With so much hoopla surrounding U.S. stocks and individual sectors, not everyone has noticed that many developed foreign markets have been quietly inching higher this year. The European reflation trade has continued to gain steam amid improving economic data and attractive corporate valuations.

The Vanguard European ETF VGK hit new highs this past week as Euro-zone factory data came in better than expected. VGK tracks 518 stocks in developed foreign markets. The United Kingdom, France, and Germany are the primary country weightings in this fund.

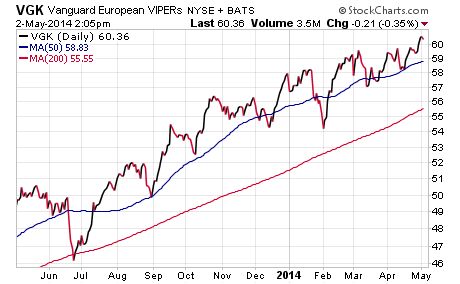

So far this year, VGK has gained 4.19 percent versus 2.40 percent for the SPDR S&P 500 ETF SPY. The chart below shows just how strong the trend has been for Europe over the last 12 months.

With investors seemingly focused on value opportunities, overseas dividend paying stocks have also been quite desirable. The iShares International Select Dividend ETF IDV holds a portfolio of 100 high-quality developed market stocks with high dividend yields over time.

This ETF is primarily made up of European companies with some Australian stocks thrown into the mix. The current yield of IDV is 4.28 percent and the fund has over $3.7 billion in total assets.

Many of these international companies are known for much higher dividend yields than their domestic peers, which may make them more attractive for income seekers. As with most dividend equity ETFs, income from IDV is paid on a quarterly basis.

Investors seeking small cap exposure may want to also consider the WisdomTree European Small Cap Dividend Fund DFE as well. Small cap stocks tend to be more economically sensitive to changes in fundamental data. That may translate into greater earnings growth if the recovery continues.

Moving forward, the pace of European equities will likely be governed by any additional accommodative action by the European Central Bank, along with further positive signs of economic activity. The most notable and immediate threat to this strength is the Ukraine situation, which has yet to be resolved in a peaceful manner.

ETF investors have a plethora of options at their disposal to take advantage of the European continent and any further upside it may provide.

Disclosure: The author currently holds IDV and DFE in his portfolio.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.