In a week already ablaze with market fervor sparked by inflation data surpassing expectations and prompting a jolting reassessment of Federal Reserve rate cut projections, Friday witnesses heightened volatility, fueled by escalating geopolitical tensions in the Middle East.

Israel is bracing for an attack from Iran, which could occur within the next 48 hours or even earlier, according to various media sources.

White House National Security Council spokesperson John Kirby stated that an Iranian attack on Israel poses a "real" and "viable" threat.

According to the Times of Israel, Hezbollah has launched a rocket barrage into Northern Israel. Meanwhile, the USS Dwight Eisenhower aircraft carrier has sailed north through the Red Sea toward Israel in a show of deterrence from the Biden administration, as an attempt to intercept missiles and drones fired by Iran.

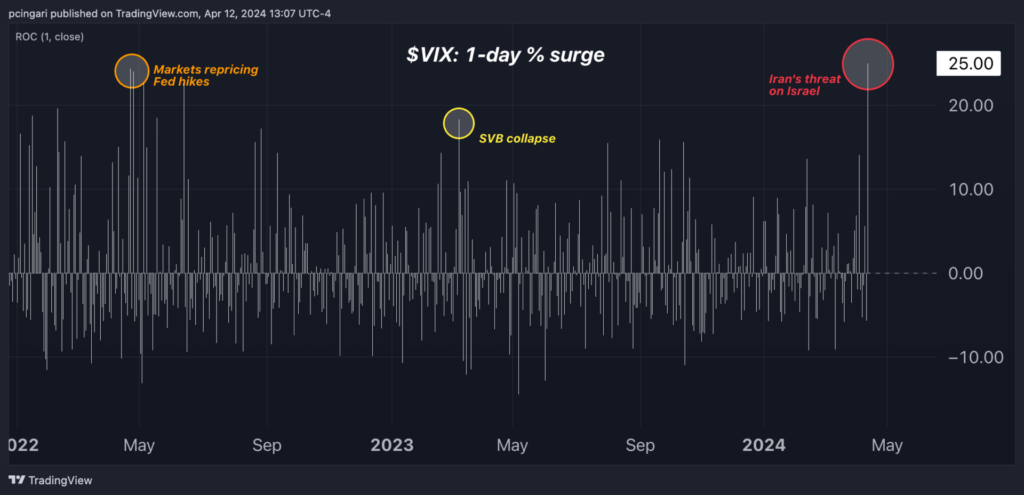

Market volatility, as indicated by the CBOE VIX Index, experienced a sharp spike, with the fear gauge surging by 23%, marking the most significant daily increase since late April 2022 and surpassing the uptick observed during the Silicon Valley Bank collapse in March 2023.

Stock indices plunged deeply into the red, with the S&P 500 declining by 1.4% and the Nasdaq 100 by 1.7%. Notably, no sectors managed to evade losses on Friday.

Amid escalating threats in the Middle East, oil prices surged, with West Texas Intermediate (WTI) light crude climbing by 1.2% to reach $87 per barrel.

Investors flocked to safe-haven Treasuries in search of a liquidity shelter, with the iShares 20+ Year Treasury Bond ETF TLT up 1%.

Gold faced a wild session, with the yellow metal spiking to a new-record high to $2,400 per ounce, before falling to $2,370. Bitcoin BTC/USD was down 1.7%, amid a worsening risk sentiment.

Chart Of The Day: VIX Spikes Over 20%, In The Most Volatile Day For Markets Since Late April 2022

Friday’s Performance In Major US Indices, ETFs

| Major Indices & ETFs | Price | 1-day %chg |

| Dow Jones | 37,950.16 | -1.3% |

| Russell 2000 | 199.18 | -1.5% |

| S&P 500 | 5,118.62 | -1.5% |

| Nasdaq 100 | 17,982.40 | -1.8% |

| СВОЕ VIX | 18.72 | 25.6% |

The SPDR S&P 500 ETF Trust SPY tumbled 1.5% to $510.49, the SPDR Dow Jones Industrial Average DIA fell 1.3% to $379.75 and the tech-heavy Invesco QQQ Trust QQQ plummeted 1.6% to $438.00, according to Benzinga Pro data.

Sector-wise, the Technology Select Sector SPDR Fund XLK felt the heaviest losses, down 1.8%, followed by the Materials Select Sector SPDR Fund XLB, down 1.7%.

Friday’s Stock Movers

- JPMorgan Chase & Co. JPM tumbled nearly 6%, despite reporting better-than-expected results last quarter, as the net interest income fell below expectations.

- Other financial companies reacting to earnings were Citigroup Inc. C, down 2%, Wells Fargo Co. WFC, down 0.5%, BlackRock Inc. BLK, down 2.3%, and State Street Corp. STT, flat for the day.

- Intel Corp. INTC dropped 4.5% following reports that China is urging national telecom companies to curb reliance on foreign chips. Peer Advanced Micro Devices Inc. AMD fell 4%.

- Arista Network Inc. ANET plummeted 9% on a double downgrade by Rosenblatt Securities.

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.