Yawn!

Yawn!

Nothing much happened over the weekend. Syria, Debt Ceiling, Taper Talk, Summers or Yellen, $110 Oil, New iPhones, yadda, yadda, yadda – and, no, we're not yadda-yaddaing over the best parts.

Let me explain how this works. The market has clearly demonstrated its inability to get over the May-July highs without a positive catalyst (assuming that would do the trick, of course) and we've been drifting along ever since as we haven't had any particularly NEGATIVE catalysts (though we are ignoring a lot of negatives) to take us down – so far.

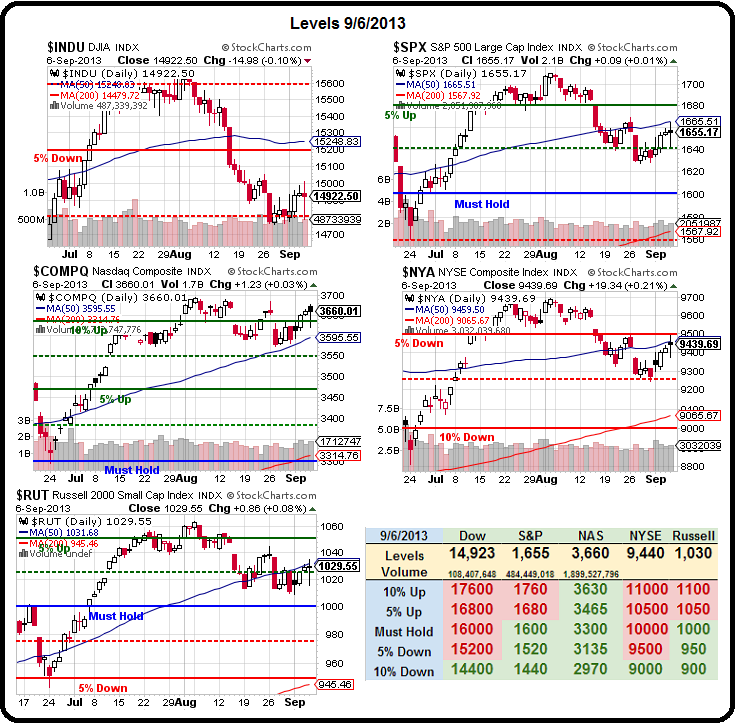

That's created an extremely technical market and, as I've been saying since early August, we simply keep an eye on our bounce levels to see if we're going to make another run at the top or not.

We came close on Friday but no cigars were handed out on the failed finish of the S&P, right between our weak (1,646) and strong (1,662) bounce lines at 1,655 (see Friday's post for details). The Dow failed to even make a weak bounce (14,960), the Nasdaq has been boosted over the strong bounce (3,640) by AAPL but not that impressive at 3,659 – especially with 1,300 declining stocks on Friday vs 1,204 advancing!

We came close on Friday but no cigars were handed out on the failed finish of the S&P, right between our weak (1,646) and strong (1,662) bounce lines at 1,655 (see Friday's post for details). The Dow failed to even make a weak bounce (14,960), the Nasdaq has been boosted over the strong bounce (3,640) by AAPL but not that impressive at 3,659 – especially with 1,300 declining stocks on Friday vs 1,204 advancing!

On the NYSE, 9,460 is the strong bounce line and they finished just under at 9,420 while the Russell, which is usually our super-star, failed to take it's strong bounce line at 1,030 and is still drifting right on that line in the Futures.

