Whales with a lot of money to spend have taken a noticeably bullish stance on DraftKings.

Looking at options history for DraftKings DKNG we detected 16 trades.

If we consider the specifics of each trade, it is accurate to state that 68% of the investors opened trades with bullish expectations and 31% with bearish.

From the overall spotted trades, 10 are puts, for a total amount of $517,926 and 6, calls, for a total amount of $373,981.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $30.0 and $55.0 for DraftKings, spanning the last three months.

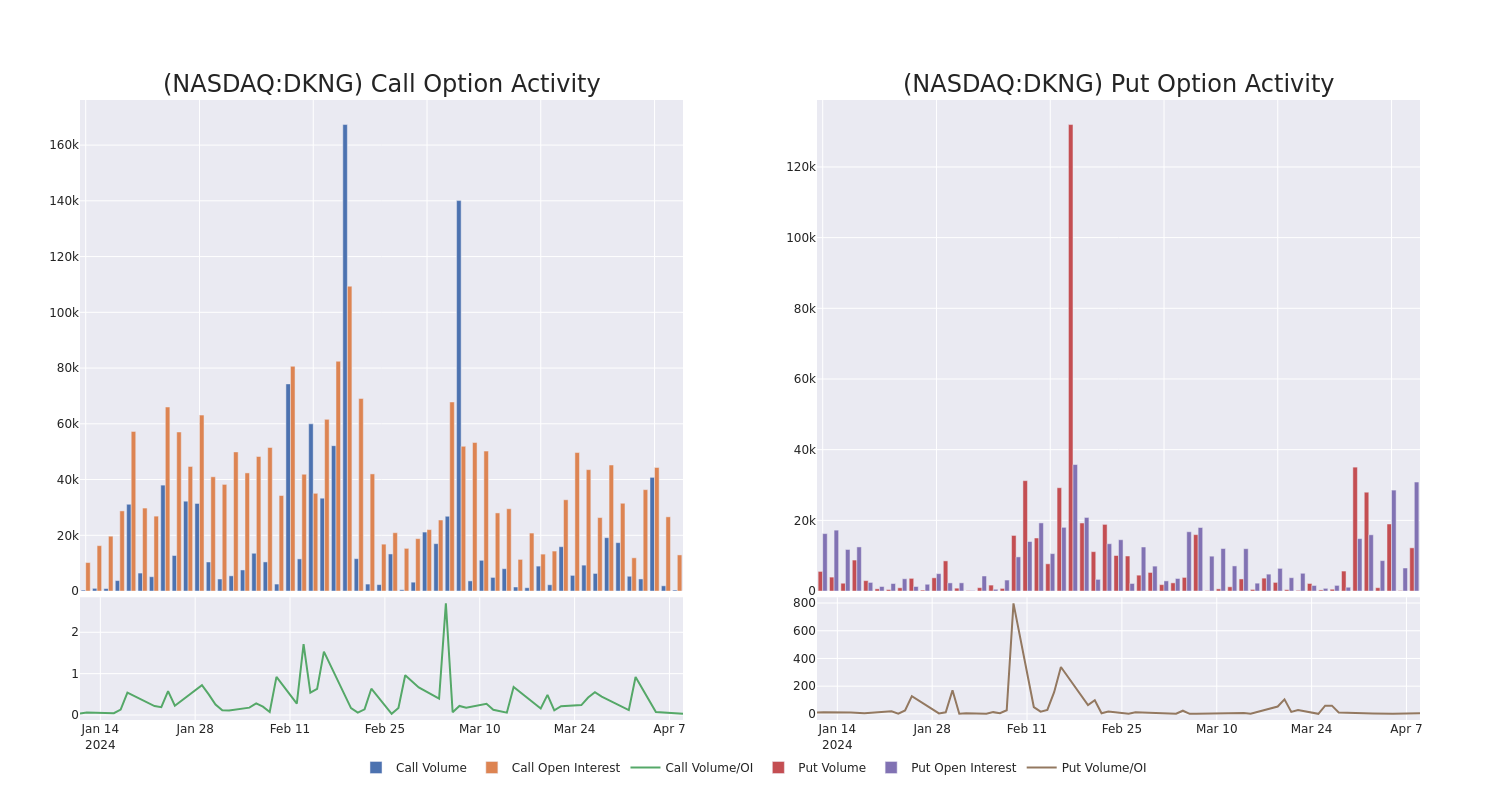

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in DraftKings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to DraftKings's substantial trades, within a strike price spectrum from $30.0 to $55.0 over the preceding 30 days.

DraftKings Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DKNG | CALL | SWEEP | BULLISH | 08/16/24 | $10.35 | $10.25 | $10.35 | $38.00 | $135.5K | 253 | 0 |

| DKNG | PUT | TRADE | BULLISH | 06/21/24 | $0.79 | $0.78 | $0.78 | $35.00 | $124.8K | 4.0K | 1.6K |

| DKNG | CALL | TRADE | BULLISH | 05/17/24 | $1.69 | $1.65 | $1.68 | $50.00 | $84.0K | 5.4K | 93 |

| DKNG | PUT | TRADE | BEARISH | 12/19/25 | $11.5 | $10.3 | $11.3 | $47.00 | $79.1K | 187 | 0 |

| DKNG | PUT | TRADE | BULLISH | 01/16/26 | $6.7 | $6.55 | $6.55 | $37.00 | $57.6K | 541 | 88 |

About DraftKings

DraftKings got its start in 2012 as an innovator in daily fantasy sports. Then, following a Supreme Court ruling in 2018 that allowed states to legalize online sports wagering, the company expanded into online sports and casino gambling, where it generally holds the number two or three revenue share position across states in which it competes. DraftKings is now live with online sports betting in 24 states (46% of the US population) and iGaming in seven states (11% of US), with both products available to around 40% of Canada's population. The company also operates a non-fungible token commissioned-based marketplace and develops and licenses online gaming products.

In light of the recent options history for DraftKings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of DraftKings

- With a volume of 4,033,294, the price of DKNG is down -0.26% at $45.39.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 23 days.

Professional Analyst Ratings for DraftKings

5 market experts have recently issued ratings for this stock, with a consensus target price of $54.8.

- Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $52.

- In a cautious move, an analyst from Mizuho downgraded its rating to Buy, setting a price target of $58.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on DraftKings with a target price of $55.

- Maintaining their stance, an analyst from MoffettNathanson continues to hold a Buy rating for DraftKings, targeting a price of $55.

- An analyst from Susquehanna has decided to maintain their Positive rating on DraftKings, which currently sits at a price target of $54.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for DraftKings with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Date of Trade | ticker | Put/Call | Strike Price | DTE | Sentiment |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.