Whales with a lot of money to spend have taken a noticeably bearish stance on ServiceNow.

Looking at options history for ServiceNow NOW we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 0% of the investors opened trades with bullish expectations and 100% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $1,151,100 and 2, calls, for a total amount of $702,170.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $600.0 to $870.0 for ServiceNow during the past quarter.

Analyzing Volume & Open Interest

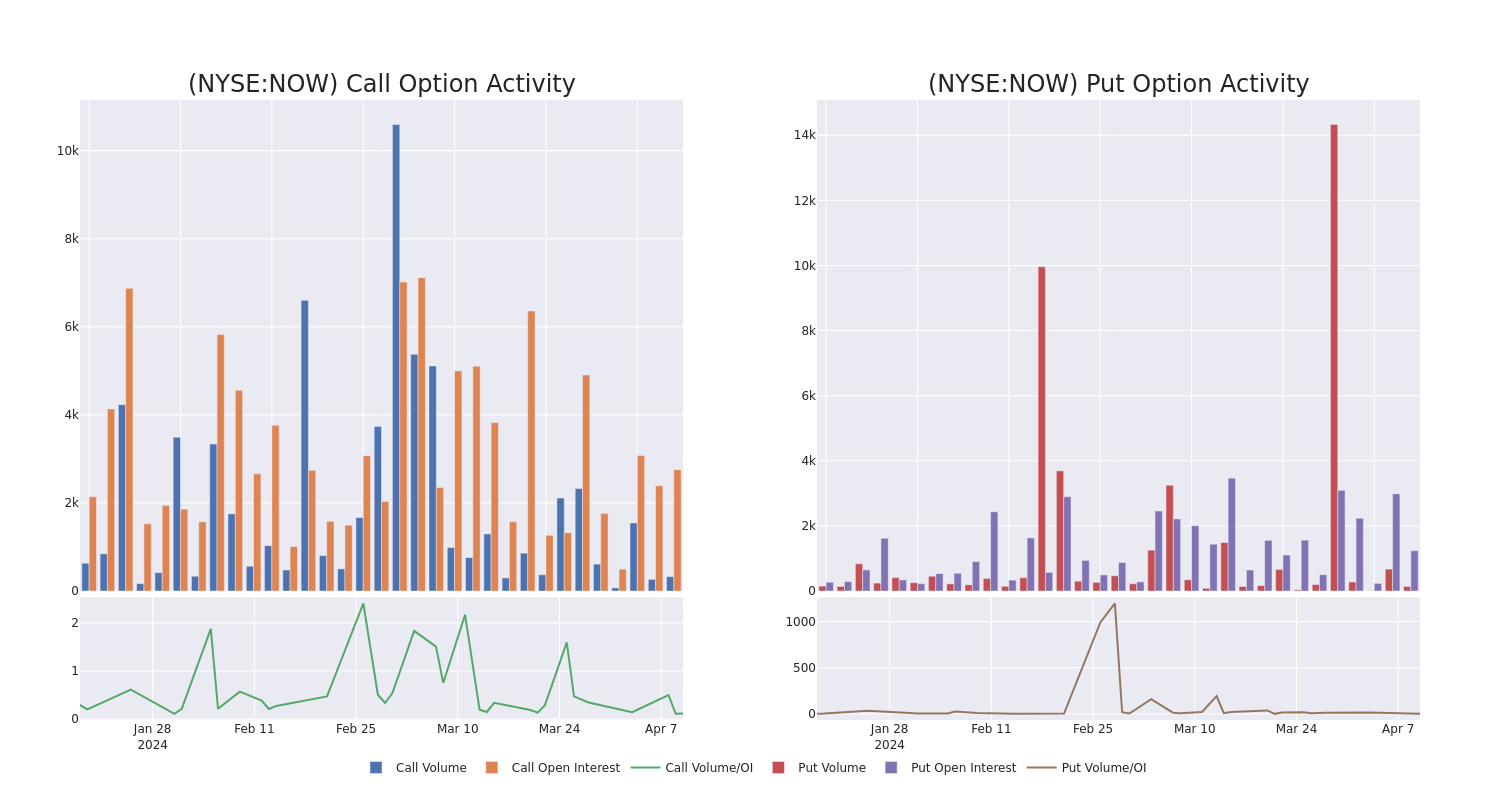

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for ServiceNow's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ServiceNow's whale activity within a strike price range from $600.0 to $870.0 in the last 30 days.

ServiceNow Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | CALL | TRADE | BEARISH | 01/17/25 | $222.8 | $219.0 | $219.0 | $600.00 | $635.1K | 373 | 1 |

| NOW | PUT | SWEEP | BEARISH | 05/17/24 | $40.0 | $38.6 | $40.0 | $770.00 | $400.0K | 358 | 201 |

| NOW | PUT | TRADE | NEUTRAL | 04/26/24 | $108.4 | $101.2 | $104.8 | $870.00 | $282.9K | 0 | 0 |

| NOW | PUT | SWEEP | BEARISH | 05/17/24 | $38.0 | $37.9 | $38.0 | $770.00 | $197.6K | 358 | 86 |

| NOW | PUT | SWEEP | BEARISH | 05/17/24 | $38.0 | $37.9 | $38.0 | $770.00 | $83.6K | 358 | 34 |

About ServiceNow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

In light of the recent options history for ServiceNow, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of ServiceNow

- Currently trading with a volume of 118,748, the NOW's price is up by 0.38%, now at $772.1.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 13 days.

What The Experts Say On ServiceNow

4 market experts have recently issued ratings for this stock, with a consensus target price of $885.0.

- In a cautious move, an analyst from Stifel downgraded its rating to Buy, setting a price target of $820.

- An analyst from Jefferies has decided to maintain their Buy rating on ServiceNow, which currently sits at a price target of $900.

- Reflecting concerns, an analyst from Stifel lowers its rating to Buy with a new price target of $820.

- Reflecting concerns, an analyst from Keybanc lowers its rating to Overweight with a new price target of $1000.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ServiceNow with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.