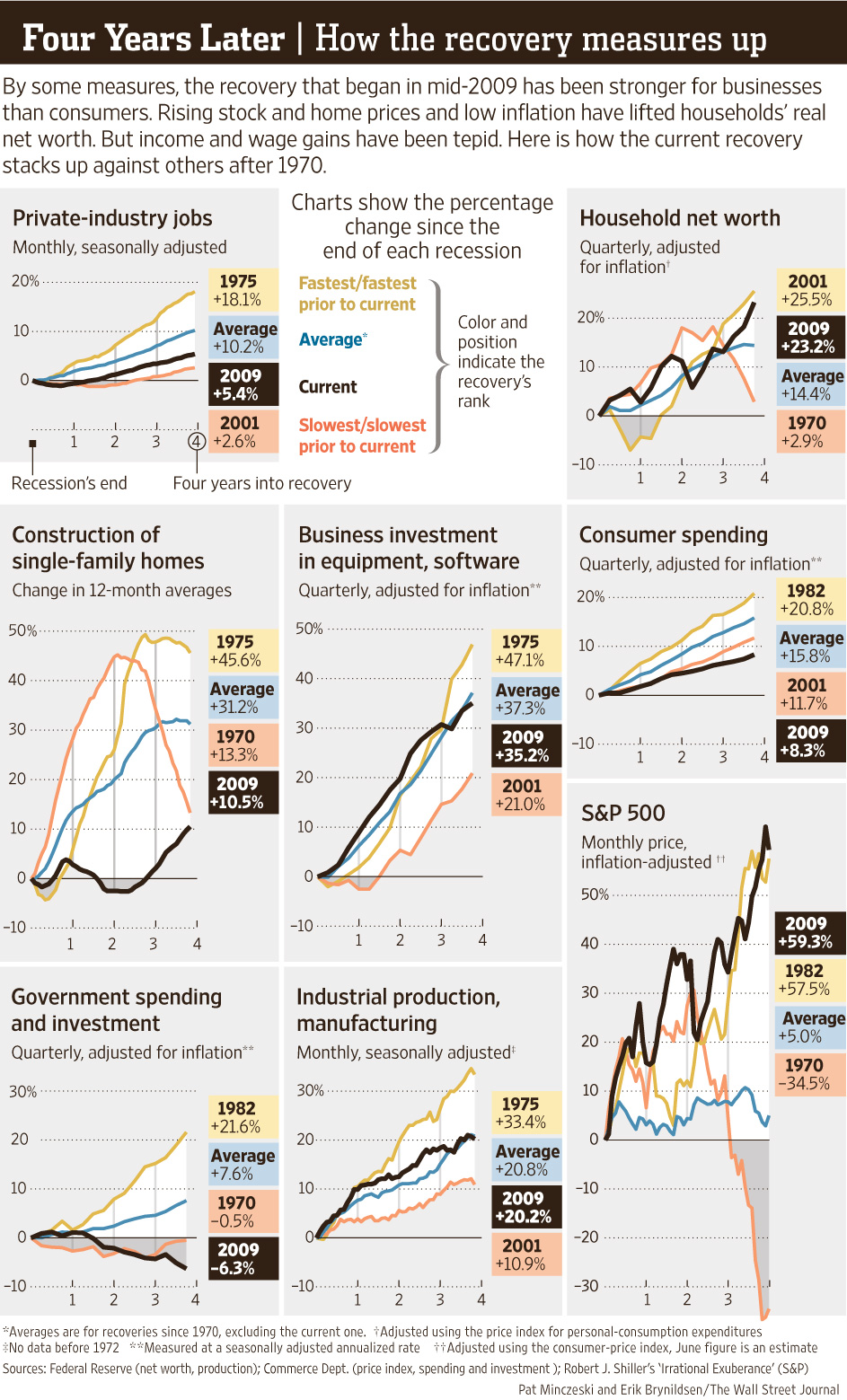

As you can see from Dave Fry's SPY chart, we went nowhere on moderate, churning volume and that's no surprise actually when you have a look at this very helpful summary from the WSJ (via Barry) that summarizes our 4-year recovery in the economy:

How can we NOT have a wishy-washy market looking at these charts? Single Family Home Construction is STILL nowhere near what a rational person would call a recovery. Consumer Spending (70% of our economy) is a DISASTER and Government Spending (20% of our economy) is 6.3% LOWER…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.