Benzinga's options scanner has just identified more than 8 option transactions on Eaton Corp ETN, with a cumulative value of $328,355. Concurrently, our algorithms picked up 2 puts, worth a total of 73,300.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $310.0 to $340.0 for Eaton Corp over the recent three months.

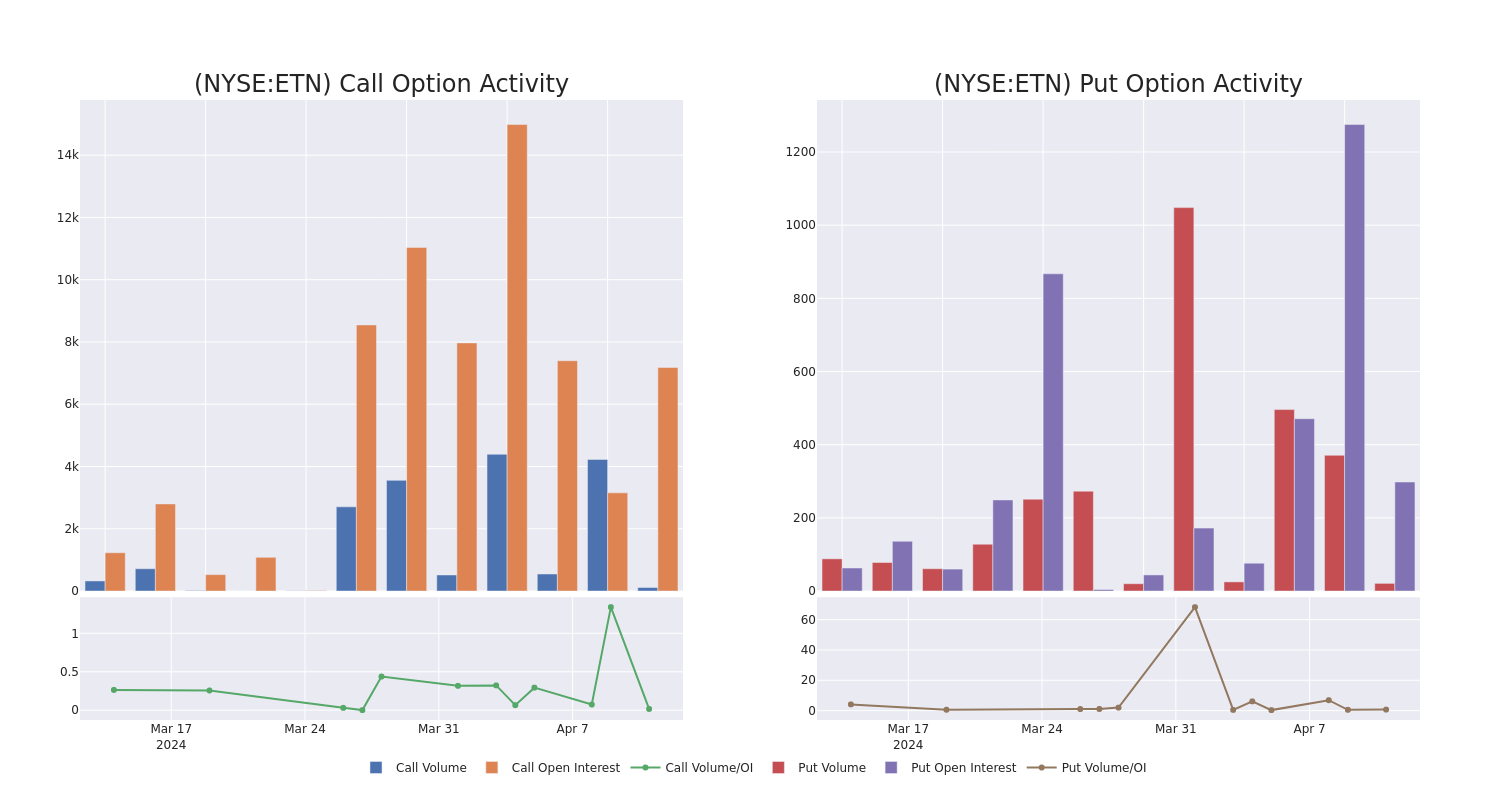

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Eaton Corp's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Eaton Corp's substantial trades, within a strike price spectrum from $310.0 to $340.0 over the preceding 30 days.

Eaton Corp Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETN | CALL | SWEEP | BULLISH | 10/18/24 | $24.1 | $23.5 | $24.1 | $330.00 | $120.5K | 30 | 0 |

| ETN | PUT | TRADE | BEARISH | 05/17/24 | $14.2 | $13.9 | $14.2 | $320.00 | $48.2K | 284 | 12 |

| ETN | CALL | SWEEP | BULLISH | 01/17/25 | $42.0 | $41.4 | $42.0 | $310.00 | $42.0K | 135 | 10 |

| ETN | CALL | TRADE | BULLISH | 05/17/24 | $10.8 | $10.7 | $10.8 | $320.00 | $41.0K | 4.2K | 99 |

| ETN | CALL | TRADE | BULLISH | 07/19/24 | $18.1 | $17.5 | $17.9 | $320.00 | $35.8K | 2.1K | 0 |

About Eaton Corp

Eaton is a diversified power management company operating for over 100 years. The company operates through various segments, including electrical Americas, electrical global, aerospace, vehicle, and eMobility. Eaton's portfolio can broadly be divided into two halves. One part of its portfolio is housed under its industrial sector umbrella, which serves a large variety of end markets like commercial vehicles, general aviation, and trucks. The other portion is Eaton's electrical sector portfolio, which serves data centers, utilities, and the residential end market, among others. While the company receives favorable tax treatment with its Ireland domicile, most of its operations are in the U.S.

Having examined the options trading patterns of Eaton Corp, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Eaton Corp's Current Market Status

- With a trading volume of 788,948, the price of ETN is up by 1.44%, reaching $318.9.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 19 days from now.

Professional Analyst Ratings for Eaton Corp

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $319.4.

- An analyst from Wolfe Research downgraded its action to Underperform with a price target of $312.

- Maintaining their stance, an analyst from RBC Capital continues to hold a Sector Perform rating for Eaton Corp, targeting a price of $286.

- Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Eaton Corp, targeting a price of $328.

- An analyst from RBC Capital upgraded its action to Outperform with a price target of $371.

- An analyst from Barclays upgraded its action to Equal-Weight with a price target of $300.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Eaton Corp options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Date of Trade | ticker | Put/Call | Strike Price | DTE | Sentiment |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.