The gold bugs are rejoicing. A crisis on the southern border, another war brewing in the Middle East, a successful cyberattack on one of the nation's energy pipelines, and obvious signs of inflation have resulted in a flight to safety.

The price of gold has risen almost 10% since early April.

Many investors would like to invest in gold, but they don’t want to deal with the hassle of buying and storing it. And buying the stocks of individual gold companies can be very risky.

These investors should consider gold ETFs, such as the SPDR Gold Shares ETF GLD, the ProShares Ultra Gold ETF UGL, and the ProShares UltraShort Gold ETF GLL.

See Also: Best Gold Stocks Right Now

The investment objective of GLD is to reflect the performance of the price of gold bullion, minus the ETF’s expenses.

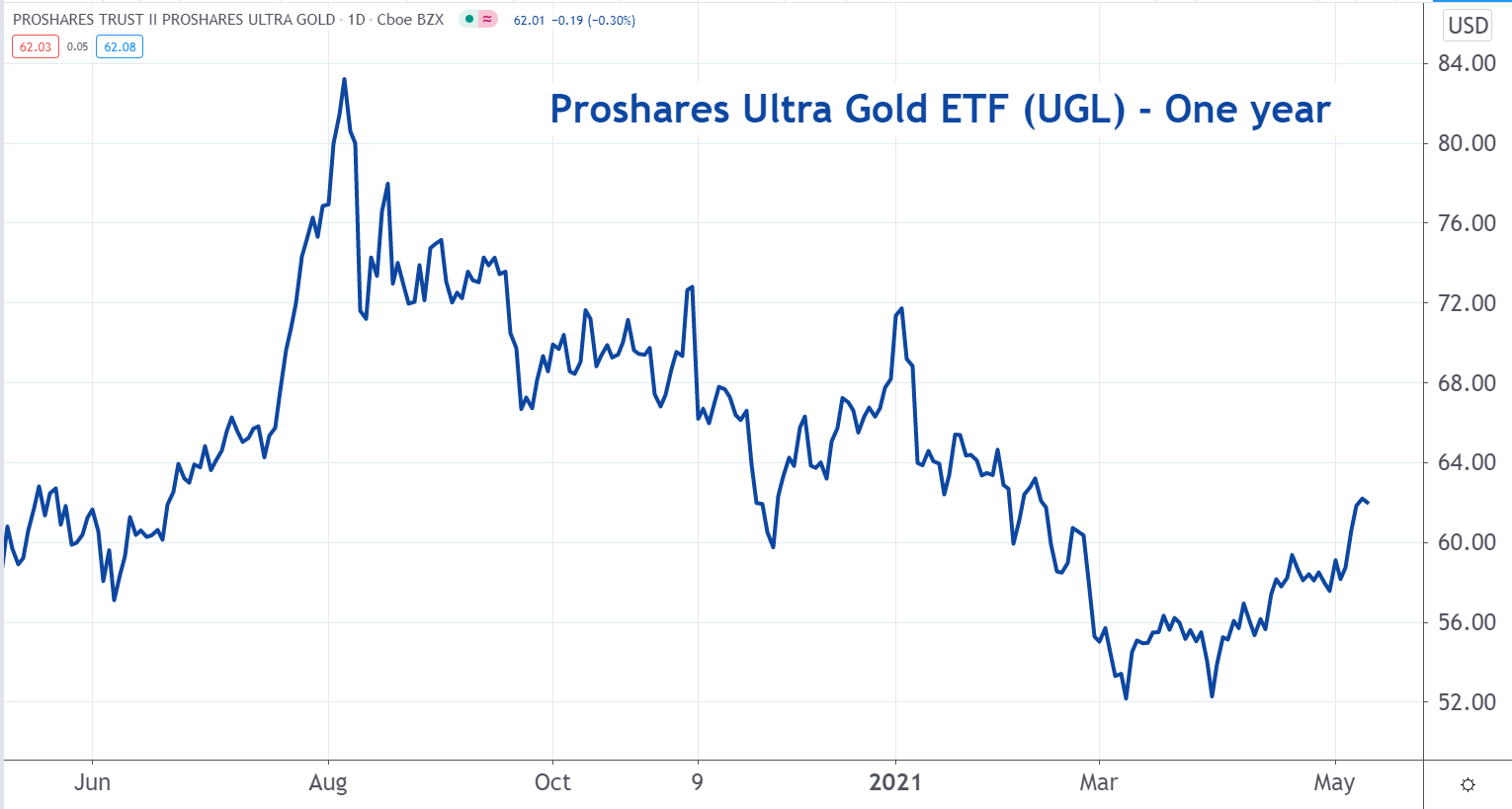

UGL is for aggressive investors. It uses leverage.

