Whales with a lot of money to spend have taken a noticeably bullish stance on Abbott Laboratories.

Looking at options history for Abbott Laboratories ABT we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $190,983 and 3, calls, for a total amount of $136,877.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $92.5 to $115.0 for Abbott Laboratories over the recent three months.

Volume & Open Interest Development

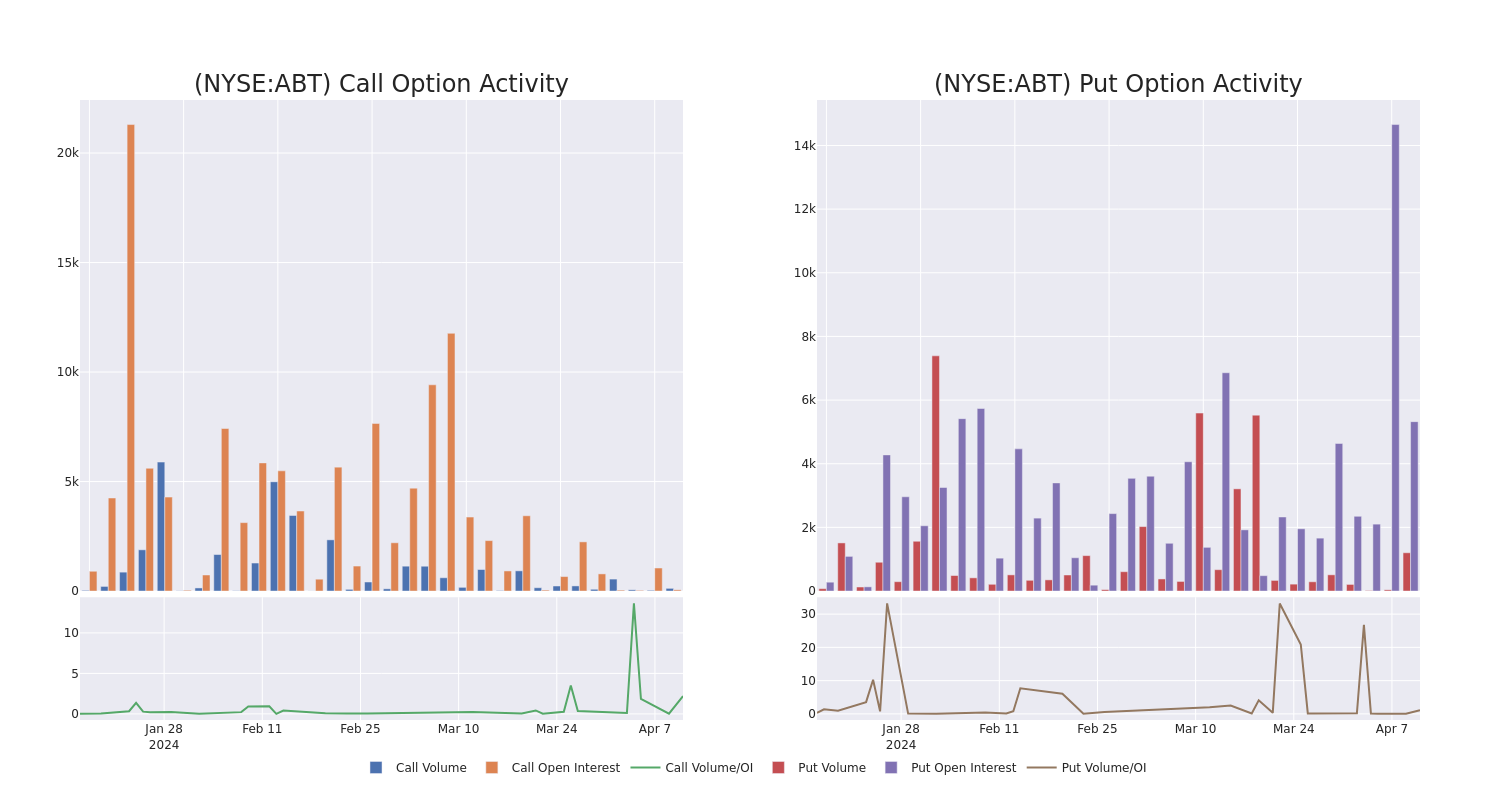

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Abbott Laboratories's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Abbott Laboratories's whale activity within a strike price range from $92.5 to $115.0 in the last 30 days.

Abbott Laboratories Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABT | PUT | SWEEP | BEARISH | 11/15/24 | $8.8 | $8.6 | $8.8 | $115.00 | $75.6K | 179 | 86 |

| ABT | CALL | TRADE | BULLISH | 06/21/24 | $19.65 | $19.25 | $19.54 | $92.50 | $54.7K | 42 | 0 |

| ABT | CALL | TRADE | NEUTRAL | 11/15/24 | $20.85 | $18.4 | $19.54 | $95.00 | $54.7K | 12 | 0 |

| ABT | PUT | SWEEP | BULLISH | 04/19/24 | $4.8 | $4.75 | $4.74 | $115.00 | $31.7K | 1.7K | 410 |

| ABT | PUT | TRADE | BULLISH | 05/17/24 | $2.71 | $2.67 | $2.67 | $110.00 | $29.1K | 1.7K | 192 |

About Abbott Laboratories

Abbott manufactures and markets cardiovascular and diabetes devices, adult and pediatric nutritional products, diagnostic equipment and testing kits, and branded generic drugs. Products include pacemakers, implantable cardioverter defibrillators, neuromodulation devices, coronary stents, catheters, infant formula, nutritional liquids for adults, continuous glucose monitors, and immunoassays and point-of-care diagnostic equipment. Abbott derives approximately 60% of sales outside the United States.

Current Position of Abbott Laboratories

- Currently trading with a volume of 1,707,071, the ABT's price is up by 0.43%, now at $111.65.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 6 days.

What Analysts Are Saying About Abbott Laboratories

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $126.5.

- Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for Abbott Laboratories, targeting a price of $128.

- An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Abbott Laboratories, which currently sits at a price target of $125.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Abbott Laboratories options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Date of Trade | ticker | Put/Call | Strike Price | DTE | Sentiment |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.