uber Technologies UBER we detected 54 trades.

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 62% with bearish.

From the overall spotted trades, 32 are puts, for a total amount of $2,168,048 and 22, calls, for a total amount of $1,397,277.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $15.0 to $120.0 for Uber Technologies during the past quarter.

Analyzing Volume & Open Interest

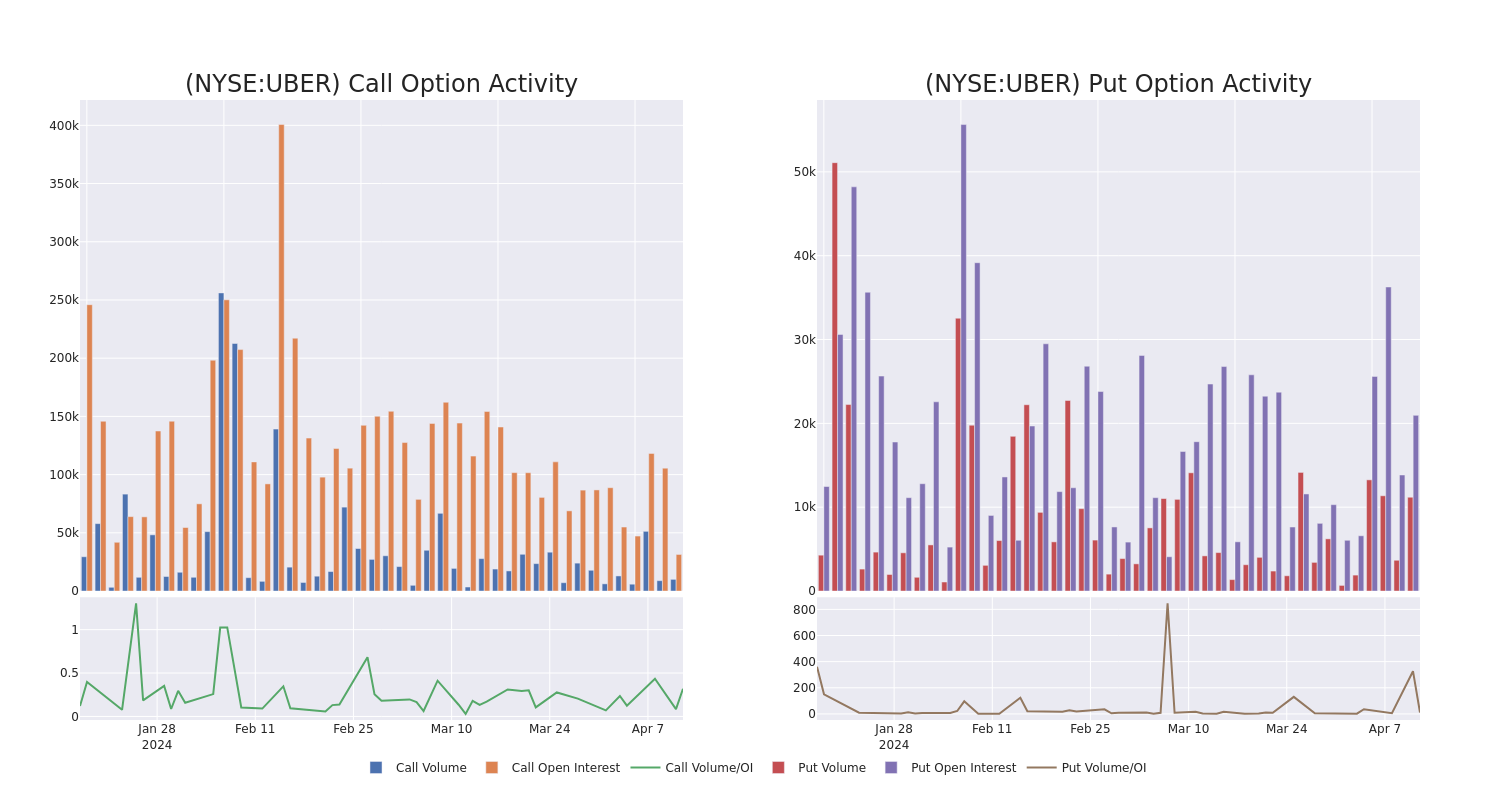

In terms of liquidity and interest, the mean open interest for Uber Technologies options trades today is 2080.24 with a total volume of 13,955.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Uber Technologies's big money trades within a strike price range of $15.0 to $120.0 over the last 30 days.

Uber Technologies Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UBER | PUT | TRADE | BULLISH | 09/20/24 | $5.9 | $5.8 | $5.8 | $72.50 | $290.0K | 709 | 0 |

| UBER | CALL | TRADE | BEARISH | 06/21/24 | $24.05 | $24.0 | $24.0 | $50.00 | $216.0K | 7.1K | 100 |

| UBER | CALL | TRADE | NEUTRAL | 05/17/24 | $0.87 | $0.85 | $0.86 | $87.50 | $215.0K | 1.3K | 2.5K |

| UBER | PUT | TRADE | NEUTRAL | 12/18/26 | $47.5 | $45.55 | $46.65 | $120.00 | $209.9K | 1 | 45 |

| UBER | PUT | TRADE | BEARISH | 01/16/26 | $45.35 | $44.8 | $45.35 | $120.00 | $204.0K | 0 | 0 |

About Uber Technologies

Uber Technologies is a technology provider that matches riders with drivers, hungry people with restaurants and food delivery service providers, and shippers with carriers. The firm's on-demand technology platform could eventually be used for additional products and services, such as autonomous vehicles, delivery via drones, and Uber Elevate, which, as the firm refers to it, provides "aerial ride-sharing." Uber Technologies is headquartered in San Francisco and operates in over 63 countries with over 150 million users who order rides or food at least once a month.

In light of the recent options history for Uber Technologies, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Uber Technologies's Current Market Status

- With a trading volume of 16,048,042, the price of UBER is down by -2.58%, reaching $73.34.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 15 days from now.

Professional Analyst Ratings for Uber Technologies

5 market experts have recently issued ratings for this stock, with a consensus target price of $94.2.

- An analyst from Wells Fargo has decided to maintain their Overweight rating on Uber Technologies, which currently sits at a price target of $95.

- Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Uber Technologies with a target price of $94.

- Reflecting concerns, an analyst from MoffettNathanson lowers its rating to Buy with a new price target of $92.

- In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $90.

- Consistent in their evaluation, an analyst from Jefferies keeps a Buy rating on Uber Technologies with a target price of $100.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Uber Technologies, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.