UGL seeks to replicate the daily investment results, before fees and expenses, that correspond to twice the daily performance of the Bloomberg Gold Subindex.

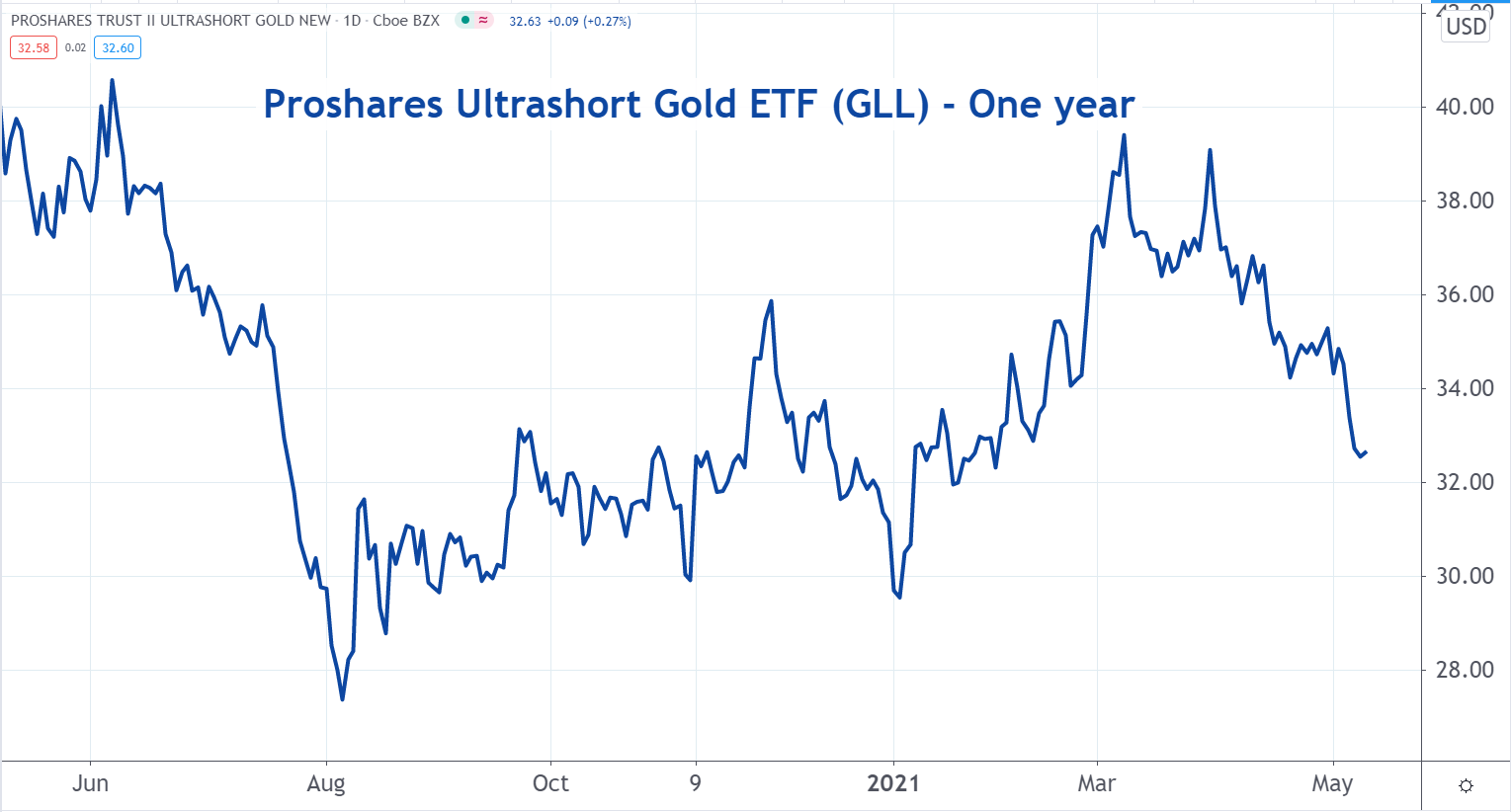

GLL is designed for aggressive investors who think the price of gold is going down. It seeks daily investment results that correspond to two times the inverse of the daily performance, minus fees and expenses, of the Bloomberg Gold Subindex.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.