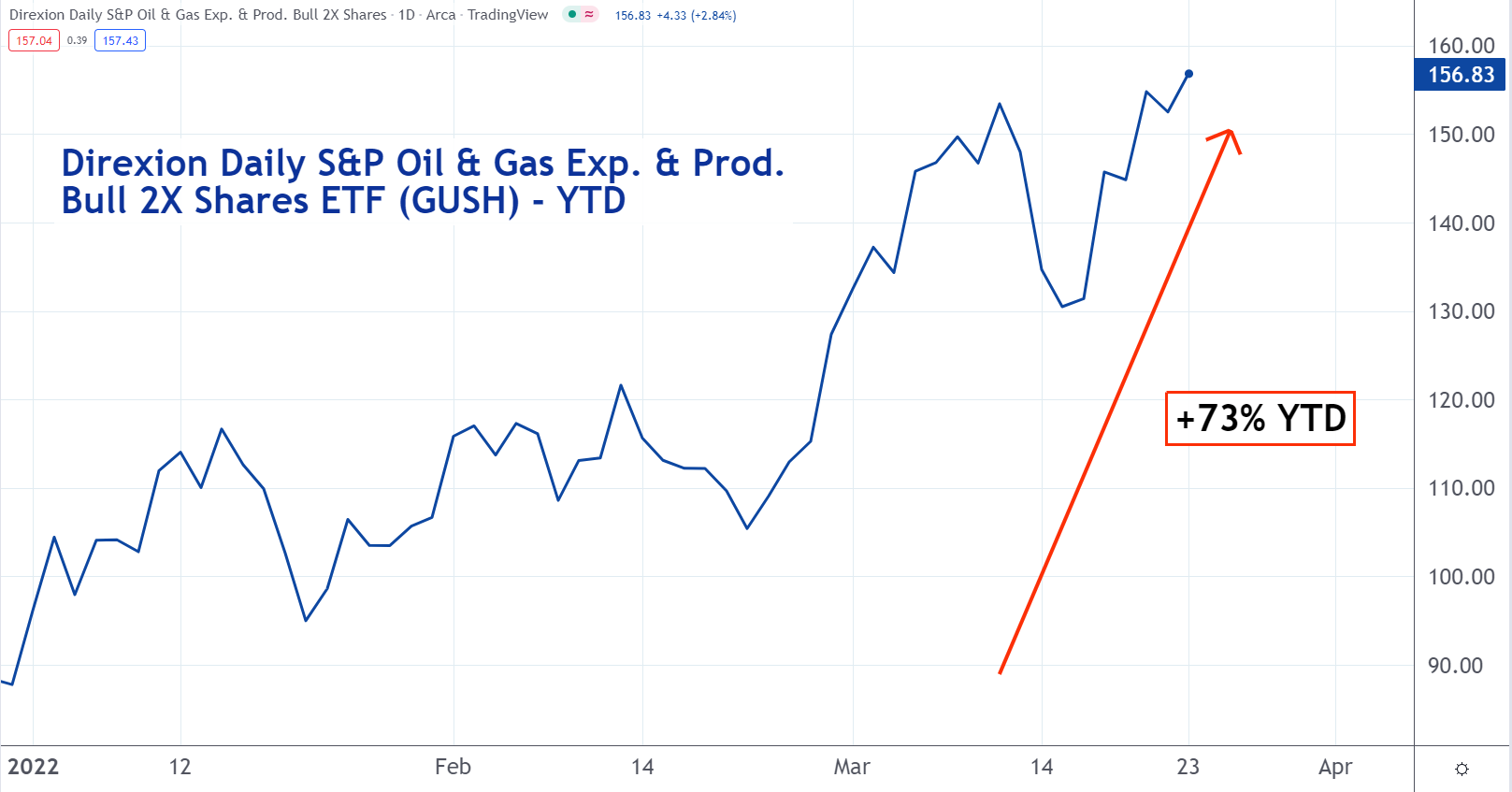

Year-to-date, the SPDR S&P 500 ETF Trust SPY has fallen by about 6%. In the same time period, the Direxion Daily S&P Oil & Gas Exploration & Production Bull 2X Shares ETF GUSH has gained about 73%.

Commodity traders have made a fortune with it.

The GUSG ETF uses leverage. It's designed to move twice as much in a given day as the benchmark index it follows. Because oil prices have risen by so much this year, the returns have been off the charts.

If oil prices continue to move higher, there’s a good chance GUSH continues to outperform the broader stock market.

Investors still need to exercise caution. The use of leverage can increase profits if things go the right way, but it can also lead to significant losses they don’t.

To learn more about ETFs and trading, check out the new Benzinga Trading School.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.