Deep-pocketed investors have adopted a bearish approach towards Union Pacific UNP, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UNP usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 19 extraordinary options activities for Union Pacific. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 21% leaning bullish and 78% bearish. Among these notable options, 12 are puts, totaling $636,525, and 7 are calls, amounting to $453,754.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $190.0 to $250.0 for Union Pacific over the recent three months.

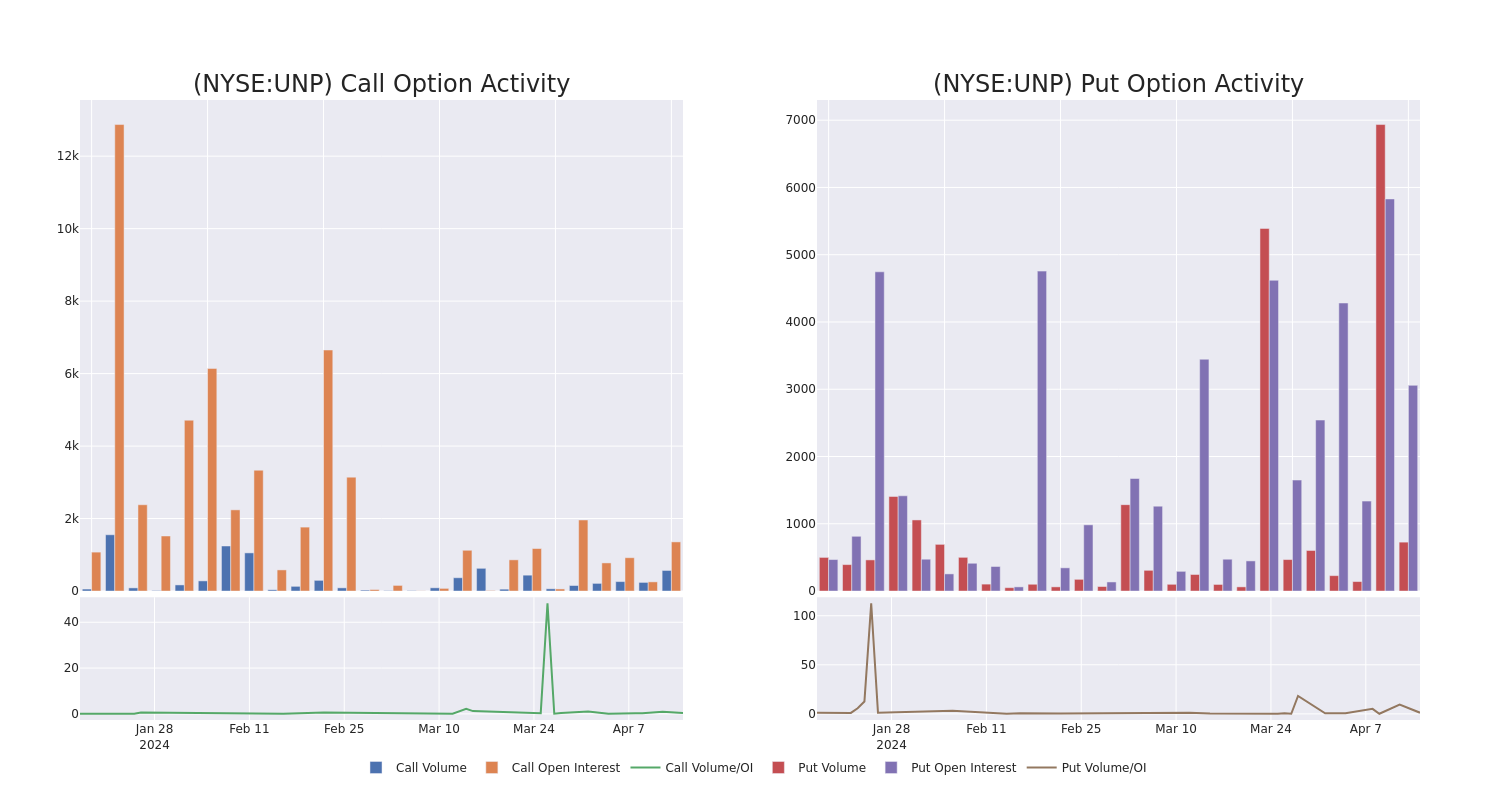

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Union Pacific's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Union Pacific's significant trades, within a strike price range of $190.0 to $250.0, over the past month.

Union Pacific Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNP | CALL | SWEEP | BEARISH | 09/20/24 | $52.9 | $51.0 | $51.57 | $190.00 | $154.8K | 54 | 15 |

| UNP | CALL | TRADE | BEARISH | 06/21/24 | $13.5 | $13.0 | $13.1 | $230.00 | $131.0K | 892 | 140 |

| UNP | PUT | SWEEP | BEARISH | 06/21/24 | $13.9 | $13.2 | $13.7 | $245.00 | $109.6K | 1.0K | 80 |

| UNP | PUT | SWEEP | BEARISH | 05/17/24 | $12.5 | $12.3 | $12.4 | $245.00 | $63.2K | 627 | 52 |

| UNP | PUT | SWEEP | BEARISH | 05/17/24 | $12.6 | $12.2 | $12.35 | $245.00 | $61.9K | 627 | 52 |

About Union Pacific

Omaha, Nebraska-based Union Pacific is the largest public railroad in North America. Operating on more than 30,000 miles of track in the western two thirds of the US, UP generated $24 billion of revenue in 2023 by hauling coal, industrial products, intermodal containers, agriculture goods, chemicals, fertilizers, and automotive goods. UP owns about one fourth of Mexican railroad Ferromex and historically derives roughly 10% of its revenue hauling freight to and from Mexico.

After a thorough review of the options trading surrounding Union Pacific, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Union Pacific

- With a trading volume of 2,297,639, the price of UNP is down by -0.2%, reaching $233.94.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 10 days from now.

What Analysts Are Saying About Union Pacific

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $254.0.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Neutral rating on Union Pacific with a target price of $243.

- Consistent in their evaluation, an analyst from Stifel keeps a Hold rating on Union Pacific with a target price of $248.

- Consistent in their evaluation, an analyst from Susquehanna keeps a Neutral rating on Union Pacific with a target price of $255.

- Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Union Pacific, targeting a price of $274.

- Reflecting concerns, an analyst from Jefferies lowers its rating to Hold with a new price target of $250.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Union Pacific, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.